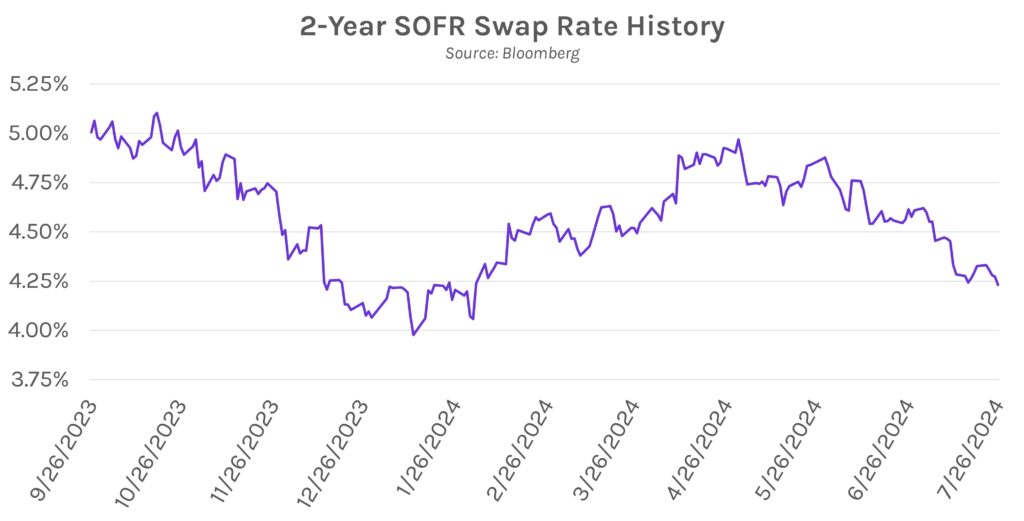

Rates drop as Fed avoids blowout inflation report. Despite slightly higher than expected core personal consumption expenditures (PCE) prices in June, swap rates fell 3-6bps. The move marked a sigh of relief for doves who wish to avoid hot inflation prints, especially after the first several months this year showed higher than expected inflationary pressures. The 2-year Treasury yield closed at 4.38%, a 7bp decline on the week, while the belly of the curve is between 4.08%-4.20%.

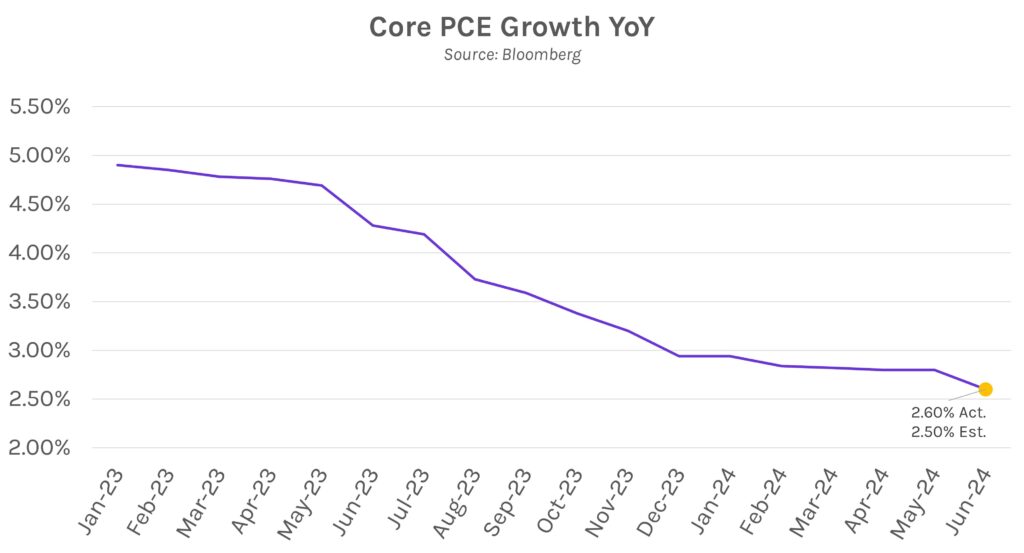

Inflation proves tame in June. PCE released today showed price growth that was in-line with estimates across most readings. Month-over-month inflation climbed slightly from May on both a core (0.2% vs. 0.1%) and headline basis (0.1% vs. 0.0%). On a year-over-year basis, headline inflation declined from 2.6% to 2.5% and core inflation was in-line with last month’s 2.6% result, now ~50bps lower than January’s level. The results are an encouraging sign of moderating inflation even as economic growth remains strong following yesterday’s GDP growth upside surprise.

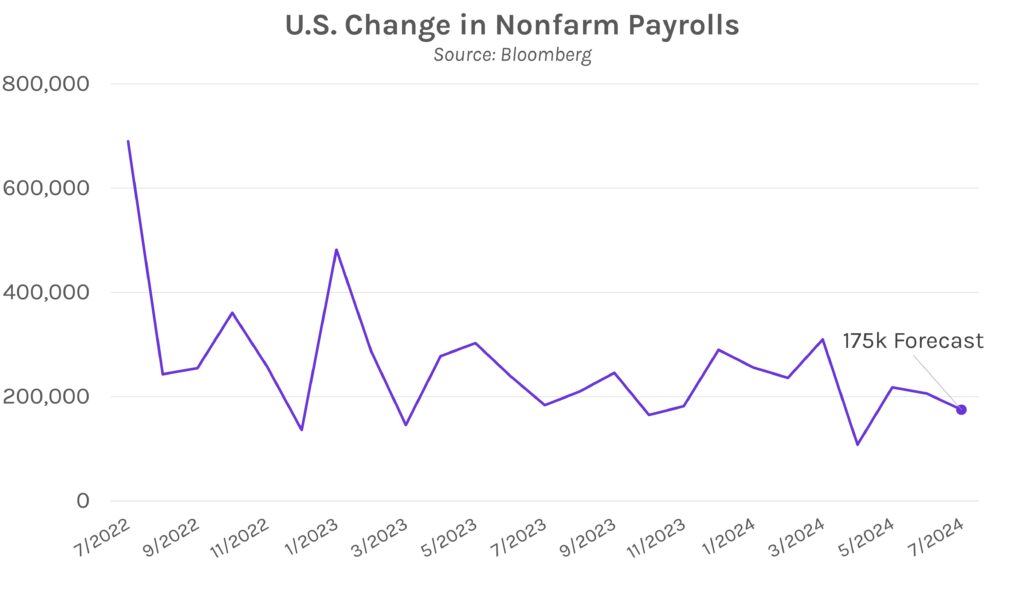

The Fed is unlikely to cut policy rates at next week’s FOMC meeting. Despite pleas from former NY Fed President Dudley for the Fed to cut rates next week, Fed Funds futures’ implied odds of a 25bp move are only ~5%. However, the Fed appears to be close to pulling the trigger at later meetings, as was evidenced by Chair Powell’s recent comments that risks to the labor market will now play a larger role in the Fed’s path forward. Nonfarm payrolls data is set to follow Wednesday’s FOMC decision on Friday, and the number of jobs added is expected to slow to 175k from 206k in June. The slowdown could cement the high probability of a rate cut in September.