Equities record best 3-day gain in 2024. Today’s rates market activity was highlighted by Israel’s rejection of a cease-fire plan that Hamas previously agreed to. The Israeli Defense Forces later announced new airstrikes against targets in Rafah, a clear sign of still robust geopolitical tensions. Swap rates were little changed on the day after a 1-3bp climb in the afternoon. Meanwhile, equities continued to rally following last week’s FOMC meeting and weak labor data. The S&P 500 and NASDAQ rose over 1%, up 3.24% and 4.77% over the past three sessions, respectively.

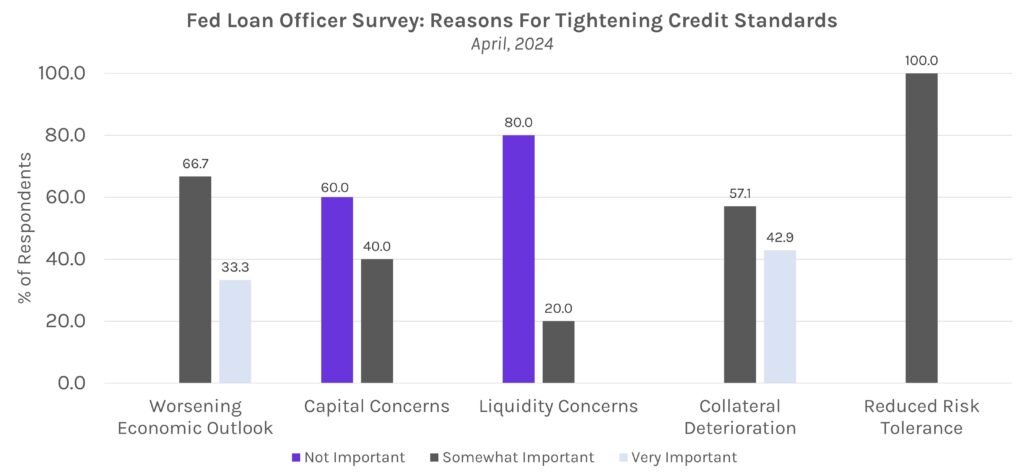

April Fed Senior Loan Officer Opinion Survey (SLOOS) sheds light on tightening loan standards. The Fed’s April SLOOS survey showed, on balance, tighter lending standards and weaker demand for C&I loans and CRE loans across all categories. Significant shares of banks reported tighter loan sizes, lower LTV ratios, increased DSCR ratios, and shortened I/O periods for CRE loan types. Banks cited uncertain CRE market outlooks and a less favorable outlook on CRE delinquency rates as key drivers of the more stringent standards. The release did say, however, that while banks tightened standards, lower net shares of banks reported tightening compared to 4Q23.

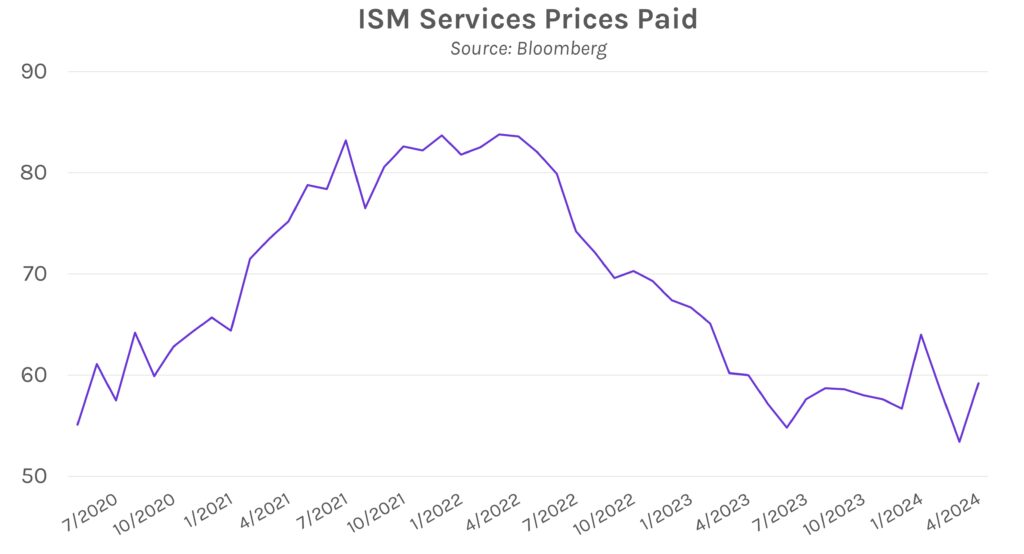

Fed President Barkin says that the full impact of rate hikes has not yet been realized. Richmond Fed President Barkin labelled current rates “restrictive” and said it should be enough to “take the edge off demand in order to bring inflation back to our target.” He added that “The full impact of higher rates is yet to come.” Barkin blamed the goods, shelter, and services sectors as the catalysts for “disappointing” 2024 inflation figures.