Equities claw-back losses and volatility dampens. It was a wild week that saw significant swings across financial markets:

- After falling ~3% on Monday as recessionary fears mounted, the S&P 500 ended roughly in-line with last Friday’s closing level, up ~2.78% over the past two days, its strongest back-to-back daily rally of 2024.

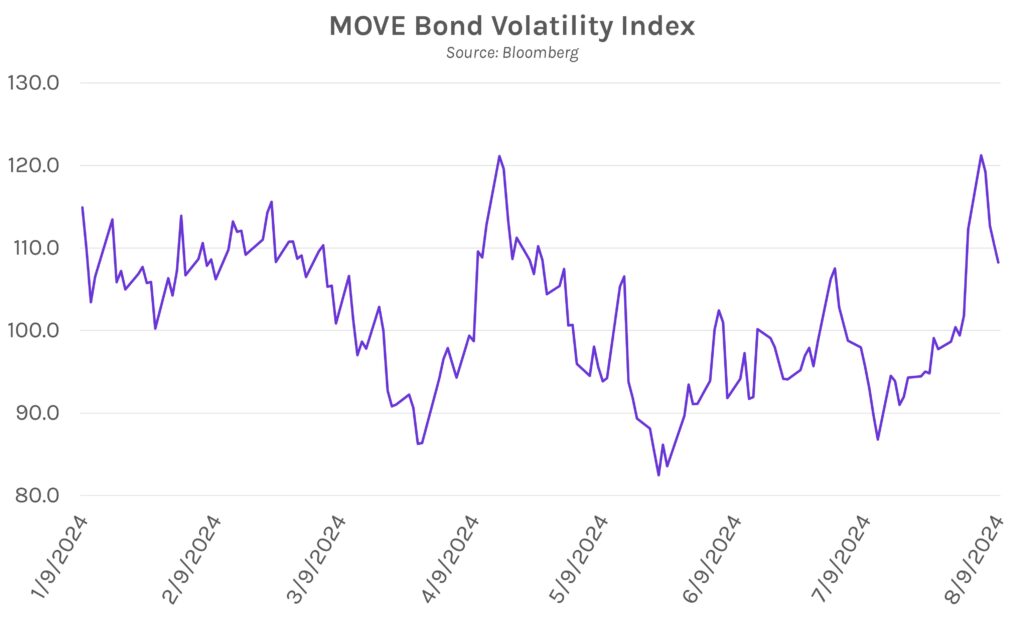

- The VIX volatility index touched its highest level since March 2020 on Monday, closing at 38.57. It faded as the week went on, falling to 20.37 today, ~1.5 points above last week’s average closing level. Similarly, the MOVE bond volatility index fell from 121.20 at Monday’s close to 108.26 today.

- After falling to their lowest levels of 2024 on Monday, the 10-year UST yield ended the week ~15 bps higher and the 2-year closed the week up ~12 bps.

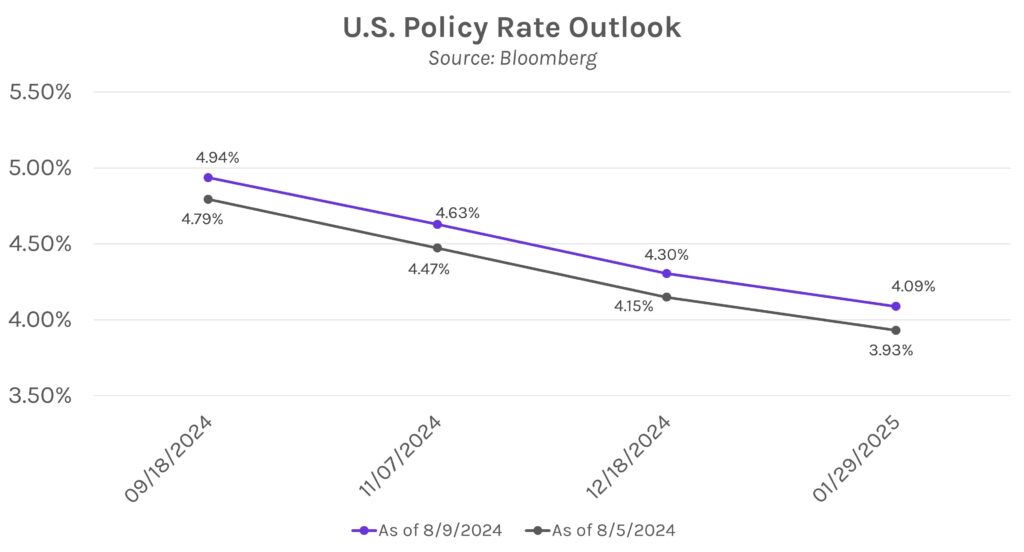

- On Monday, futures markets priced an 85% chance of a 50bp rate cut in September; now, odds are slightly less than 50%.

Economists expect a quarter-point cut in September. Asurvey of 51 economists conducted by Bloomberg between August 6-8 showed that ~80% expect just a 25bp cut in September, and see the same in November, December and 1Q25. The results are at odds with major banks such as JPMorgan and Citigroup who call for a 50bp cut next month. Encouragingly, 69% of respondents also expect an economic soft landing during this cycle.

Bank of Japan’s dovish announcement seen as a break from normal policy. After the BOJ rocked global markets with a 25bp rate hike last week, the decision itself and deputy governor Uchida’s dovish pledge this week were viewed by some as an unwise break from a data-dependent approach to policymaking. Former BoJ official Masamichi Adachi said, “The policy decision itself was problematic but there were communication problems as well,” in response to Uchida pledging that the bank won’t hike if markets remain volatile. Head of currency strategy at Danish investment bank Saxo Markets Charu Chanana said, “The mixed BoJ communications will only spook more volatility…if only they keep their communication aligned, at least that may spare them from panic moves and unnecessary volatility both in yen and equities.”