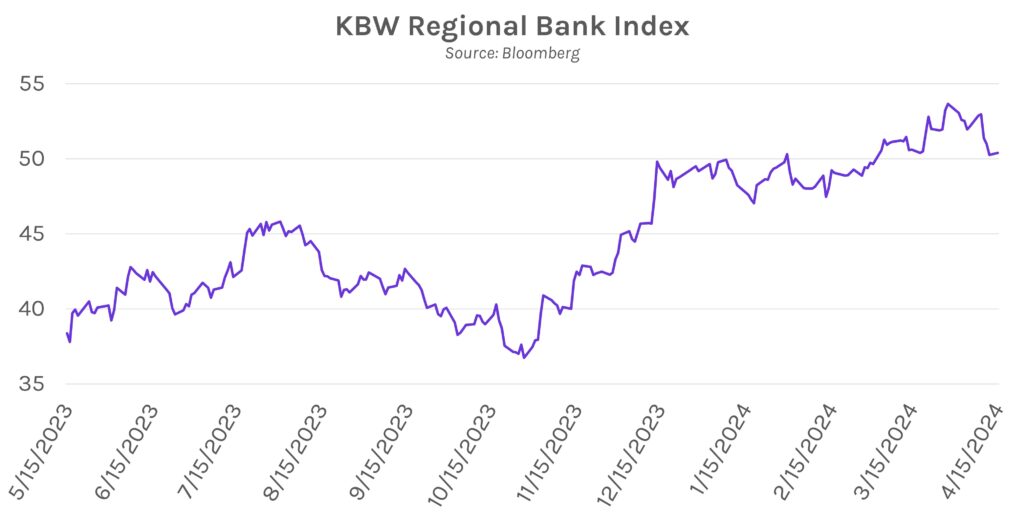

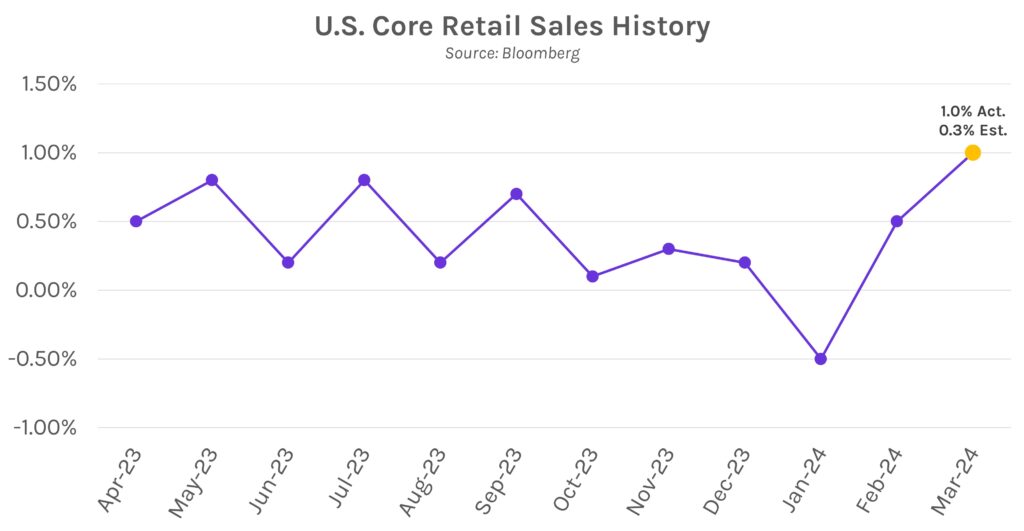

Rate curve bear steepens while Goldman boosts bank stocks. Strong retail sales in March forced rates immediately higher by ~4bps as the Fed was left with more evidence of a robust economy. The 2y yield rose to within 1bp of the 5% threshold before falling throughout the remainder of the session to 4.92% while the long end rose 8-9bps. Rates are generally at their highest levels this year, though they remain 25-40bps off 2023 highs. Meanwhile, Goldman’s stronger than expected net income and revenue in Q1 saw its stock rise ~3% today, leading bank stocks to generally outperform. The KBW Bank Index rose 0.30% while the NASDAQ and S&P 500 dropped 1.79% and 1.20%, respectively.

Retail sales beat expectations across all measures in March. Retail sales meaningfully exceeded survey estimates across all measures for March and were revised higher across the board for February. Headline retail sales grew 0.7% vs. 0.4% estimates and core retail sales grew 1.0% vs. 0.3% estimates on a MoM basis. Additionally, control group sales, used to calculate GDP growth, grew 1.1% vs. 0.4% estimates. Deputy chief U.S. economist at Capital Economics Andrew Hunter said, “The strong rise in retail sales in March and upward revision to February’s data will further support the Fed’s stance that there is no rush to start lowering interest rates.”

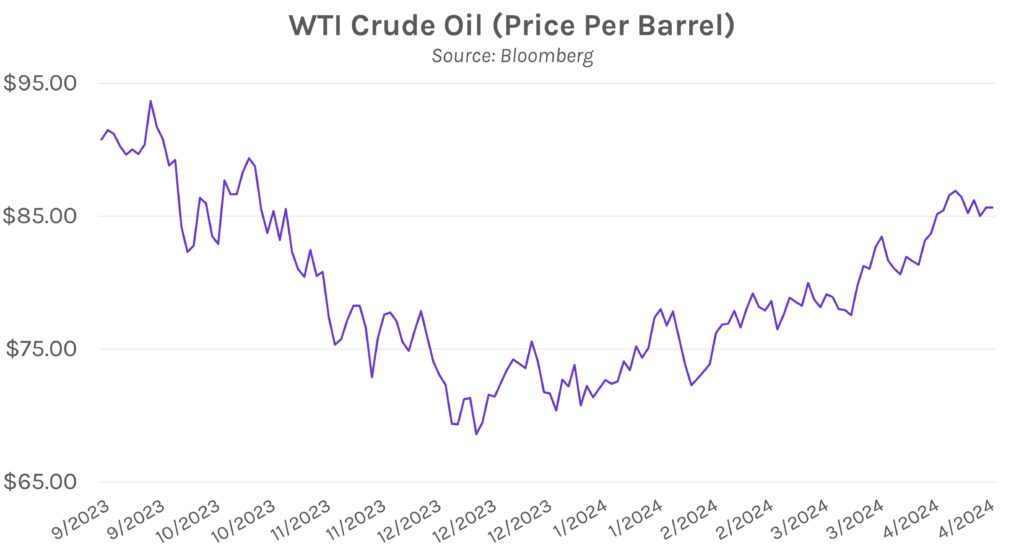

Israeli military official suggests that Israel will counterattack Iran. IDF Chief of Staff Herzi Halevi asserted today that Iran’s weekend missile launches will be “met with a response.” Attention has shifted toward Prime Minister Benjamin Netanyahu as Israel weighs their options. Global leaders have urged Netanyahu and Israel to hold back on significant counterattacks; the US has stated that while they are committed to defending Israel, they will not take part in any response. Among concerns are oil prices, which so far have avoided a significant blowout. Both Brent and WTI crude oil were nearly unchanged on the session and are lower than their highs reached after the announcement of an imminent Iran offensive (Friday). The former is now just above $90 per barrel while the latter is ~$86 per barrel.