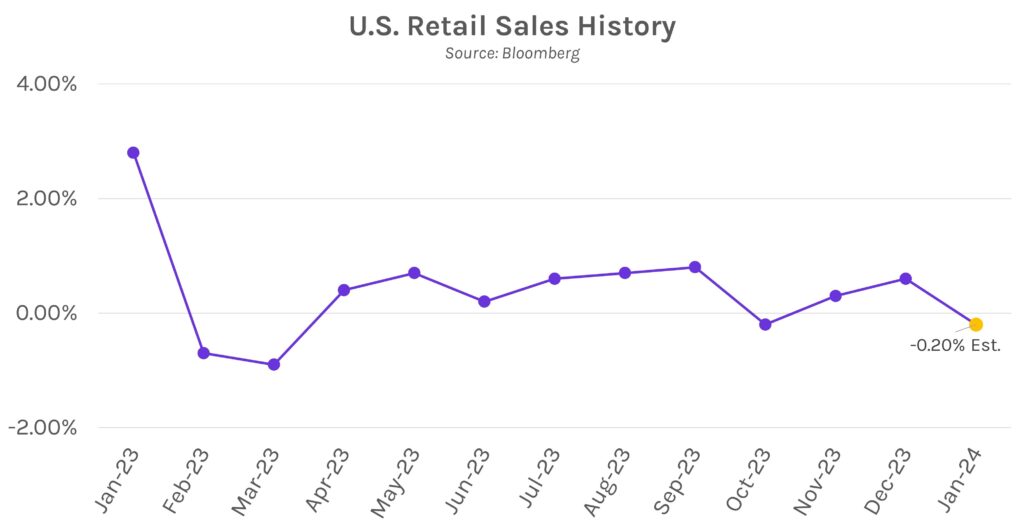

Rates and equities reverse course after yesterday’s volatile session. The swap/yield curve bull steepened today as attention turned to tomorrow’s retail sales data, which is expected to decline to -0.2% in January from +0.6% in December. Short-term rates fell over 8bps while the long-end dropped 3-6bps, which partially offset yesterday’s CPI-inspired 8-20bp rise. Meanwhile, the SPX and NASDAQ rose 0.96%-1.30%, the former back above 5,000 after a brief hiatus.

UK inflation was lower than expected in January. The UK has made significant progress in their inflation battle, as January CPI figures were lower than expected across all categories. Core and headline YoY figures stayed flat at 5.1% (vs. 5.2% estimate) and 4.0% (vs. 4.1% estimate), respectively, while services YoY data (more directly linked to domestic pressures) increased to 6.5% (vs. 6.8% estimate). Household goods and food prices declined significantly, the latter doing so on a monthly basis for the first time in two years. The data eased concerns that a tight labor market could provide stickier inflation, fueled by yesterday’s strong wage report and unemployment rate decline.

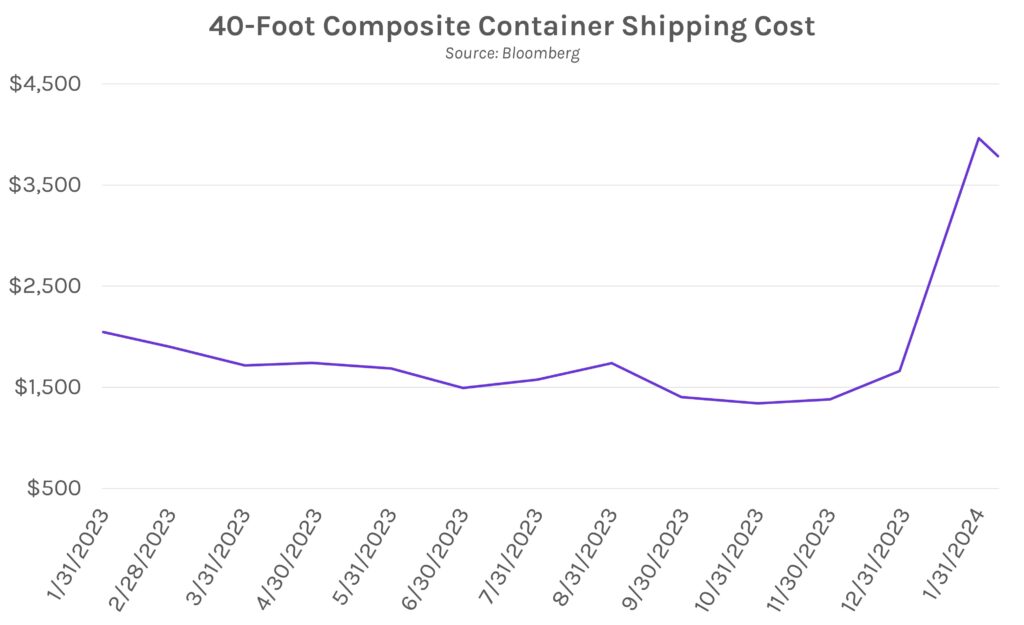

Israel President Netanyahu calls Hamas “delusional” as Gaza cease-fire talks stall. Israeli Prime Minister Netanyahu decided against sending a delegation to Cairo for talks aimed at a possible cease-fire and hostage exchange with Hamas. Hamas asked for the complete withdrawal of Israeli troops from Gaza in return for releasing hostages, a demand which the Prime Minister called “delusional.” The development comes amidst closed-door battles between key government officials and military leaders over invading the southern Gaza city of Rafah, which borders Egypt, versus holding back and instead working on releasing hostages. The spillover effects of the conflict have driven up global shipping costs to multi-year highs (excluding rises driven by COVID-19).