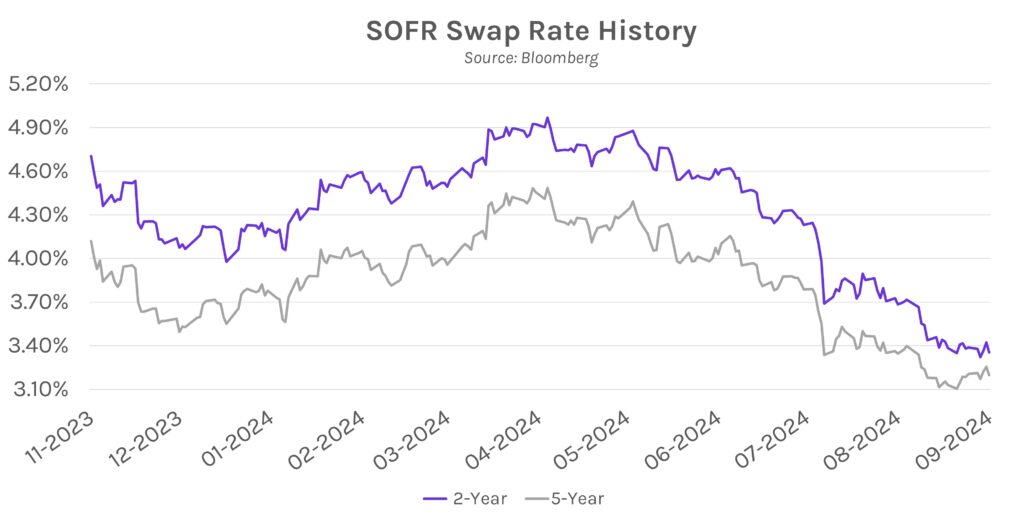

Rates decline on PCE day. Today’s inflation data met or trailed expectations across all readings, providing the Fed with more evidence that inflation is under control. The data drove a 3-7bp rate decline across a steepening curve, largely offsetting yesterday’s move. Rates rose ~3 bps across the curve on the week. Meanwhile, equities were little changed despite the generally positive inflation data, with the S&P 500 and NASDAQ down 0.13% and 0.39%, respectively.

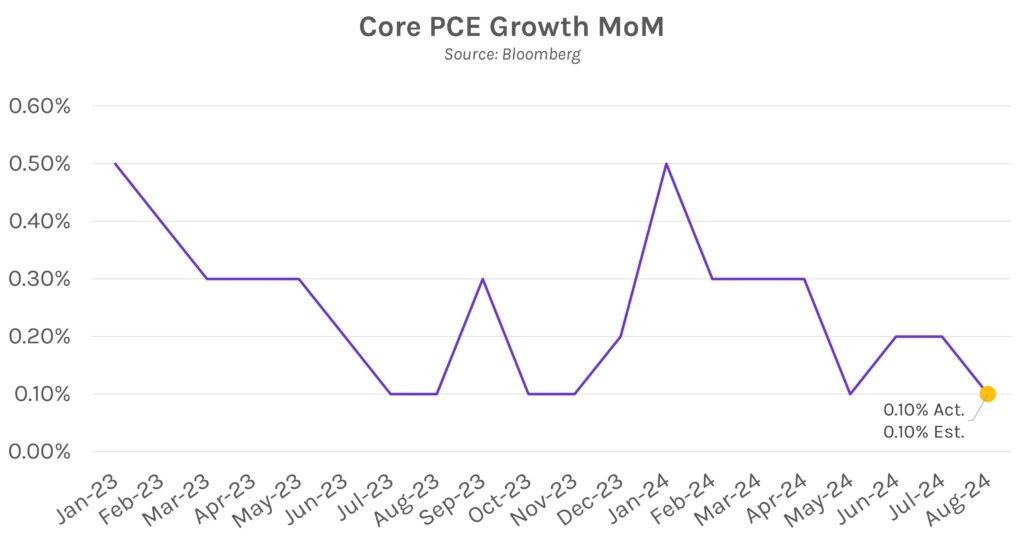

Inflation continues to retreat. PCE inflation data released today showed that inflation largely continued to moderate in August. On a month-over-month basis, headline inflation declined from 0.2% to 0.1%, in-line with expectations, and core inflation declined from 0.2% to 0.1%, below expectations of 0.2% growth. On the year, headline inflation fell 0.1% more than expected, from 2.5% to 2.2%, while core-inflation met expectations with a 0.1% climb to 2.7%. Chief economist at Nationwide Kathy Bostjancic said, “The modest rise in consumer inflation in August on its own provides strong reason for the Fed to continue easing…”

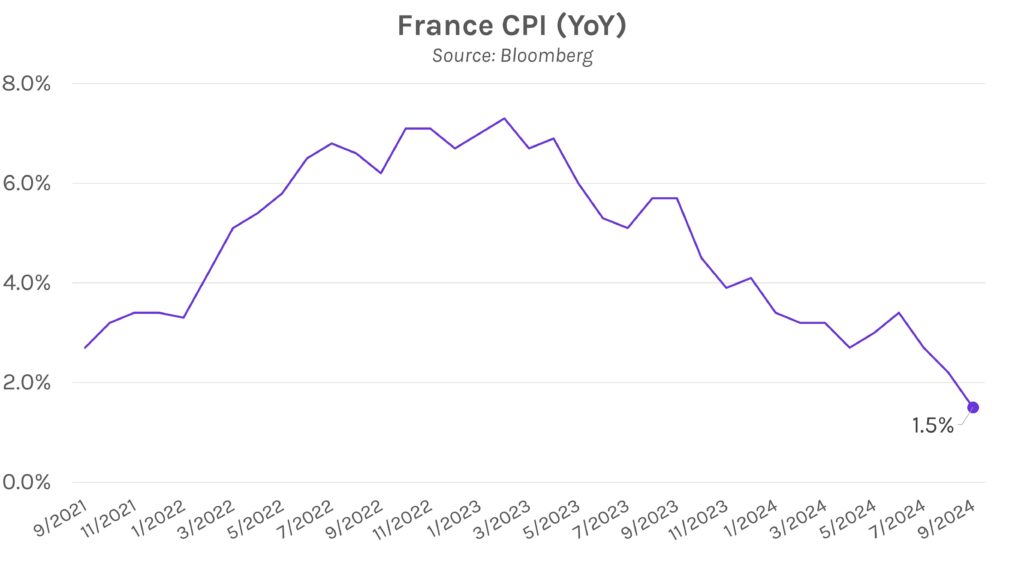

October ECB rate cut is more likely after inflation slows in France and Spain. The European Central Bank (ECB) is now over 80% likely to cut policy rates by 25bps at next month’s meeting, according to futures markets. That marks a significant increase from 40% odds at the beginning of the week and 60% as of yesterday. Slowing inflation in France and Spain drove the shift, with consumer prices now at 1.5% in France and 1.7% in Spain (versus estimates of 1.9%). France’s 1.5% price growth is its lowest level since July 2021 while Spain hit a year-plus low.