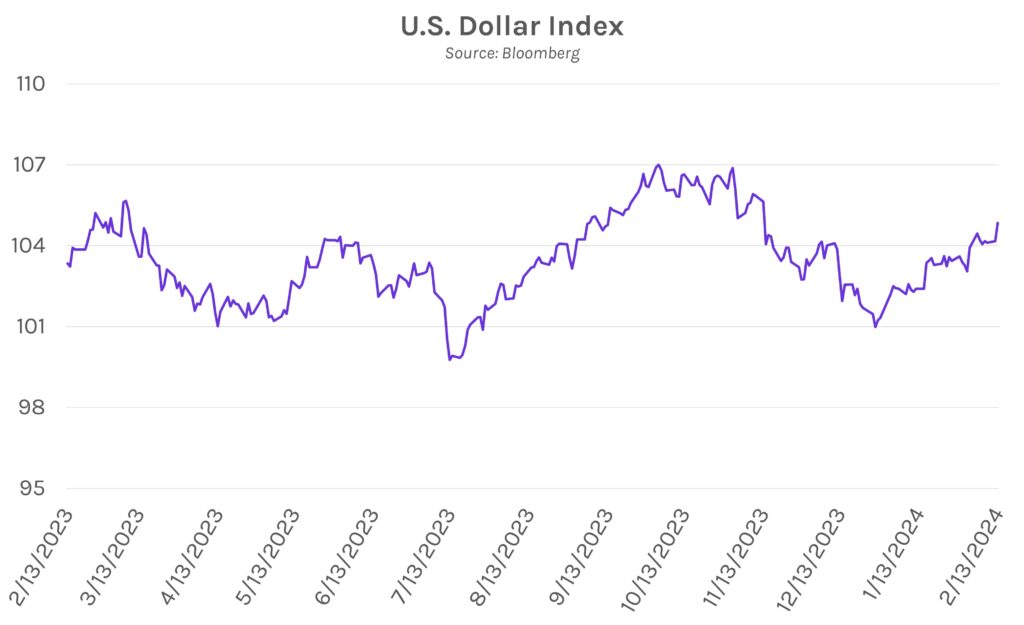

Swap rates soar, equities tumble after inflation proves sticky. Today’s CPI data was higher than expected, yet another blow to rate cut bets as the path to disinflation appears bumpy. Policy-sensitive short-term rates saw the largest rises of ~20bps while the long end climbed 8-15bps. Rates are now 25bps-55bps higher over the past month and are at their highest levels since late November / early December. The dollar soared alongside rates, as the U.S. Dollar Index closed at ~105 after a 0.75% gain. Meanwhile, equities plummeted on the data as the SPX, DJIA, and NASDAQ fell 1.7%-2%, with the SPX now below 5,000 and the DJIA well off yesterday’s all-time high.

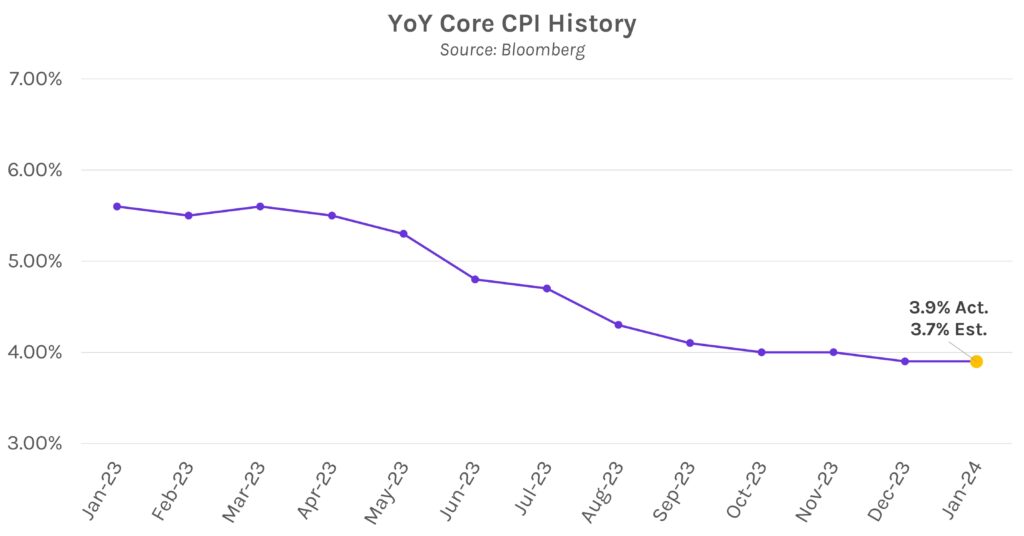

January CPI exceeds estimates across measurements. US consumer prices exceeded forecasts across all conventions. YoY headline CPI growth of 3.1% and core growth of 3.9% were both 0.2% higher than forecasts (2.9% and 3.7%, respectively). On a monthly basis, headline growth of 0.3% and core growth of 0.4% were both 0.1% higher than forecasts (0.2% and 0.3%, respectively). Higher shelter costs drove more than two-thirds of the overall increase, while food, insurance and medical care also increased. Goods and energy prices declined, however, while used car prices fell by the most since 1969.

UK labor market remains robust as CPI is on deck. Wage growth (excluding bonuses) in the UK rose 6.2% YoY in December, a decrease from November’s 6.7% gain but higher than the 6.0% estimate. Meanwhile, the unemployment rate unexpectedly dropped to 3.8%, another signal that the labor market remains strong. The tight labor market could delay rate cuts, which are currently expected to commence in August or September. Markets will now turn attention to tomorrow’s CPI figures, which are generally expected to rise in January from December; core, headline, and services YoY prints are forecasted to rise to 5.2%, 4.1%, and 6.8%, respectively.