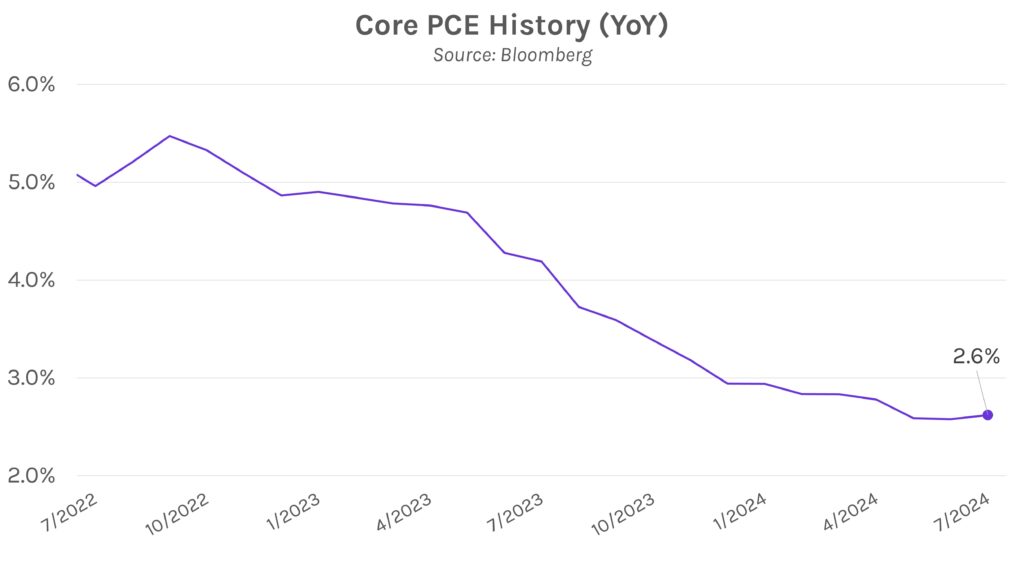

Rates close slightly higher despite dovish comments from Fed Governor Waller. Swap rates rose 1-3bps today after trading within a ~10bp range throughout the session. Volatility peaked after Fed Governor Waller stated that inflation is “softening much faster than I thought it was going to.” His comments drove an immediate 5-8bp decline in Treasury yields before rates reversed course into the market close. The move cemented a 2-7bp rise in rates over the week.

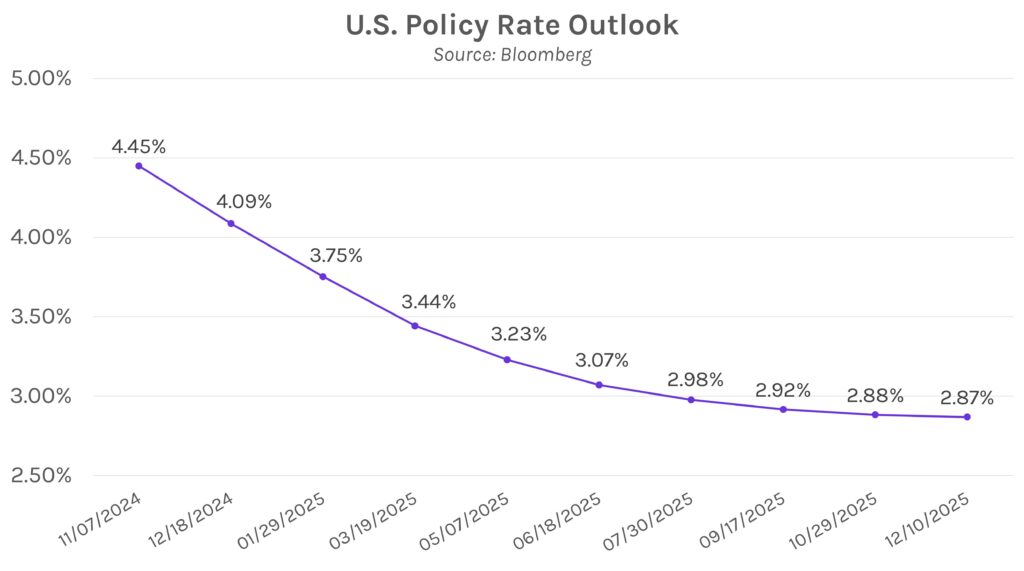

The Fed finally cut rates, but what’s next? The Fed commenced the rate cut cycle with an aggressive 50bp move, largely driven by concerns about slowed US hiring and rising unemployment. Policy voters also expressed greater confidence that inflation is subsiding, allowing for faster implementation of monetary easing. Fed Funds futures currently have ~75bps of rate cuts priced in by the end of 2024, a higher forecast than the updated Dot Plot projection of 50bps.

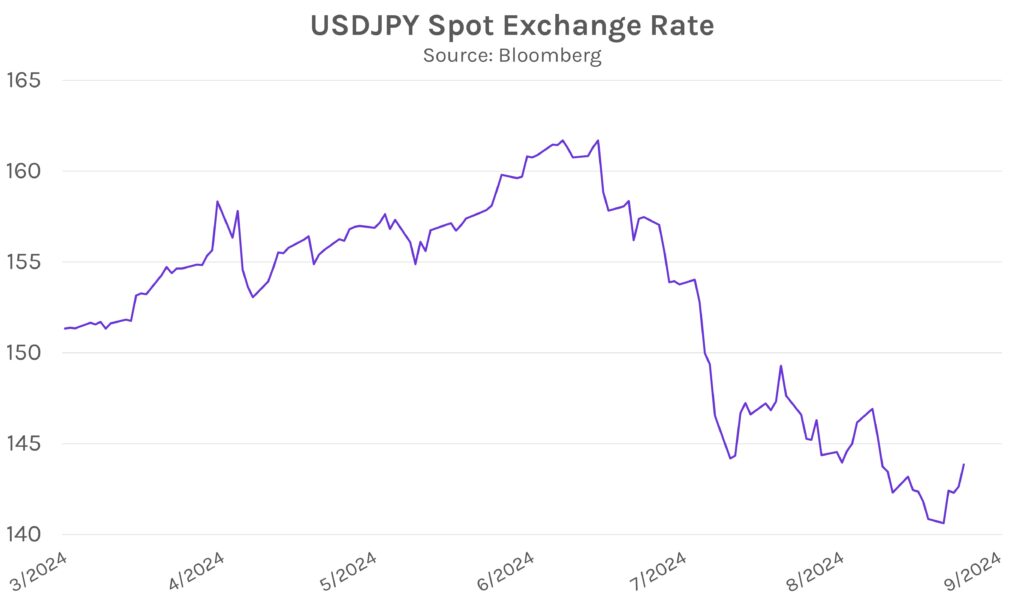

Bank of Japan holds rates steady, signals that an October rate hike is unlikely. The BOJ held policy rates at 0.25% today after July’s 0.15% rate hike. BOJ Governor Ueda suggested that further moves may be delayed due to a few factors, including a stronger yen that could limit inflationary progress. However, he maintained that “If our economic and price forecasts are achieved, we will raise interest rates and adjust the degree of monetary support accordingly.”