Equities hit all-time highs in rate-cut aftermath. The yield curve steepened today as the short end of the curve declined 2-4 bps while the belly and long end of the curve climbed 1-3 bps. The move follows yesterday’s 50bp rate cut and updated Dot Plot, which showed a median expectation for 50 bps of additional easing in 2024. Meanwhile, the S&P 500, DJIA, and NASDAQ surged 1.26%-2.51% today, closing at all-time highs. The NASDAQ and S&P 500 are up over 20% year-to-date.

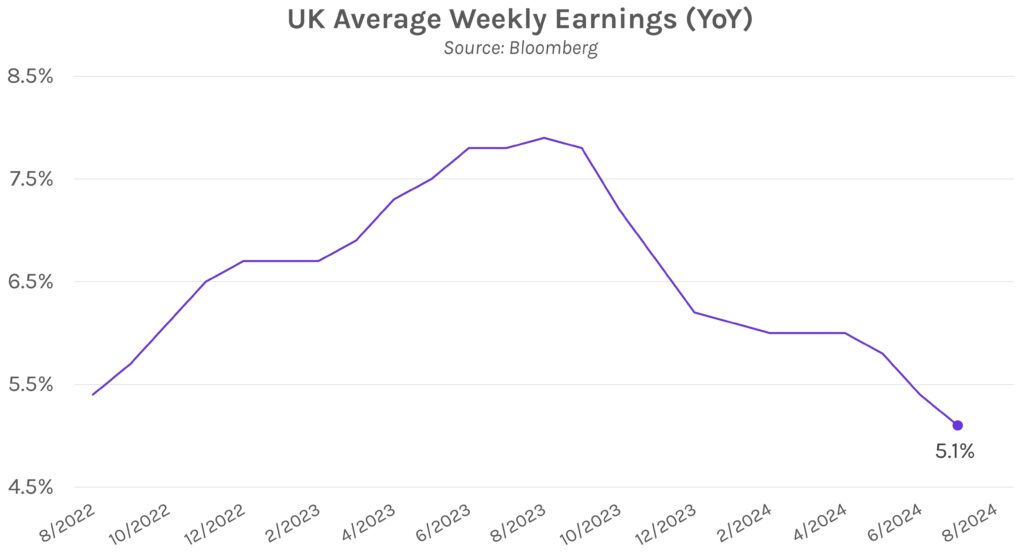

Bank of England (BoE) holds rates at 5%. The BoE held policy rates steady at 5% today after a 25bp rate cut in August from 5.25%, a 16-year high. The decision was nearly unanimous, an 8-1 vote with (external BoE member) Swati Dhingra the sole voter in favor of 25 bps of easing. BoE Governor Andrew Bailey offered hawkish commentary, saying that “It’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.” Elevated wages have remained an inflationary concern, though last week’s data showed average earnings (excluding bonuses) in the three months to July grew 5.1%, a two-year low.

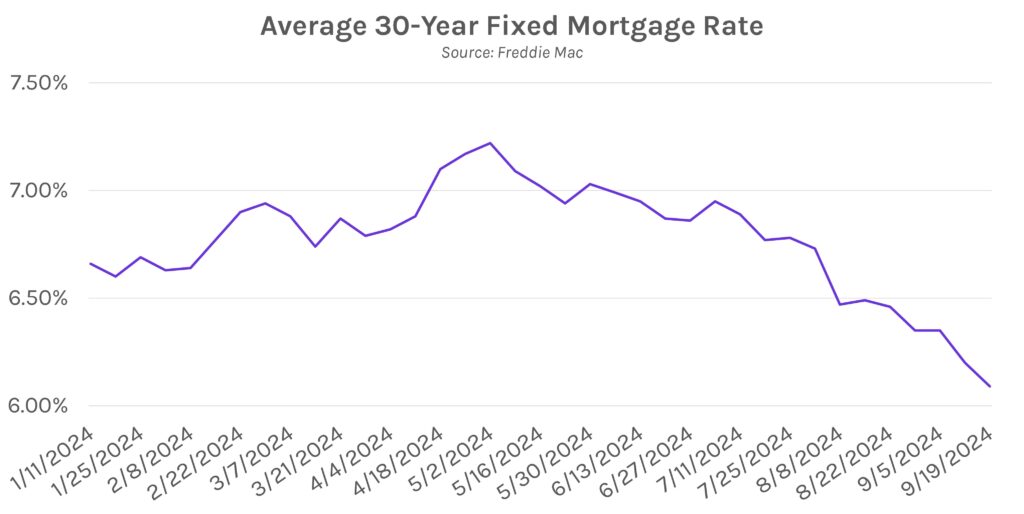

Mortgage rates dip to recent low. The average rate on a 30-year fixed rate loan fell to 6.09% over the 7-days that ended 9/19/2024, according to a statement from Freddie Mac, the lowest since the week of 2/9/2023. Mortgage rates have fallen 1% since early May, with half the decline occurring since August, due to elevated Fed cutting expectations. Some observers hope the declines will support a lagging housing market, but the outlook is mixed. While National Association of Realtors chief economist Lawrence Yun believes lower rates will incentivize housing sales, others such as Wharton professor of real estate Ben Keys are more concerned with the economic instability signaled by aggressive Fed cuts, and therefore, the negative impact on housing demand.