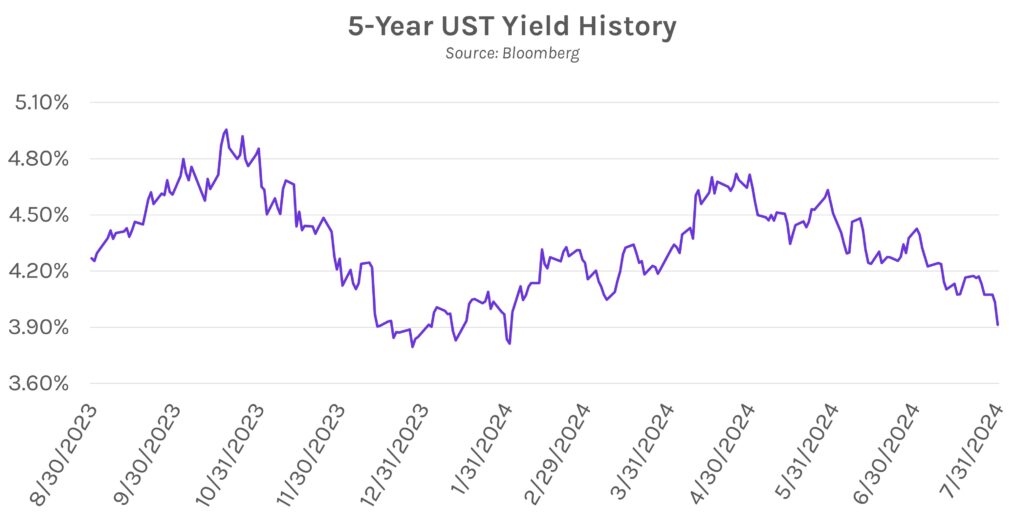

FOMC presser drives afternoon bond rally. Swap rates plummeted 9-12bps to their lowest levels since February following today’s FOMC meeting, where Chair Powell signaled that September could mark the start of rate cuts. The 2-year Treasury yield is now below 4.26% while 5-year and 7-year yields are well below 4%. Meanwhile, equities soared on Powell’s comments and strong days from Nvidia and Meta, with the NASDAQ up 2.64% and the SPX rising 1.58%.

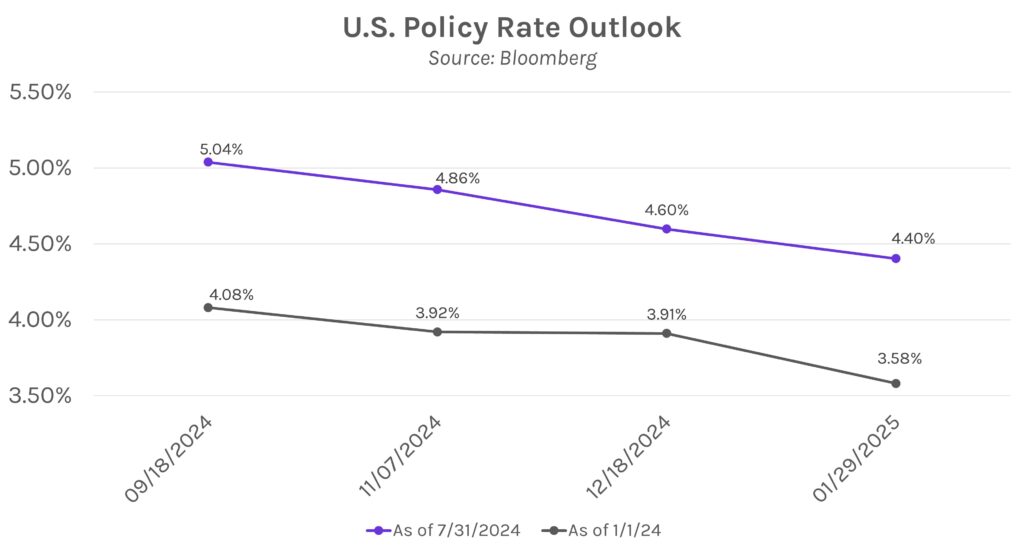

Powell discusses path to a September rate cut. As expected, the Fed held the target Fed Funds rate steady at 5.25% to 5.50%. Encouragingly, the FOMC statement noted recent progress toward the 2% inflation target and featured softer language about the committee’s focus on inflationary risks. The new language did, however, express a renewed focus on labor market stability. Chair Powell emphasized this in his press conference when he said, “The downside risks to the employment mandate are real now…” On the cutting timeline, Powell said that if upcoming data points to lower inflation and continued labor market strength, a September rate-cut could be on the table. The remark was a nod in the market’s direction – at least a 25bp cut in September is fully priced into futures markets. Powell also said that based on how the economy evolves, he can “imagine a scenario in which there would be everywhere from zero cuts to several cuts,” which was viewed as opening the door to three cuts in 2024, more than the two implied by the Fed’s June dot plot. A side-by-side comparison of the July and June FOMC meeting statements can be read here.

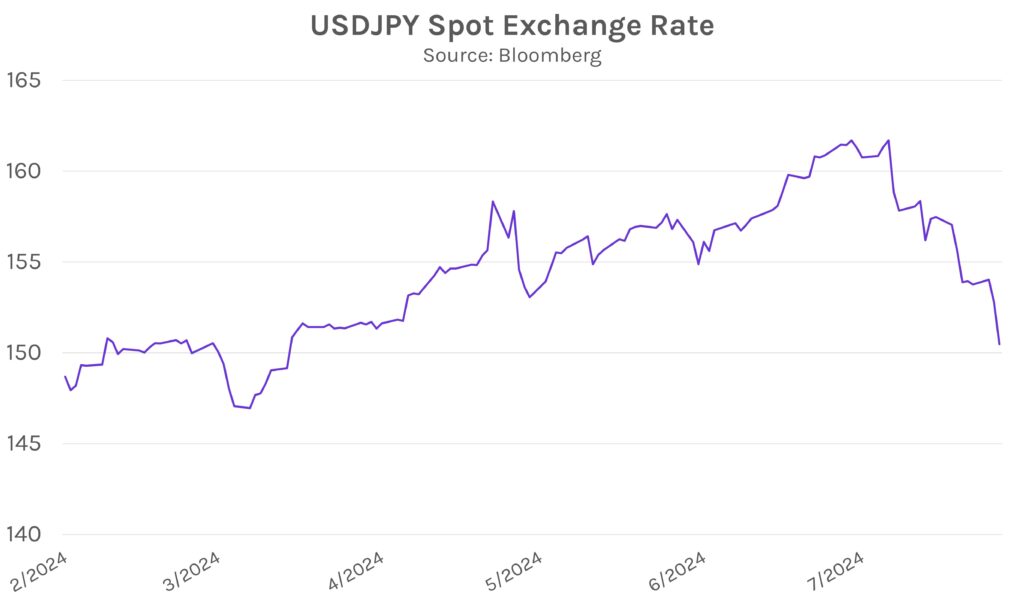

BOJ hikes policy rates again. The Bank of Japan (BOJ) raised interest rates to 0.25% today from 0.10% previously, their second hike this cycle in a shift away from negative rates. The 15bp rate hike pushed policy rates to their highest level since 2008, and BOJ Governor Ueda signaled that there could be more to come in 2024. He stated, “If data shows economic conditions are on track, and if such data accumulates, we would of course take the next step.” The BOJ also announced plans to halve monthly bond purchases to 3 trillion yen as of Q1 2026, contributing to the yen’s rise to ~150 per dollar, its strongest level since March.