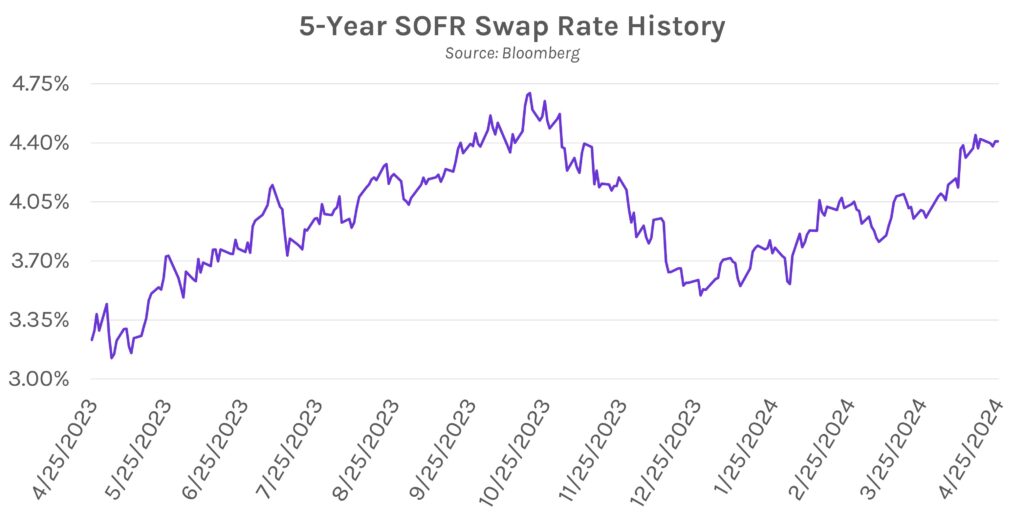

Long term rates rise after lackluster 5y UST auction. Swap rates were little changed at the short end of the curve but rose 3-4bps at the long end after today’s $70B UST auction saw weak demand. Durable goods orders contributed as well after data revealed a significant increase in March. A quiet few days for rates should turn quickly, with GDP, personal income and spending, and PCE figures on deck. Meanwhile, equities again dominated the conversation after Tesla rose over 12% on Elon Musk’s comments that the company would launch cheaper models. Meta shares fell over 15% in after-hours trading after announcing underwhelming Q2 revenue expectations, despite strong profits and revenue in Q1.

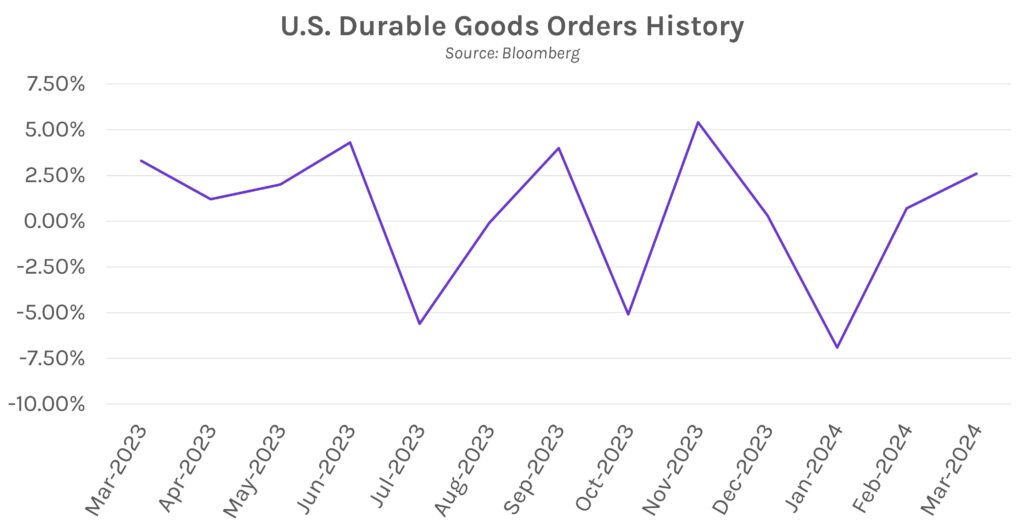

Durable goods orders beat masks broader manufacturing weakness. Orders for durable goods made in the US climbed 2.6% in March vs. 2.5% estimates. The results were ~2% higher than February’s downwardly revised 0.7% growth, largely driven by new car and plane orders. Despite this, most other categories saw little change in a sign of ongoing manufacturing weakness. Nationwide financial markets economist Oren Klachkin said, “Not so encouraging news from the durable goods front dampens hope of an acceleration in equipment spending…this continues to be a soft spot in an otherwise strong economy.”

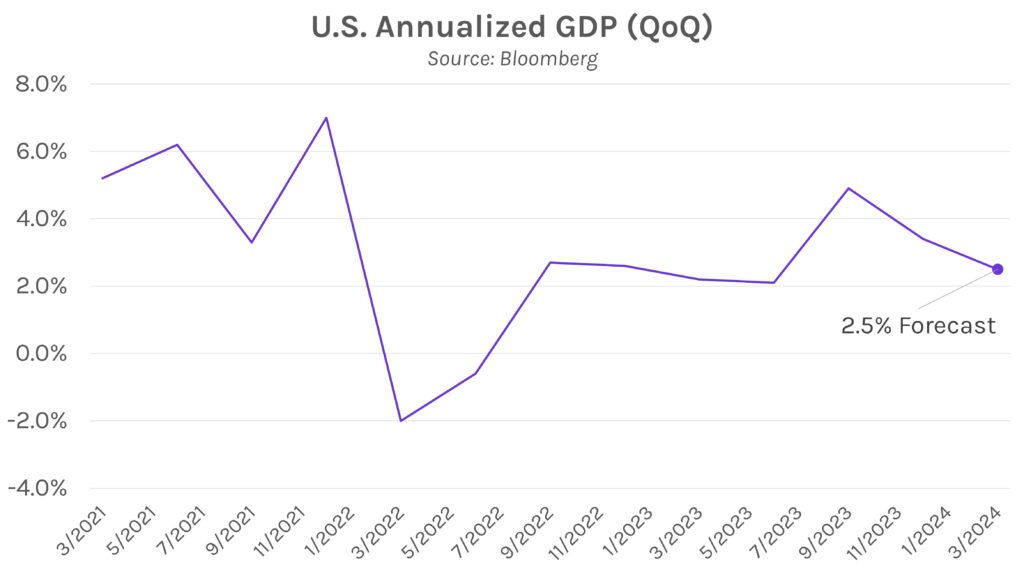

GDP, PCE on deck. The core PCE price index (QoQ) is expected to accelerate from +2.0% in December to +3.4% in March, yet another bump in the road to sustained 2% inflation. Meanwhile, GDP is expected to decline 0.9% to 2.5% growth, which is far below the recent high of 4.9% in Q3 2023 but remains in the desired range for the Fed’s targeted soft landing.