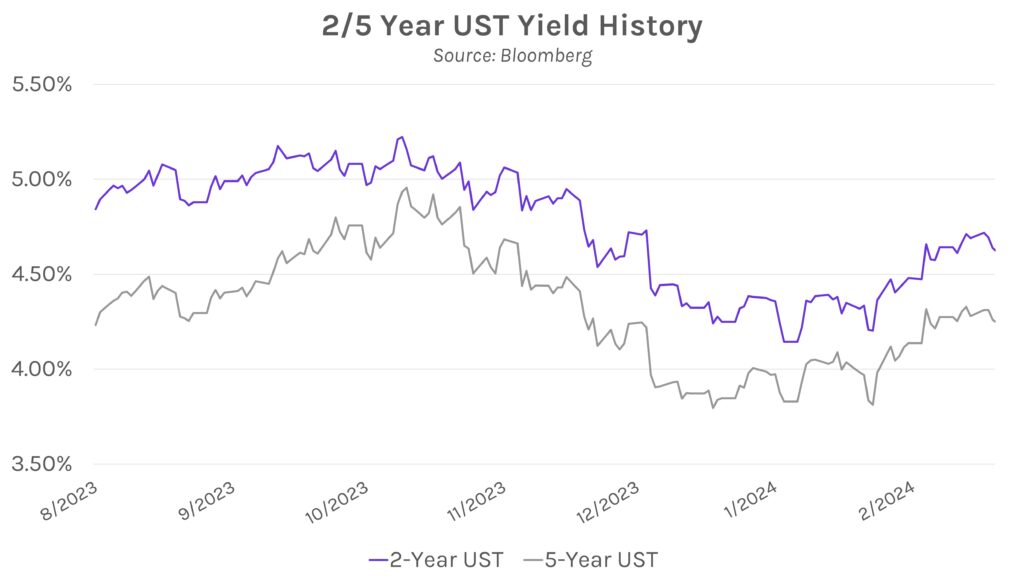

Rates rise ahead of CPI data. Swap rates/Treasury yields rose 1-6bps to start the week ahead of tomorrow’s inflation data. High bond issuance (nearly 15 corporate issuers today and a $56B 3y UST auction) largely drove the increase in rates, as supply overwhelmed demand. Meanwhile, equities dropped in a continuation of last week’s sell-off, as markets remain concerned that current levels (including numerous all-time highs across major indices) may have reached over-bought territory.

Core CPI is expected to drop in February. After coming in higher than expected in January, core consumer price growth is expected to slow in February. The MoM print is expected to decline to +0.3% from +0.4%, while the YoY level is expected to drop 0.2% to +3.7%. The +3.7% level would be the lowest since April 2021 and would break a streak of two consecutive +3.9% prints. Meanwhile, headline levels are expected to be less favorable, as CPI is forecasted to stay flat YoY and increase 0.1% MoM.

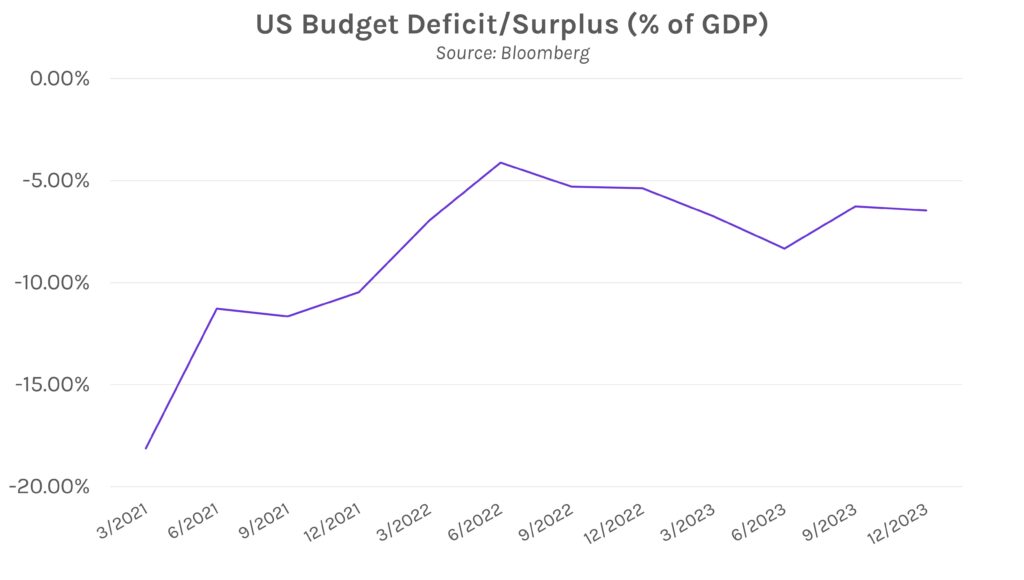

Biden announces deficit plan, eyes higher taxes for corporations and wealthy. President Biden released a federal budget proposal today, which includes a $7.3T budget for the 2025 fiscal year. The plan would aim to establish new social programs while bolstering funding for Medicare and Social Security, implement tax credits for middle class homebuyers, and create ~$3T of deficit cuts over the next 10 years. These programs would be funded by raising the corporate tax rate from 21% to 28%, increasing company taxes for stock buybacks, and raising minimum tax rates for corporations and the wealthiest Americans. The proposal appears to have little chance of making it through the Republican-controlled House of Representatives.