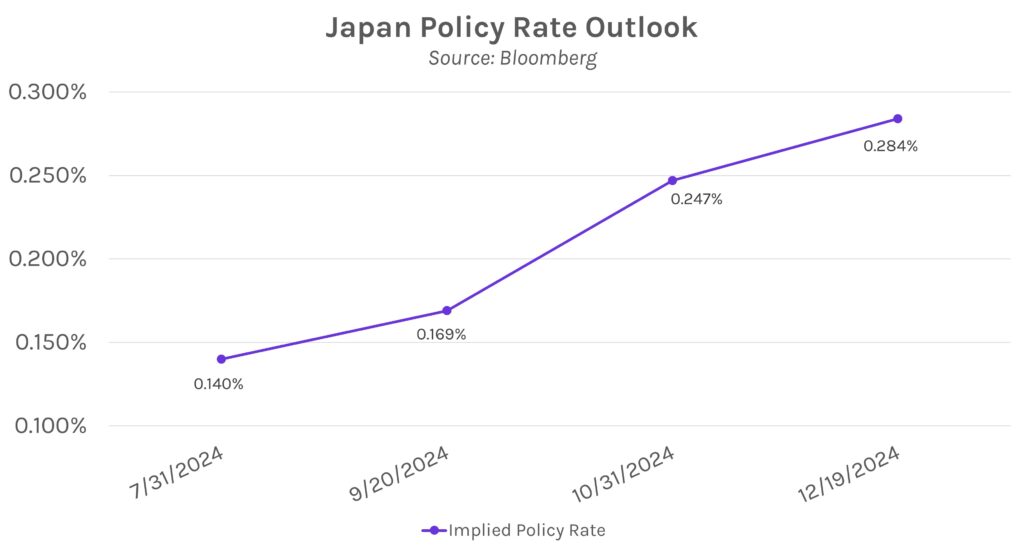

Rates close nearly flat ahead of several policy rate decisions. Swap rates rose 1-2bps at the short end of the curve and declined 1-3bps at the long end of the curve in a quiet day for rates. However, rates will likely see increased volatility with the Fed, Bank of Japan, and Bank of England set to announce policy rate decisions in the next few days. While the Fed is unlikely to cut rates, the BOJ and BOE are priced in by futures as over 50% likely to hike and cut rates, respectively.

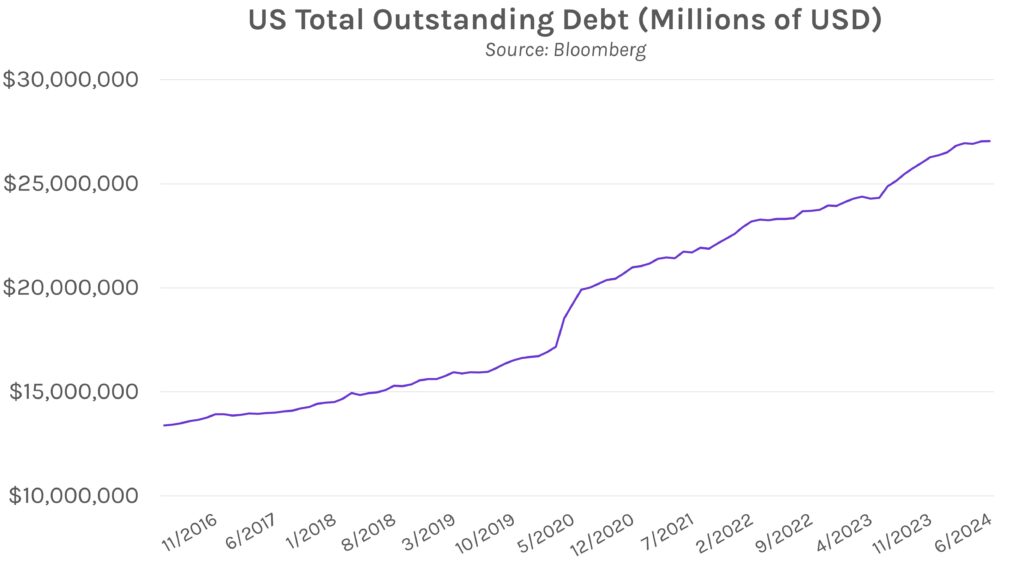

US Treasury reduces estimate for borrowings in Q3. The Treasury announced today that it now estimates $740B in net borrowings in Q3 2024 (July through September), down from the previous $847B estimate. The move is largely the result of the Fed’s recent decision to slow the runoff of its Treasury holdings, an effort to curtail its pace of quantitative tightening. Fewer borrowings could contribute to a Treasury rally, as over-supply has occasionally overwhelmed demand at Treasury auctions.

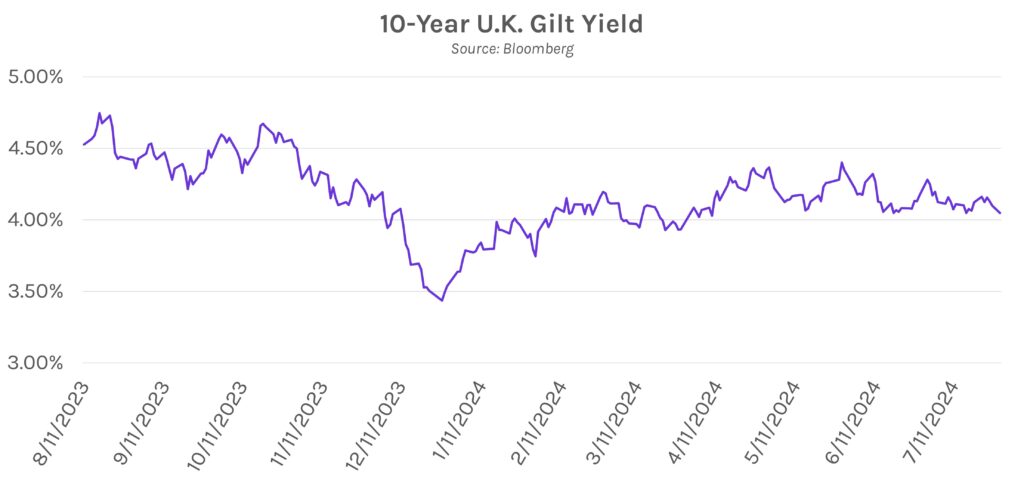

Bank of England may cut rates on Thursday, but outlook remains cloudy. Surveyed economists expect the BOE to reduce rates at Thursday’s policy meeting, but futures pricing is roughly split at ~54% implied odds of a 25bp cut. Looking ahead, expectations are for a slow cutting pace with only two 25bp cuts priced in this year. Observers also expect the bank to be vague about its outlook, with Bank of America UK Economist Sonali Punhani saying, “The BOE is unlikely to give clear guidance on the future rate path… it would keep the focus on the data to determine the timing of the next move.” The BOE’s meeting comes the day after Wednesday’s Fed meeting.