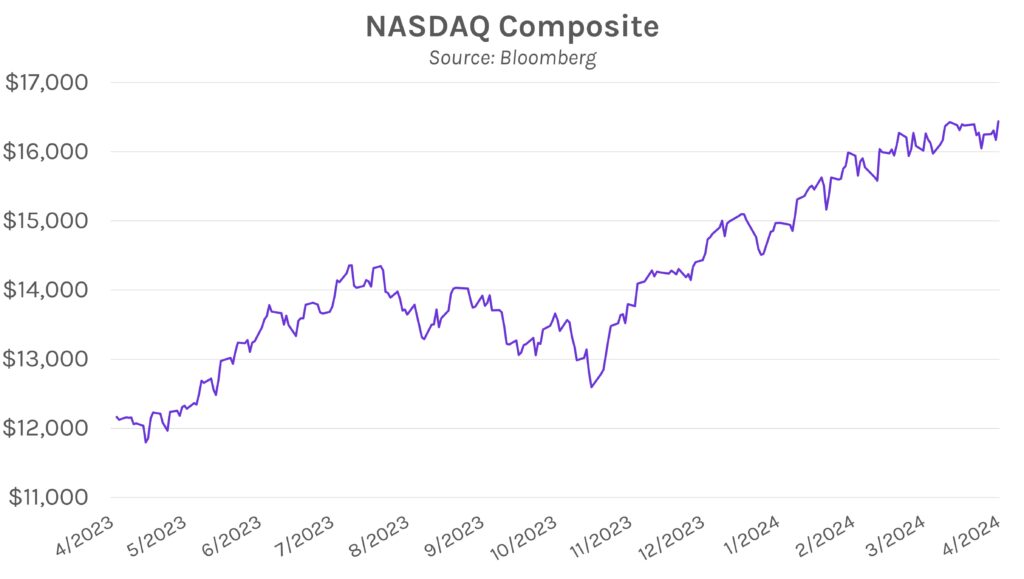

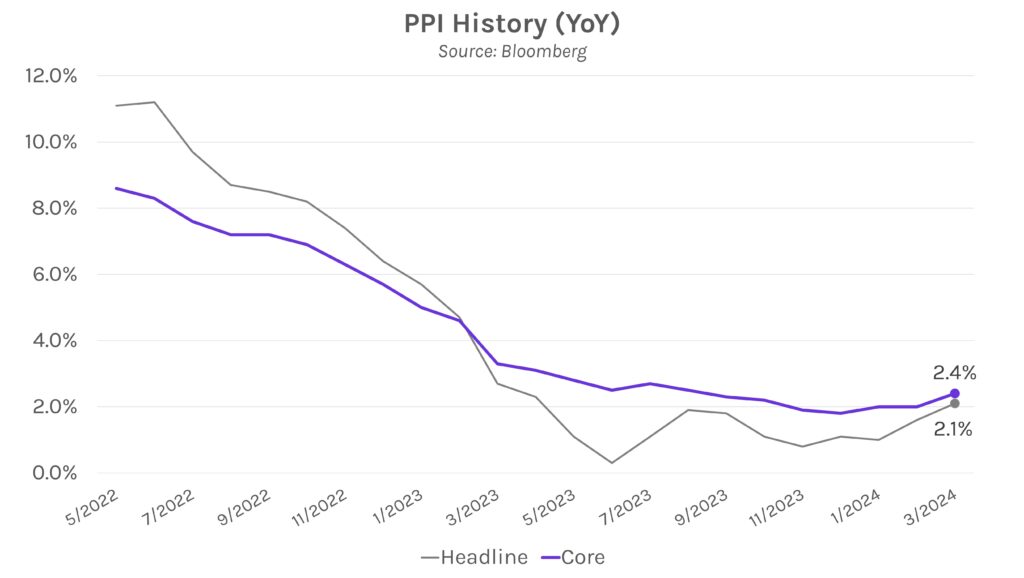

Rates decline before a weak UST auction drives an afternoon sell-off. March Producer Price Index figures were lower than expected, a positive sign after yesterday’s hot inflation print. Short-term rates immediately plummeted ~7bps after the data but grinded higher throughout the session to close nearly unchanged following weak demand at a $22B 30y UST auction. Elsewhere, major US equity indices were higher, as the NASDAQ jumped 1.68% while the S&P 500 rose 0.74%.

Cooler PPI data may set the stage for softer PCE. Markets generally viewed March PPI positively after yesterday’s blowout CPI print. All measures were below or in line with expectations except core YoY PPI, which was 2.4% vs 2.3% estimates. Several categories from PPI, notably healthcare services, feed directly into PCE, so today’s data may moderate March PCE results. Matthew Martin, a US economist at Oxford Economics, wrote, “After another sizzling CPI report, producer prices offer some relief for Fed officials who may view the recent price reports as too hot to consider rate cuts in the immediate future.”

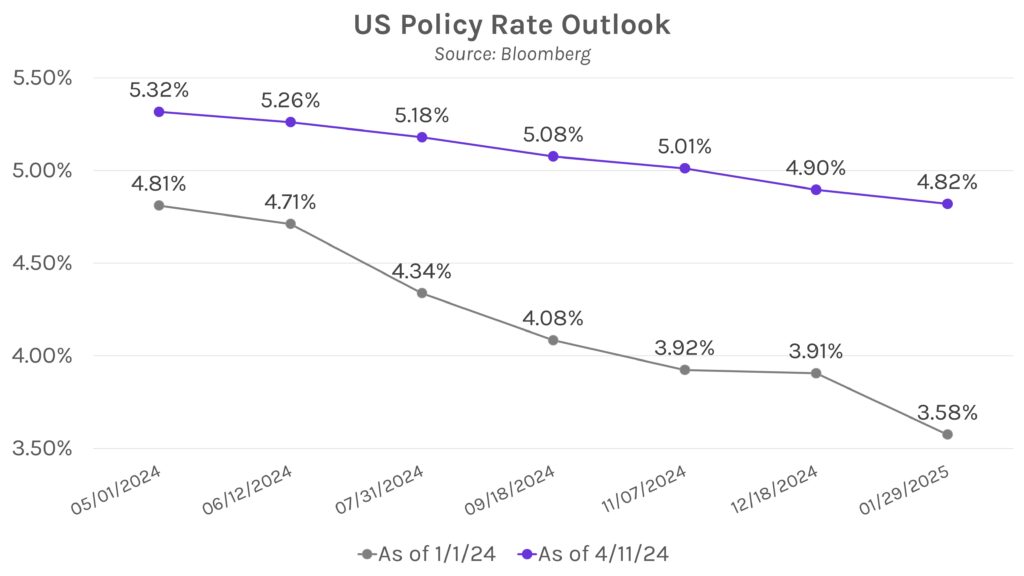

Boston Fed President Collins says that sticky inflation may warrant fewer 2024 rate cuts. Yesterday’s CPI print pushed rate cut expectations back to September, a shift that the Fed’s Collins seemingly agrees with. She argued that recent inflation figures “highlight uncertainties related to timing, and the need for patience… this also implies that less easing of policy this year than previously thought may be warranted.” Collins added that labor market strength “reduces the urgency to ease.” However, she maintained that the recent data have not “materially” changed her outlook, and she believes that rate cuts will commence in 2024.