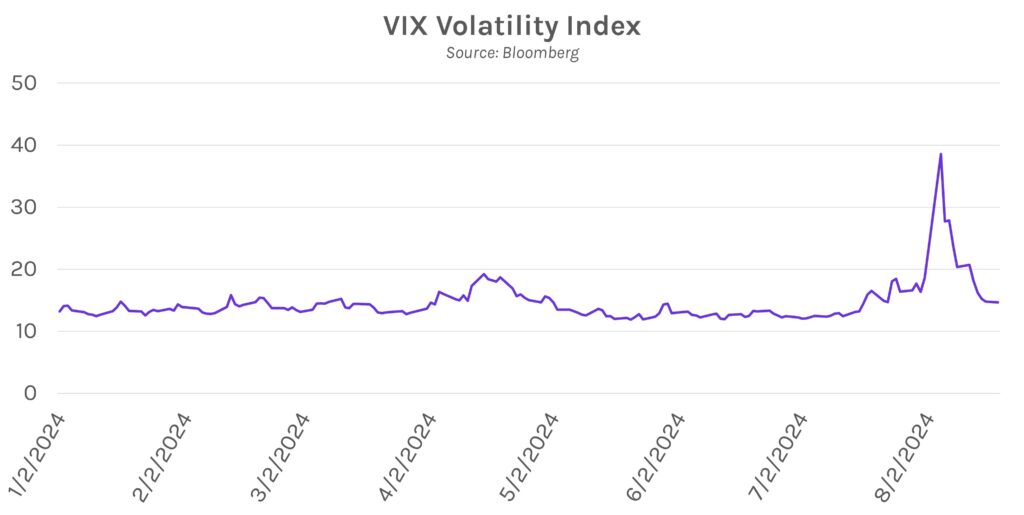

Equities highlight a quiet rates session. Swap rates traded within a ~5bp range today and closed no more than 2bps away from their opening levels. The short end of the curve rose 1-2bps while the long end of the curve declined 1-2bps, with most attention geared towards Chair Powell’s upcoming Jackson Hole speech on Friday. Elsewhere, a late-session surge in equities helped major indices close 0.58% – 1.39% higher. The VIX “fear gauge” dropped over 1% to 14.65, well off the multiyear high of ~39.0 set earlier in the month.

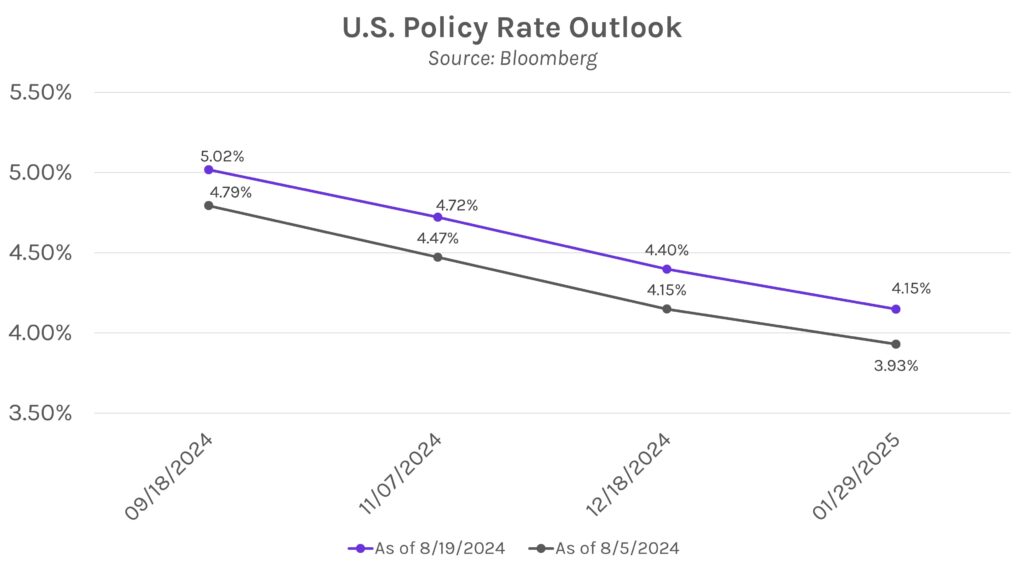

Markets try to predict Powell’s speech. Days ahead of his speech scheduled for 10:00 AM EST on Friday, markets are already thinking deeply about what Chair Powell might say at the annual Jackson Hole Economic Symposium. Bank of America strategist Ohsung Kwon said today he believes Powell will lead with a dovish tone to indicate the Fed is shifting its focus “to preventing undesired weakness in the labor market,” which was echoed by Goldman Sachs chief economist David Mericle who said Powell “might reiterate the message from his July press conference that the FOMC is watching the labor market data carefully and is very well positioned to support the economy if necessary.” Overall, Kwon added that Powell may largely repeat language from the FOMC meeting, steering away from more explicit guidance on rate cuts.

Canadian inflation is expected to slow to a multiyear low. The Bank of Canada has cut their policy rate at two consecutive meetings, and they are likely to continue that trend throughout the remainder of 2024. BOC Governor Macklem offered dovish comments at the most recent meeting, stating that “downside risks are taking on increased weight in our monetary policy deliberations” and noting “progress” in their fight against inflation. The progress is expected to continue as tomorrow’s consumer price index data is expected to slow to 2.5% price growth in July from 2.7% previously. That would mark the lowest level since March 2021 and another step towards a 25bp rate cut in September, where a move is currently 100% priced in.