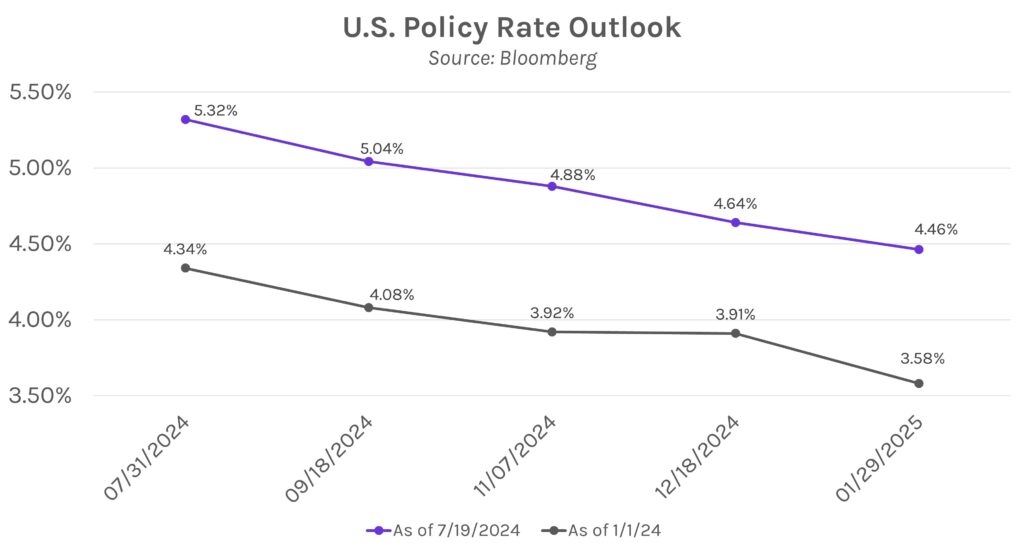

Rates fall ahead of US policy decision. Swap rates fell 3-4bps today despite higher-than-expected US consumer confidence, with most market attention geared toward tomorrow’s FOMC decision. The Fed remains unlikely to cut rates tomorrow, as Fed Funds futures currently price in more than a 95% chance of no change to benchmark borrowing rates. Chair Powell’s press conference will be the focal point as markets look for guidance on the Fed’s mindset toward September’s meeting, where the Fed is currently expected to cut rates by 25bps.

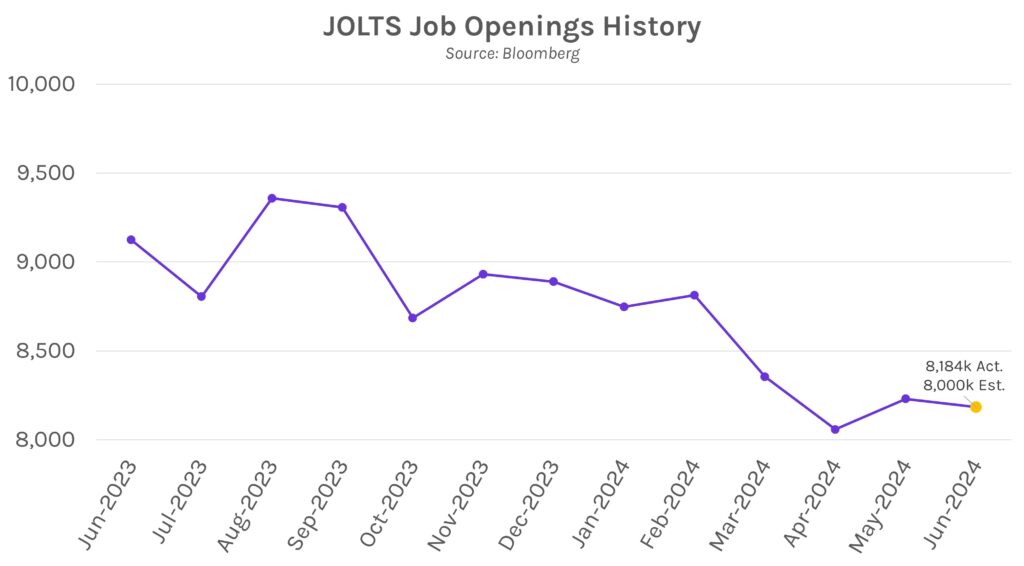

Job openings increase in June. JOLTS job openings for June were above forecasts at 8.18 million (8mm expected), while May’s figures were revised upward to 8.23 million. The results surprised markets given softer hiring and wage data, where the unemployment rate has gradually increased from 3.7% in January to 4.1% in June, and nonfarm payrolls growth has declined from a YTD peak of 310,000 in March to 206,000 in June. Commenting on the results, Santander chief US economist Stephen Stanley said, “The June JOLTS report offers yet another clear signal that the labor market is not deteriorating in the fashion that an increasing chorus of doom-and-gloomers are asserting.”

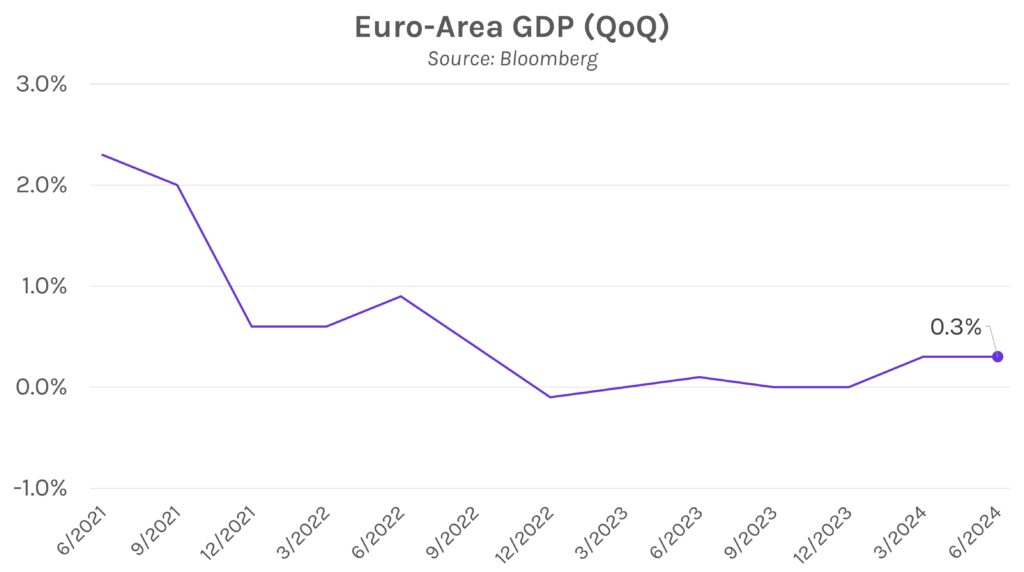

German inflation, euro-area economic growth accelerate. German consumer prices grew at a faster pace than expected (+2.6%) in July, and their GDP fell by -0.1%, a particular concern given they are the euro-area’s largest economy. On the other hand, the broader euro-area economy grew more than expected in Q2. According to advance data, GDP rose 0.3% in Q2 versus the estimate of 0.2%. The mixed bag of data adds to the sentiment expressed by ECB President Lagarde a few weeks ago, who said that the outcome of their September policy meeting remains “wide open.”