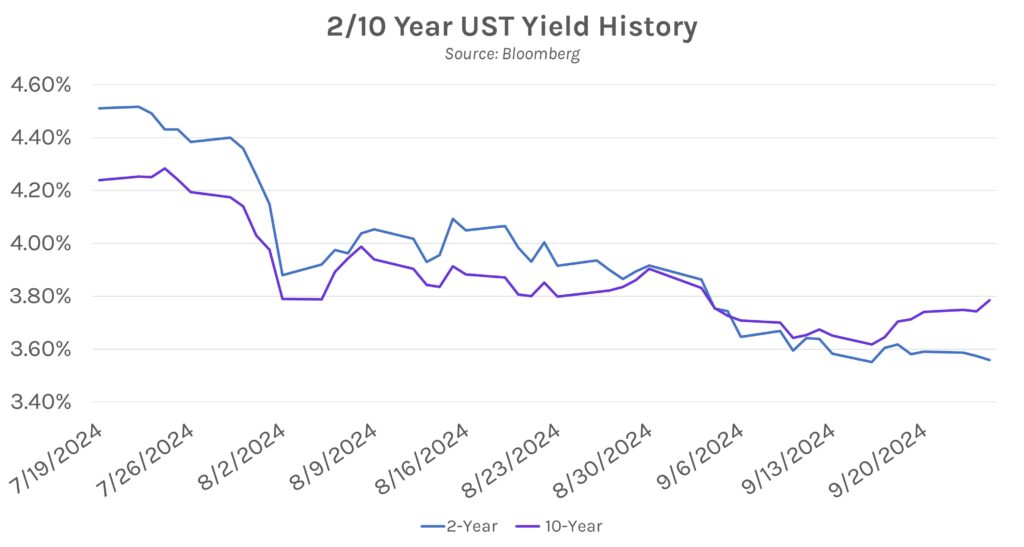

Rates rise while the curve continues to steepen. Swap rates traded within a ~5bp range at the short end of the curve and closed ~2bps higher today. Meanwhile, the long end of the curve saw more volatility, closing ~6bps above opening levels after grinding higher throughout the session. The move extended recent curve steepening that was largely driven by the Fed’s 50bp rate cut last week; the 2s10s spread is now 22bps, its steepest level since June 2022.

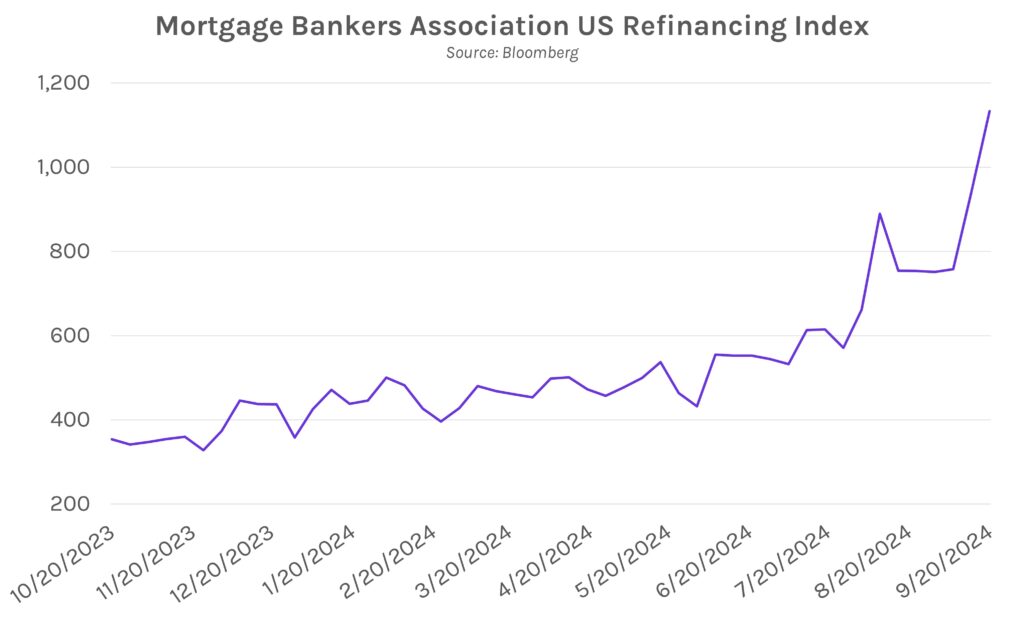

Mortgage activity climbs, driven by refinancings. The Mortgage Bankers Association (MBA) weekly survey showed elevated mortgage applications for the week ended September 20. Overall mortgage application volume increased 11%. Refinancings drove the overall increase, with the refinancing index climbing 20.3% to reach its highest level since April 2022. MBA VP and deputy chief economist Joel Kan said, “As a result of lower rates, week-over-week gains for both conventional and government refinance applications increased sharply. The refinance share of applications is now at 55.7%…they now account for the majority of applications, given the seasonal slowdown in purchase activity.”

China announces another rate cut. After China surprised markets on Monday night with an aggressive stimulus package, they added to the momentum today by announcing a 30bp cut to the medium-term lending facility rate (now at 2%). That marked the largest cut to the medium-term rate since its inception in 2016. Monday’s announced package included cuts to mortgage rates, short-term repo rates, bank reserve requirements, and 800 billion yuan of liquidity support for equities.