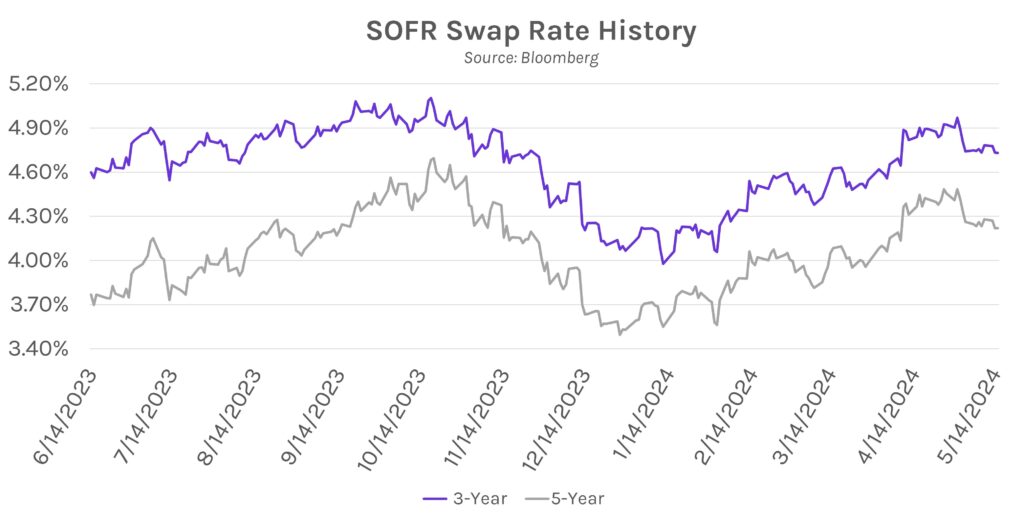

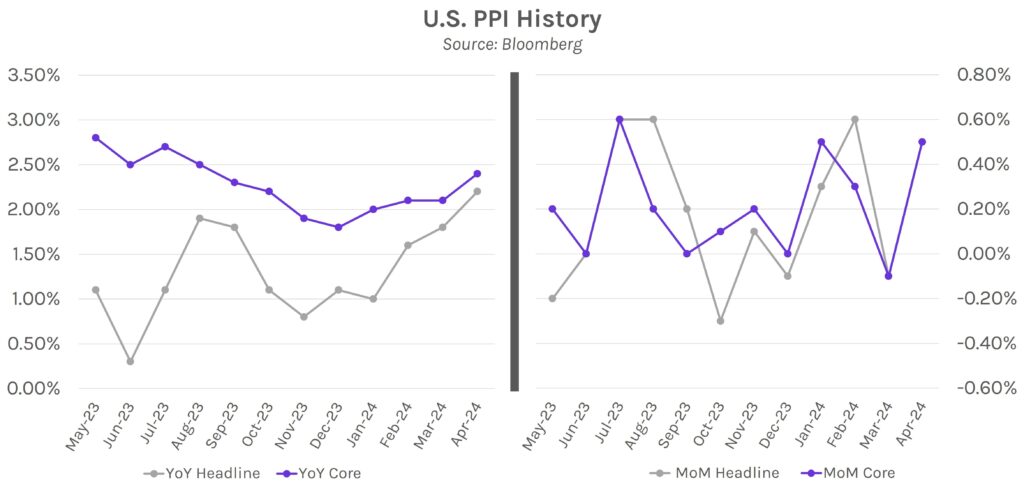

Rates fall after producer price index (PPI) data. Swap rates closed ~5bps lower today after the release of producer price data, despite inflation being higher than expected in April. Rates rose ~5bps immediately after the data release but grinded lower throughout the session as markets interpreted the data as less troubling than it originally seemed. Equities generally rallied today, with the NASDAQ leading major equity indices at +0.75%. Meanwhile, consumer price data is on deck tomorrow, which could provide another volatile session.

Markets shrug off April PPI results. Core producer price inflation was +0.5% vs. +0.2% estimates on a month-over-month (MoM) basis and +2.4% vs. +2.3% estimates on a year-over-year basis. Service inflation largely drove the results, linked specifically to portfolio management and investment advice. Despite flying past expectations, markets largely shrugged off the release since categories that feed into personal consumption expenditures (PCE) eased, while last month’s PPI data was revised lower and showed a MoM decline (-0.1%) in March.

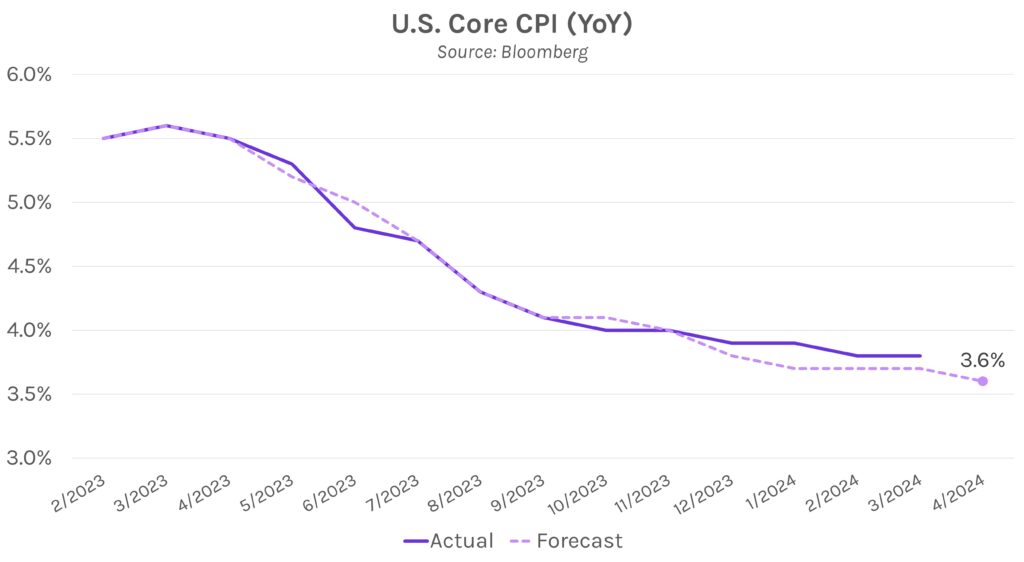

Core CPI is expected to decline to a multiyear low. Core consumer price growth is expected to slow in April to +3.6% annualized and +0.3% month-over-month. The decline would be another step toward the first rate cut of the cycle after PPI’s lower revision in March, especially after the past four CPI prints were higher than expected. Stalled progress toward 2% long-term inflation has seen rate cut projections trimmed to 1-2 25bps moves in 2024 from 6-7 at the beginning of the year. Meanwhile, headline inflation is expected to decline to +3.4% annualized from +3.5% in March.