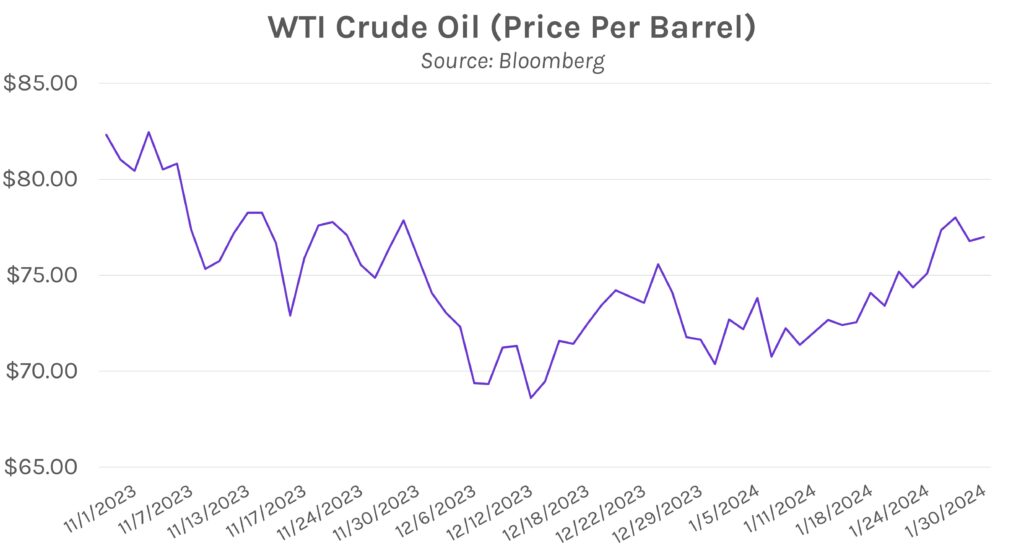

Rates decline ahead of FOMC meeting. Swap rates fell 3 – 6bps ahead of the January FOMC meeting, which commences tomorrow. The Treasury’s smaller than expected quarterly borrowing estimate led the rate decline, as short-term rates fell ~3 bps and the long end dropped 6+ bps. Equities rallied on the news, with the SPX now at over 4900, yet another all-time high. Meanwhile, crude oil prices declined from the weekend on news that three U.S. service members were killed in Jordan after a drone strike.

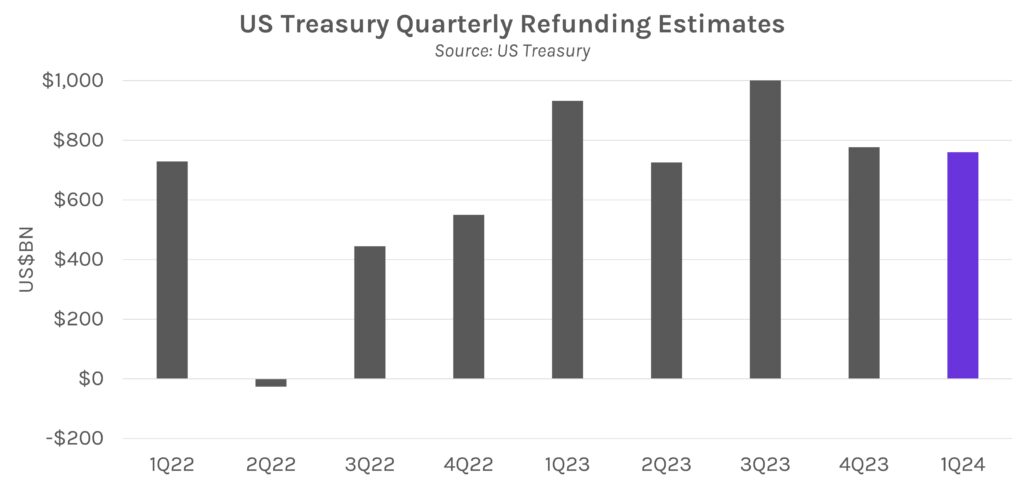

US Treasury reduces borrowing estimates. Largely expected to increase borrowing in 1Q24, the US Treasury instead surprised markets today by announcing that it expects $760 billion in net borrowing, $55 billion lower than the initial estimate announced in October 2023. The reduction was, according to the Treasury, “largely due to projections of higher net fiscal flows and a higher beginning of quarter cash balance.” UST Yields fell immediately following the news, with 2 and 10-year yields declining ~2 bps and ~3 bps, respectively.

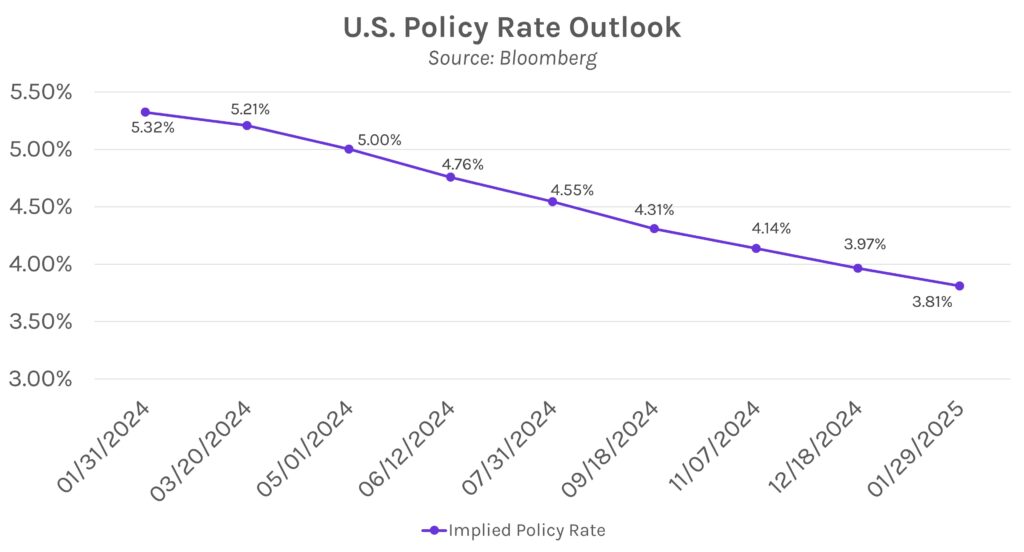

January FOMC meeting: markets await Powell comments, inevitable rate pause. The Fed is expected to keep rates unchanged yet again at this month’s FOMC meeting, the most recent hike having come in July 2023. Much has changed since July, however, as disinflation has shown significant progress. Core PCE (YoY) was 2.9% in December, a 1.3% decline from 4.2% in July. Ahead of Wednesday’s announcement and Powell press conference, markets expect five or six 25 bp rate cuts in 2024.