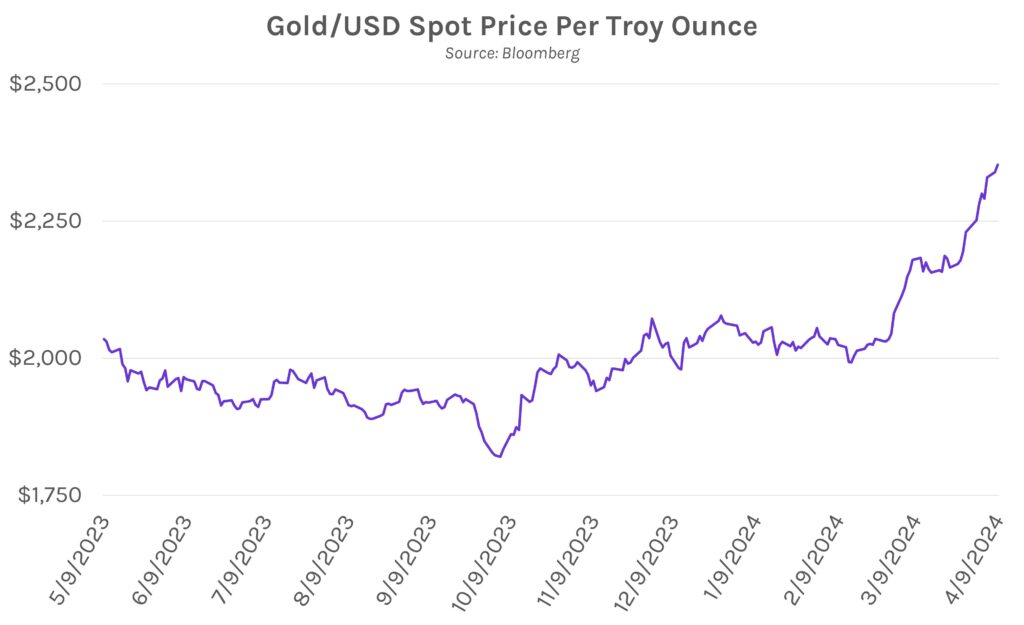

Rates fall ahead of Consumer Price Inflation (CPI). Rates gradually fell throughout today’s session and closed 4-6bps lower as markets await CPI data. CPI is expected to show a slowdown of core inflation growth in March. Meanwhile, gold rose to a new all-time high while rates declined, now over $2,353 per troy ounce. In the Middle East, continued optimism regarding Gaza-related diplomatic efforts saw Brent crude fall nearly 1%, closing below $90 per barrel.

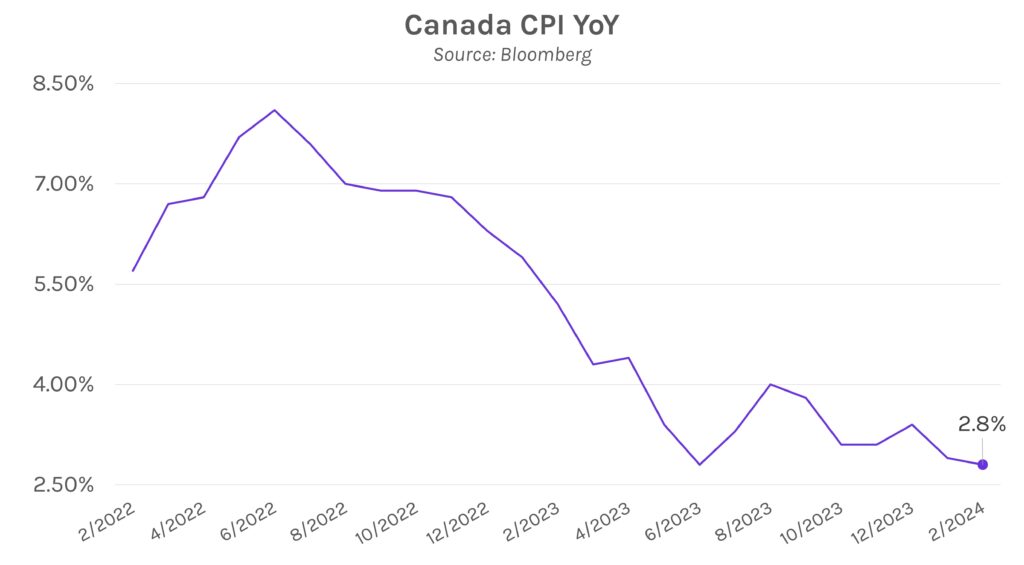

Bank of Canada (BoC) to announce policy decision tomorrow. The BoC is widely expected to hold rates steady at 5% tomorrow. Futures markets have a ~17% chance of a 25bp rate cut priced in as June remains the likely start-point for monetary easing. Despite the probable hold, evidence is mounting for the BoC to begin accommodation; CPI is within policy range (+2.8% in February YoY) and well below the peak of +8.1% in June 2022. Furthermore, March’s labor reports showed that the economy lost jobs while the unemployment rate unexpectedly rose to 6.1%.

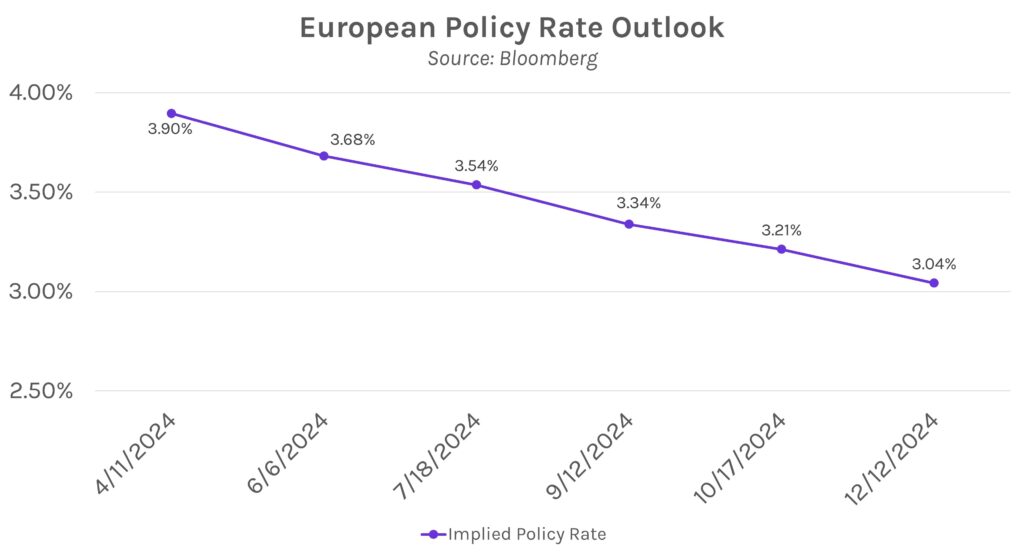

Eurozone loan demand in focus. Higher borrowing costs are depressing corporate loan demand, leading to a “substantial decline” in 1Q24, according to today’s published ECB’s Bank Lending Survey. Net demand for loans by firms fell 28% despite expectations of 2% growth. The ECB report explained that a higher interest rate environment, declining fixed investment for firms, and lower consumer confidence for households largely drove the dampening in loan demand. Chief European economist at T. Rowe Price Tomasz Wieladek said, “The weaker firm loan demand raises the risks of an investment slowdown later in the year…this is a clear indicator that monetary policy remains too tight in the Euro area.”