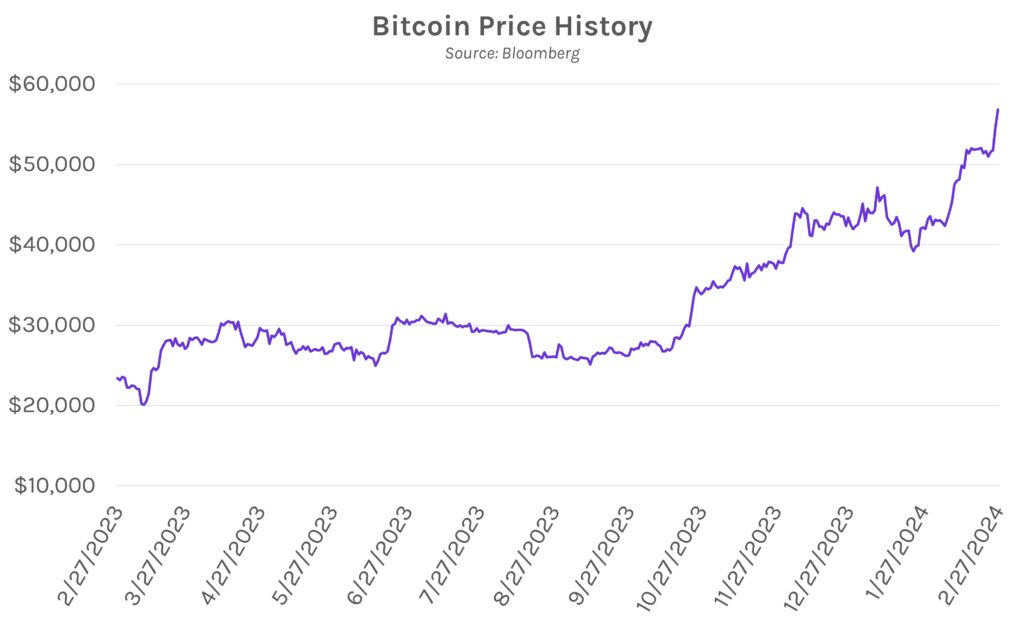

Debt issuance pushes long term rates higher. Record corporate debt supply in February and waves of Treasury issuance have overwhelmed demand, and today’s story was no different. Seven corporate borrowers sold IG bonds today after yesterday saw the most deals in a single day this year, while a $42B 7y UST auction followed. Yields were mixed, with the 2-year down ~2bps but the long end 2-3bps higher. Equities were also mixed, the S&P 500 and NASDAQ up 0.17%-0.37%, while the Dow fell 0.25%. The “fear gauge” VIX dropped 2.26% to a multiweek low while Bitcoin continued its surge, up nearly 4% today to ~$57k.

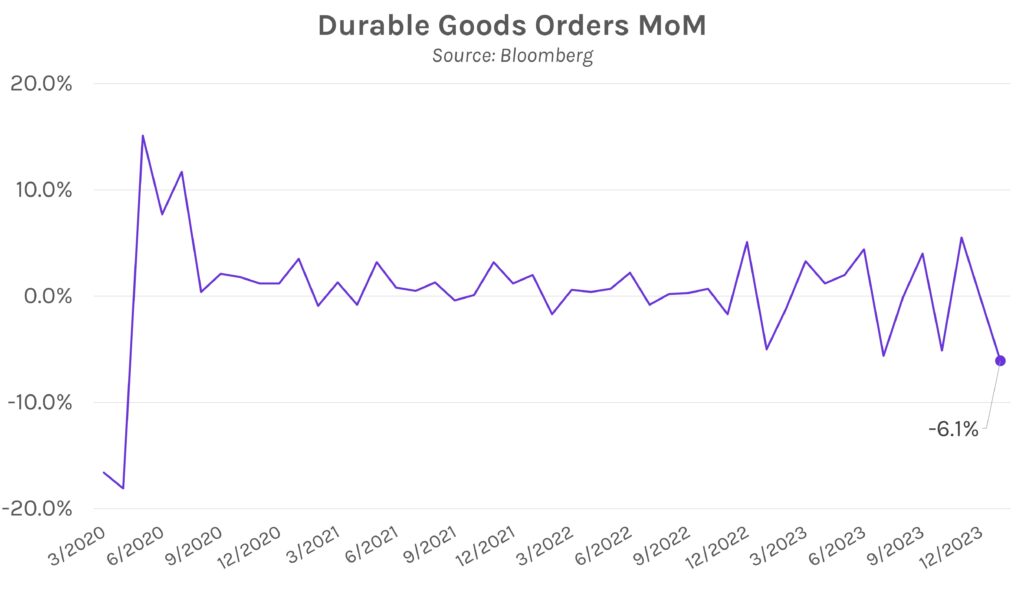

Durable goods orders fall to multiyear lows, consumer confidence declines well below forecasts. Preliminary durable goods orders in January dropped to -6.1% from a revised -0.3% in December, the lowest level since April 2020. The decline was driven by orders for transportation equipment, which fell -16.2% versus -0.6% in December. Durables ex transportation was lower than expected as well, coming in at -0.3% after December’s +0.5%. Meanwhile, consumer confidence was just under 107 in February despite the forecast of 115.

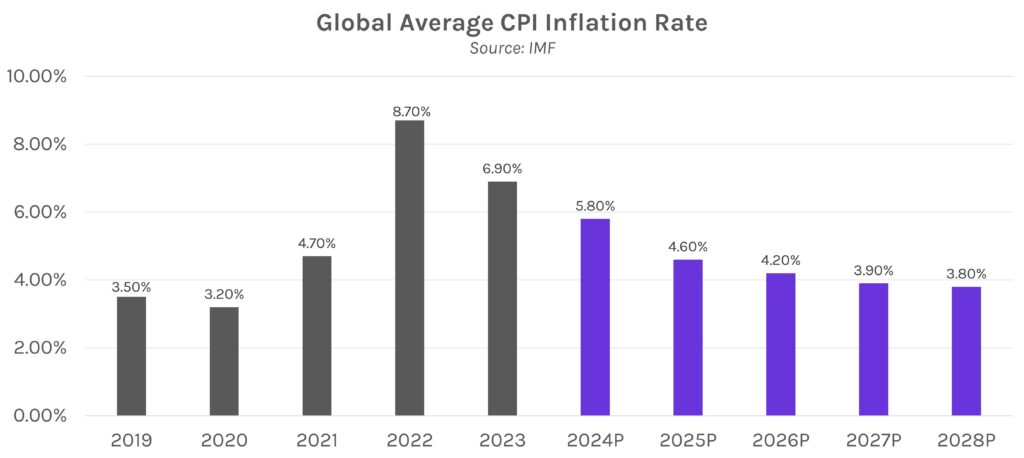

G20 thinks global soft-landing odds are growing. A draft of the G20’s closing statement for its Brazil meeting (currently underway) revealed that the organization sees an ever-growing chance of a soft economic landing for the world economy. The draft stated, “Risks to the global economic outlook are more balanced. Upside risks include faster-than-expected disinflation… inflation has receded in most economies, thanks in large part to appropriate monetary policies, the easing of supply chain bottlenecks….” Despite the acknowledgment of disinflation progress, the draft cautioned against the potential for “adverse inflationary dynamics resulting in persistently tight financing conditions.”