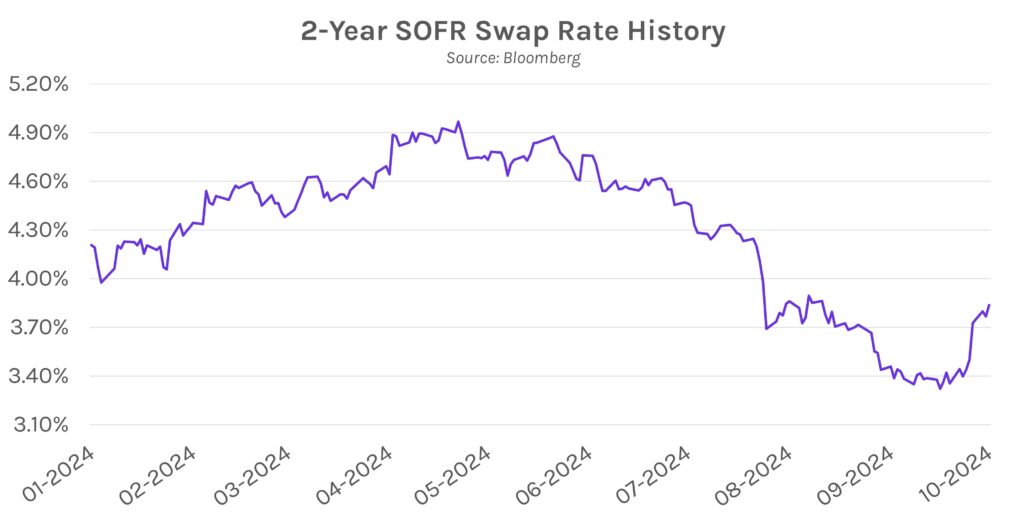

Rates climb ahead of inflation day. Swap rates grinded higher throughout the session and closed 5-7 bps above opening levels. FOMC minutes contributed to the move as several Fed officials were concerned about the 50bp rate cut that was announced last month. The move comes ahead of tomorrow’s inflation report, set for release at 8:30 AM ET. Meanwhile, the S&P 500, DJIA, and NASDAQ rose 0.60%-1.03% today to new all-time highs.

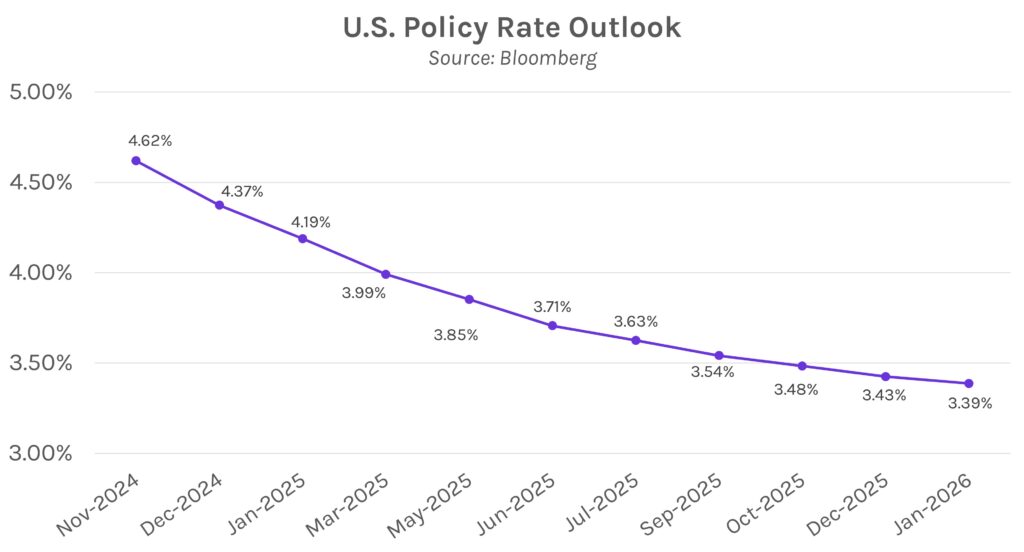

FOMC heavily debated size of September rate cut. A key takeaway from the September FOMC meeting minutes released today was that some voters required significant swaying to vote for a 50bp rate cut. The minutes stated, “Some participants observed that they would have preferred a 25-basis-point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision…” The minutes added that several voters believed a 25bp cut would have offered the Fed more room to digest upcoming data, “…in line with a gradual path of policy normalization…” Still, all voters supported a cut, whether 25 bps or 50 bps.

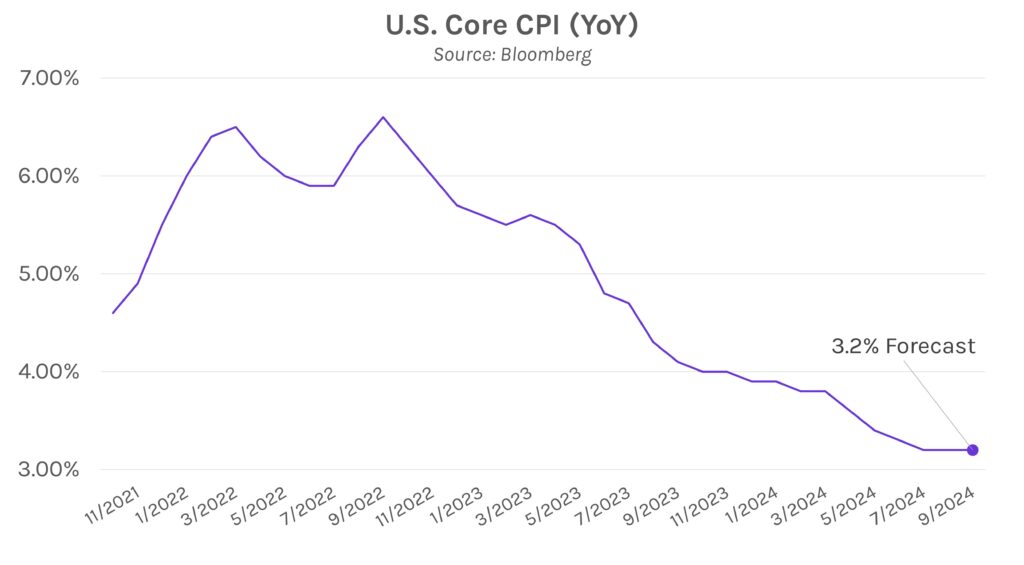

Consumer price growth is generally expected to have slowed in September. Tomorrow’s inflation release will prove crucial as markets continue to evaluate the Fed’s potential rate cut timeline. The consumer price index (CPI) is forecasted to decline in September in three of four readings, including monthly core CPI, which is expected to fall to +0.2%. Year-over-year core CPI is the lone outlier, forecasted to remain flat at 3.2%. An upside inflation surprise could drive another significant rise in rates after last week’s labor data showed strong hiring and a decline in unemployment.