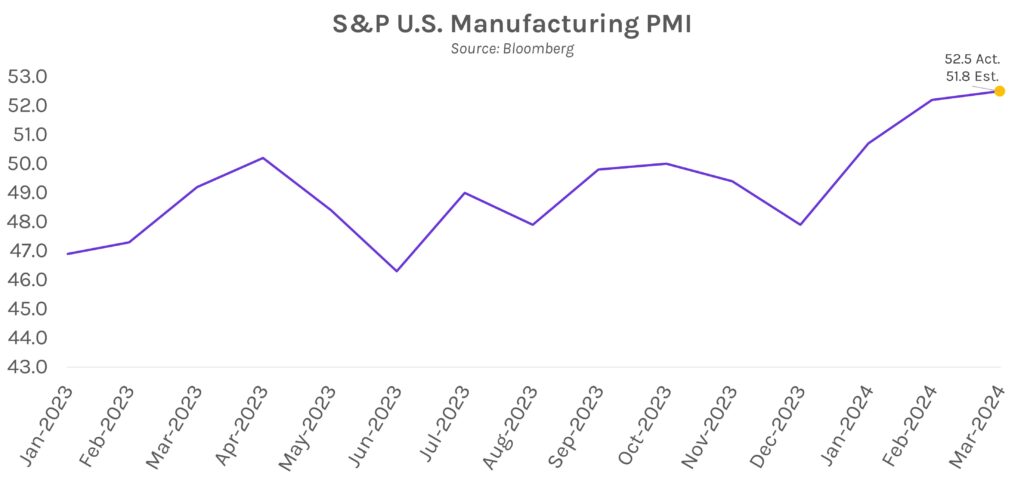

European central banks headline in quiet US rates session. Switzerland’s 25bp rate cut and the BOE’s dovish commentary following their policy meeting highlighted amid a calm US rates session. US rates rose ~3bps on the short end of the curve after Philadelphia manufacturing and US PMI were above expectations in March but remain ~5bps lower since yesterday’s FOMC meeting. Elsewhere, major equity indices rose to fresh all-time highs, with the S&P 500 at 5,240, the Dow near 40,000, and the NASDAQ over 16,400.

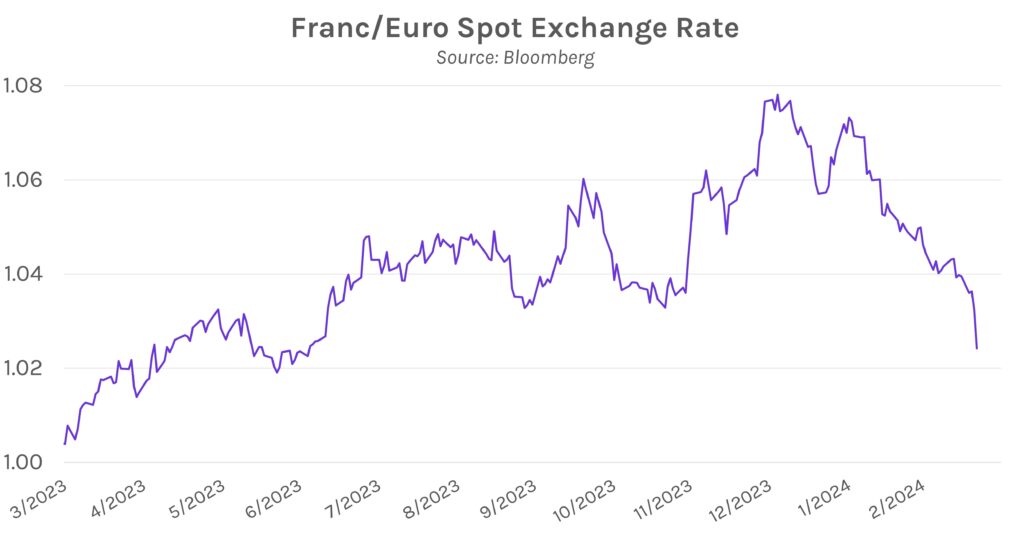

Swiss National Bank (SNB) unexpectedly cuts rates. Switzerland stole headlines today after they cut their policy rate by 25bps to 1.5%, the first major central bank to do so this cycle. The unexpected move was driven by lower inflation expectations. SNB President Thomas Jordan shared, “the easing of our monetary policy has been made possible because the fight against inflation over the past 2 1/2 years has been effective.” The Swiss franc tumbled following the announcement, dropping to a 4-month low against the dollar and an 8-month low against the euro.

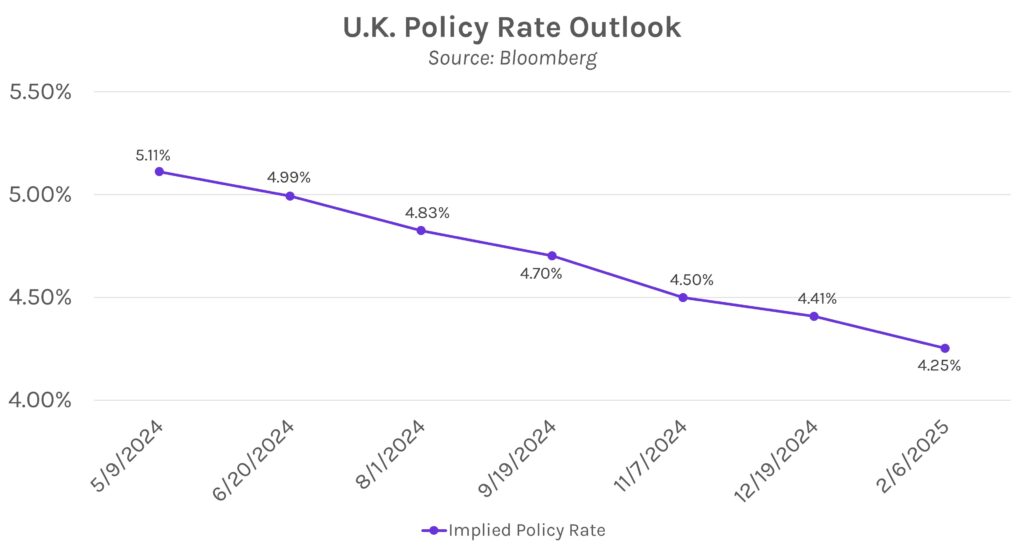

March Bank of England (BOE) meeting spurs rate-cut chatter. The BOE announced today that they will hold policy rates at 5.25%, but 2 notable hawks moderated their stance by voting for the hold which was viewed as a sign that cuts may be on the horizon. The meeting minutes also contained language hinting that cuts could happen soon, but still said that officials would “keep under review” how long rates should be held constant. BOE Governor Andrew Bailey said following the meeting that market pricing for 2-3 cuts is “reasonable” but also added, “…we have still got some way to go, particularly with what I call the more persistent bits of inflation. That’s particularly the services element.”