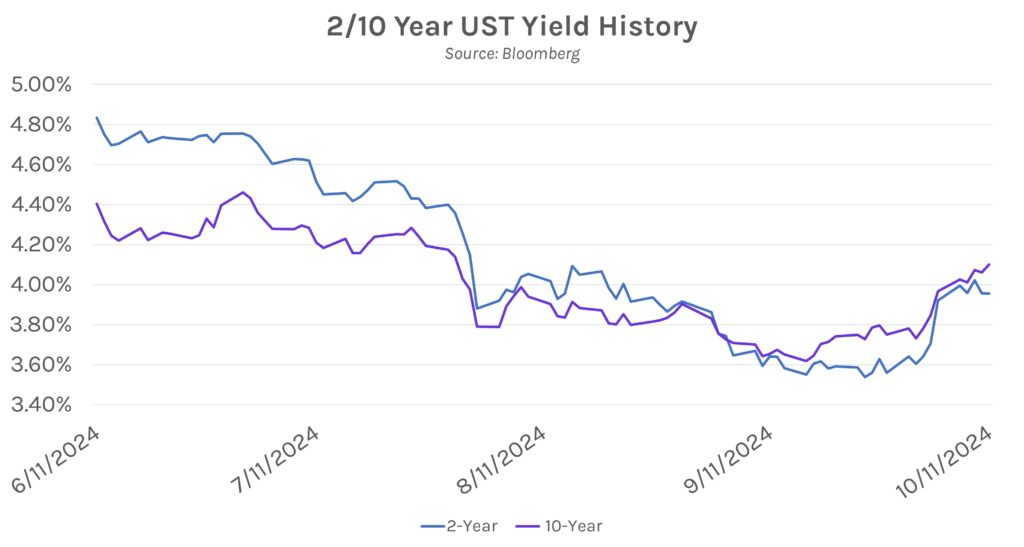

Rates close nearly flat on PPI day. Rates whipsawed in the aftermath of today’s inflation print, first falling ~4bps before almost immediately recovering to pre-data levels. Rates then grinded lower throughout the afternoon to close little changed. The swap and yield curves steepened this week, a common theme over the past few months; the 2s10s Treasury spread is now +14bps after 2+ years of curve inversion. Elsewhere, the S&P 500, NASDAQ, and DJIA rallied 0.33%-0.97% today, setting new all-time highs.

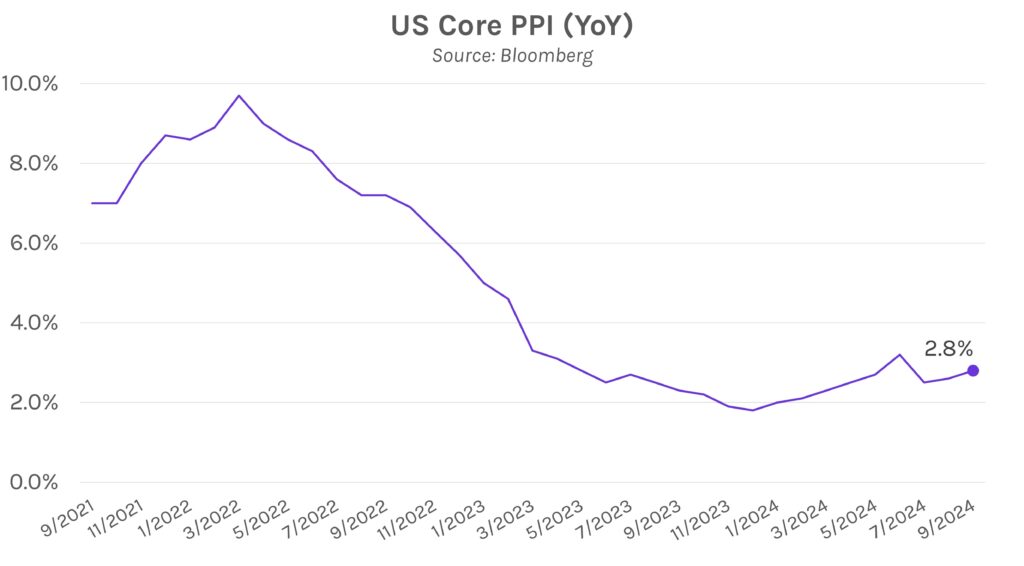

PPI shows mixed inflationary progress. The Producer Price Index (PPI) declined month-over-month (MoM) but climbed annually (YoY) in September. Core YoY PPI was 2.8%, exceeding the 2.6% forecast while August’s 2.4% print was revised upward to 2.6%. Excluding June’s 3.2% producer price growth, 2.8% PPI marks the highest level since May 2023. Meanwhile, core MoM PPI decelerated to 0.2% while headline MoM PPI shrunk to 0.0%. The mixed results ultimately did little to shift market expectations for the Fed’s rate cut timeline.

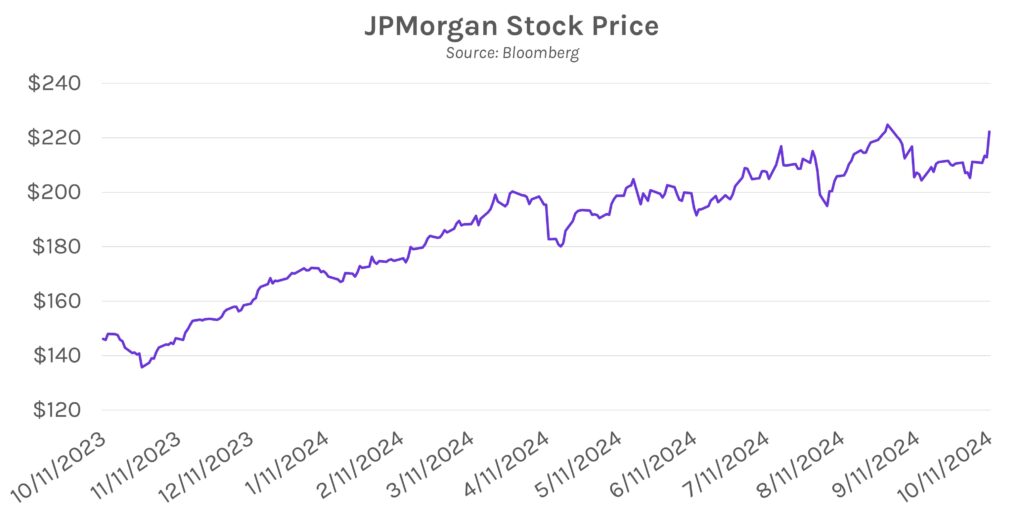

Jamie Dimon highlights global risks. JPMorgan hosted its quarterly earnings call this morning, reporting a surprise 3% increase in net interest income and upward revisions to its interest income outlook even as rates decline. Despite the strong results, CEO Jamie Dimon highlighted in the company’s quarterly earnings release that geopolitical conditions “are treacherous and getting worse.” He added that “while inflation is slowing and the U.S. economy remains resilient,” fiscal deficits, infrastructure needs, trade restructuring and global remilitarization remain critical issues. Wells Fargo also reported earnings today; while better than expected overall, they reported below-forecast net interest income.