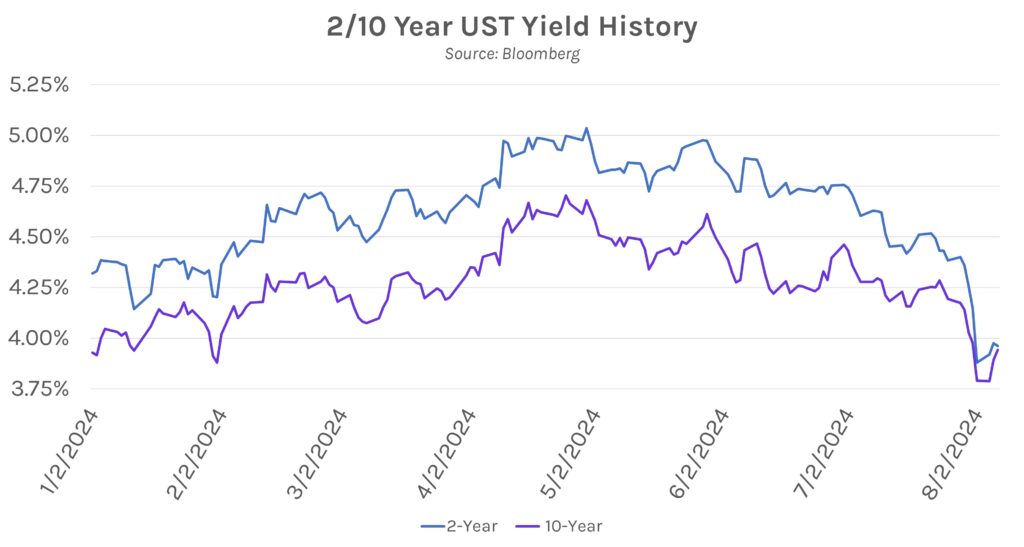

Equity comeback stalls despite Bank of Japan’s dovish pledge. BoJ deputy governor Uchida pledged today that the central bank will maintain loose policy after last week’s hike fueled unprecedent market volatility. US equities opened higher on the comments, with the S&P 500 and the NASDAQ climbing ~1.80% and ~2.10%, respectively, vs. yesterday’s closing levels during intraday trading, only to reverse course ending the day ~0.77% and ~1.05% lower following a weaker-than-expected 10-year UST auction. The auction results coupled with the highest daily volume of US investment grade debt issuance in 2024 drove up longer term yields, with the 10-year UST yield closing ~5bps higher.

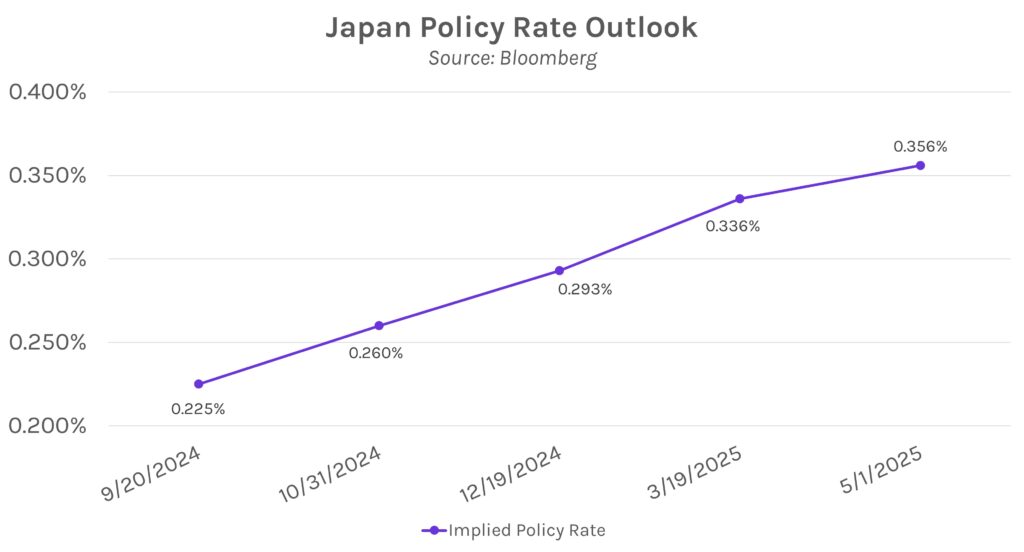

BoJ comments prompt rewrite of future hiking odds. Uchida said today that he believes “the bank needs to maintain monetary easing with the current policy interest rate for the time being…” speaking after total Japanese market cap shrank by over $1 trillion USD in the three-days following the July 31st policy meeting and after the popular Yen carry-trade was upended due to the expectation of higher Yen-denominated borrowing costs. Swap market pricing now shows a 20% chance of another 25bp hike by December vs. +60% after last week’s hike.

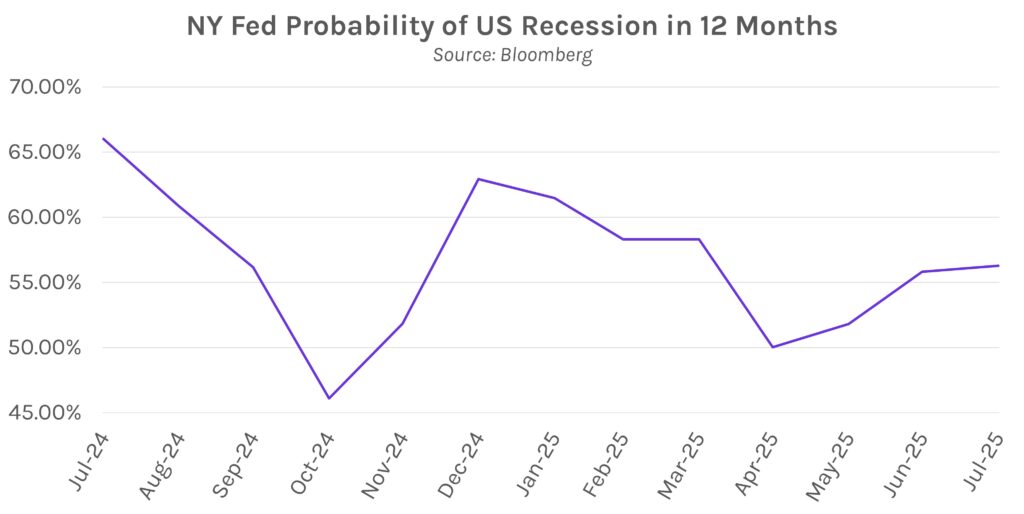

Major banks raise U.S. recession odds. JPMorgan Chase economists wrote today that US news “hints at a sharper-than-expected weakening in labor demand and early signs of labor shedding”. They now see a 35% chance of a US recession by year end, up from 25% in early-July. The move follows Goldman Sachs economists who revised their year-ahead recession odds from 15% to 25% earlier this week.