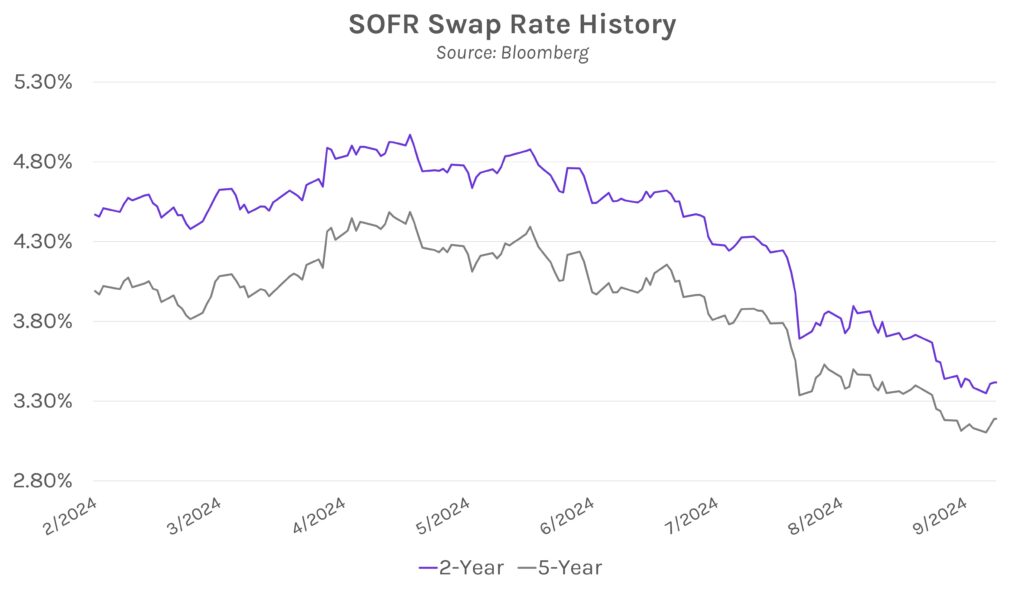

Rates close higher after the Fed cuts policy rates by 50bps. Rates markets were highly volatile in the immediate aftermath of the Fed’s 50bp rate cut, as the short end of the curve plummeted ~12bps before rising throughout the remainder of the session. The short end of the yield curve closed 1-2bps higher today. Meanwhile, the long end of the curve closed above pre-FOMC decision levels, up ~6bps on the day. Chair Powell’s hawkish lean at his press conference largely drove the rise in rates.

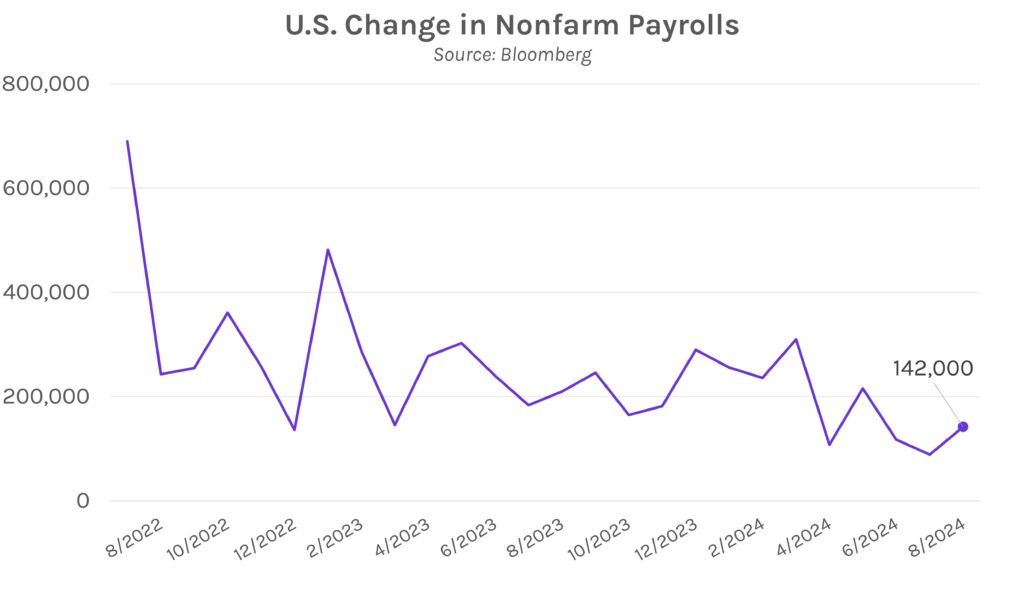

Fed opts for a 50bp rate cut with a lone dissenter. After weeks of debate about the size of the Fed’s initial rate cut, the Fed ultimately opted for a 50bp move. In his post-meeting press conference, Chair Powell highlighted US economic strength and said that the decision to cut rates by 50bps reflected the FOMC’s “growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in the context of moderate growth and inflation moving down to 2 percent.” He highlighted that restrictive policy has brought inflation “much closer to our objective” and emphasized that “downside risks to employment have increased.” He acknowledged the balancing act the Fed faces in cutting rates to support labor markets while being careful not to hinder progress on inflation. A side-by-side comparison of the September and July FOMC meeting statements can be read here.

Following the decision, Governor Bowman captured headlines with her dissenting vote for a 25bp cut. This marks the first time a governor has voted against a Fed interest rate decision since 2005. Some viewed the vote as denying Chair Powell a true consensus at this pivotal monetary policy moment, though Powell has previously defended dissents. After the July meeting, he said, “before the pandemic, we had plenty of dissents. And dissents happen. It’s part of the process.”

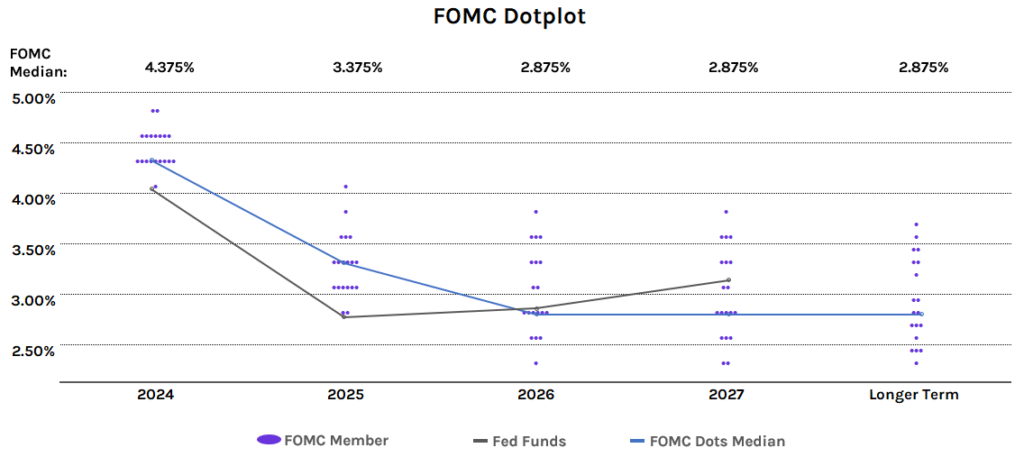

A look at the Fed’s updated Dot Plot. The Fed’s updated Dot Plot shows a median expectation of 50bps of additional rate cuts through 2024. That is consistent with Fed Funds futures, though futures are nearly 50/50 between 50bps and 75bps of accommodation this year. The Dot Plot’s median Fed Funds forecast for 2025 and 2026 year-end are 3.375% and 2.875%, respectively. The longer-term estimate is also 2.875%, a 0.125% increase from June’s forecast.