Powell and banking sector concerns drive risk-off session. FOMC day kicked off with renewed banking sector concerns after New York Community Bancorp reported higher than expected loan loss provisions related to their partial acquisition of Signature Bank last year. Rates plummeted on the news while the KRE Index dropped ~5.8% on the day, only for Chair Powell to add to the risk-off sentiment. Rates ended the session 8-13 bps lower, with 3y-10y Treasury yields now below 4%. Meanwhile, the SPX fell 1.6% today in its worst session since September while the tech-heavy NASDAQ dropped 2.23%.

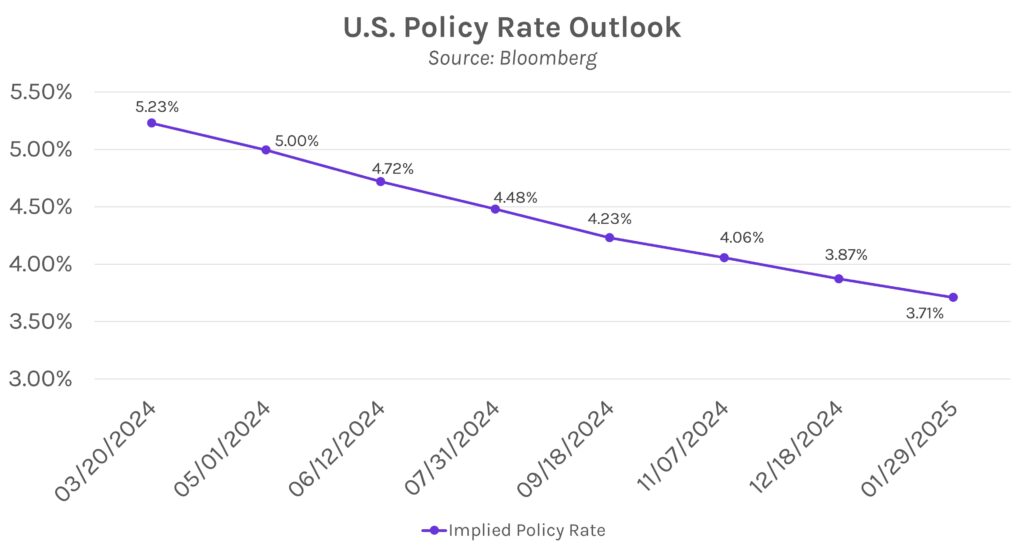

Chair Powell throws water on March rate cuts. The Fed held rates steady at a 5.25% – 5.50% target range, in-line with market expectations ahead of today’s announcement. The FOMC noted in their statement that it needs more evidence of a sustainable reduction in inflation before cutting rates. Chair Powell said at the press conference, “Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level confidence by the time of the March meeting.” Still, he said that the Fed Funds rate has likely peaked (echoing his words at the last meeting), and expects easing this year, but left the door open to keep rates elevated if needed. UST yields fell immediately following the release, with the 10-year rate down ~4 bps, while the 2-year was down ~7 bps. A side-by-side comparison of the January and December FOMC statements can be read here.

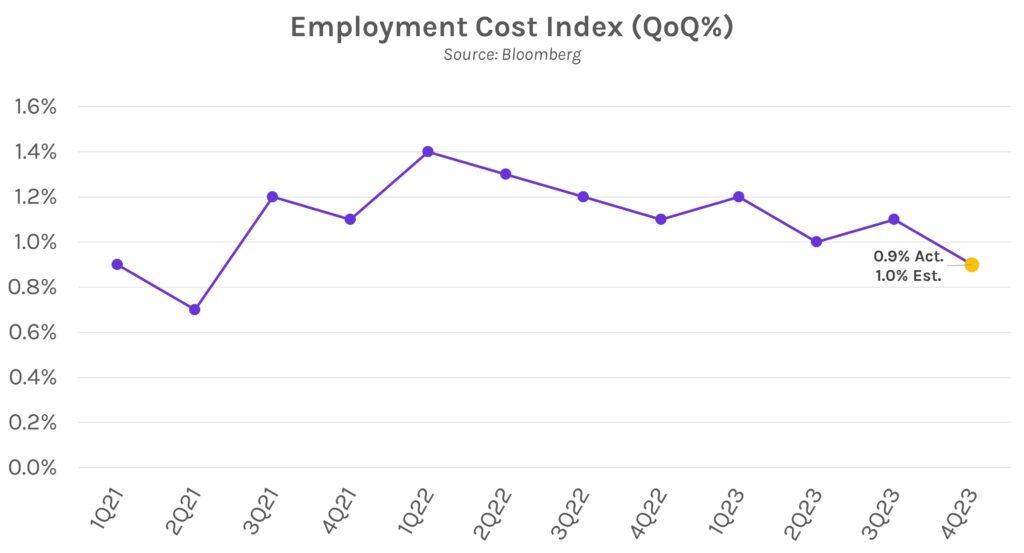

Labor market shows continued signs of cooling ahead of NFP. This morning’s data showed that a gauge of employment costs rose 0.9% in Q4 2023, its smallest advance since 2021 and a decrease from 1.1% in Q3. Meanwhile, private payrolls increased 107k in January, a ~50k decline from December. The figures follow yesterday’s prints that showed fewer voluntary quits, which suggests diminished confidence amongst workers that they can find employment elsewhere. All eyes are on Friday’s NFP report, which is expected to decline to 185k in January from 216k previously.