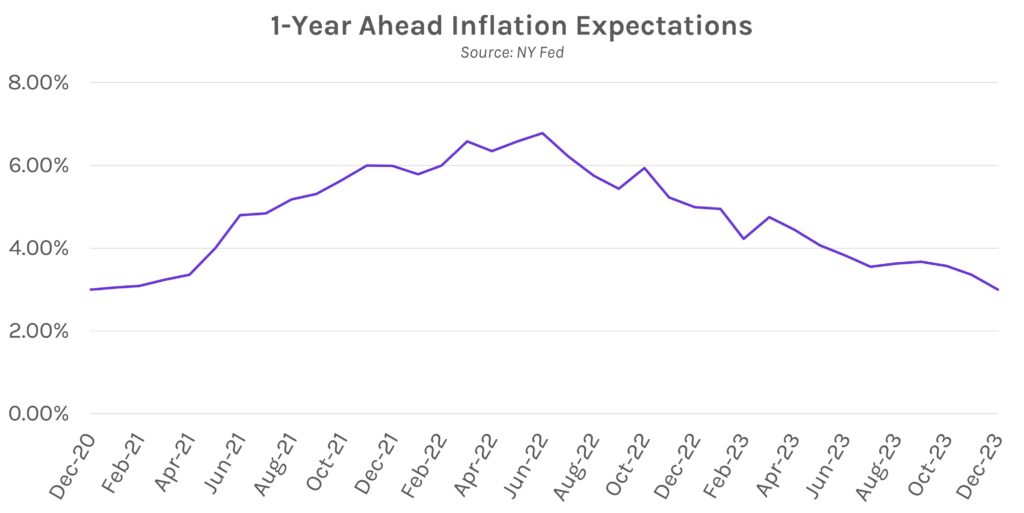

Rates little changed ahead of CPI tomorrow. Swap rates and Treasury yields traded within a ~4bp range throughout the session and closed nearly unchanged. The seesaw session was relatively uneventful as markets prepare for tomorrow’s inflation data. Today’s 1-year inflation expectation release came in at 3%, the lowest level since December 2020. Meanwhile, the DJIA closed at an all-time high today (38,797) after a .32% climb, though gains were limited elsewhere.

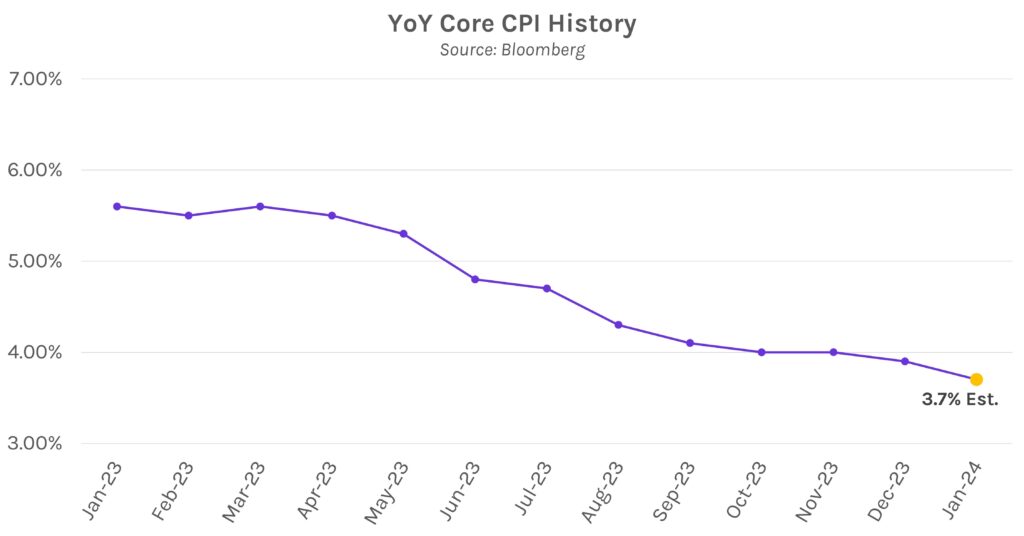

January CPI expected to show declining inflation. Tomorrow’s CPI report is expected to show declining inflation on a yearly basis and stable inflation on a monthly basis. YoY core and headline CPI are expected to hit their lowest levels in over 2 years at 3.7% and 2.9%, respectively, following a slight uptick in December. If expectations are realized, headline YoY CPI growth will have fallen 6.2% since peaking in June 2022. MoM headline and core CPI are expected to hold steady for a third straight month at 0.2% and 0.3%, respectively.

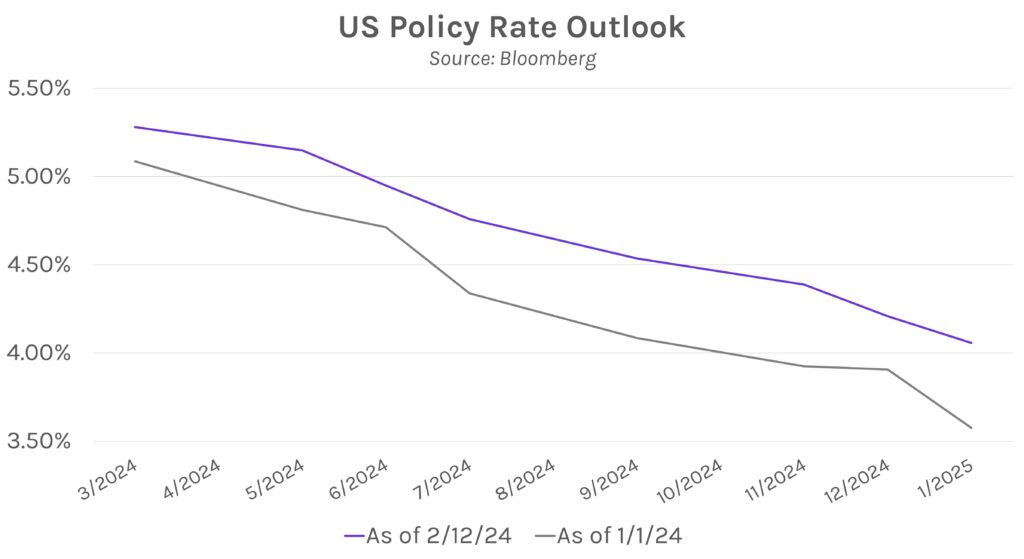

Fed’s Barkin and Bowman double down on hawkish commentary. Fed President Barkin warned today that there’s a “real risk” of continued inflationary pressure, as he believes that businesses may be slow to reduce their increased prices. The comments follow Barkin’s dismissal of imminent rate cuts last week, one of many policy voters to suggest that the March timeline was too early. Fed Governor Michelle Bowman reiterated that sentiment today, as she stated that rate cuts are not appropriate “in the immediate future.” She added, “As long as economic conditions remain where they are… I think that tells me that our policy rate is in the right place.”