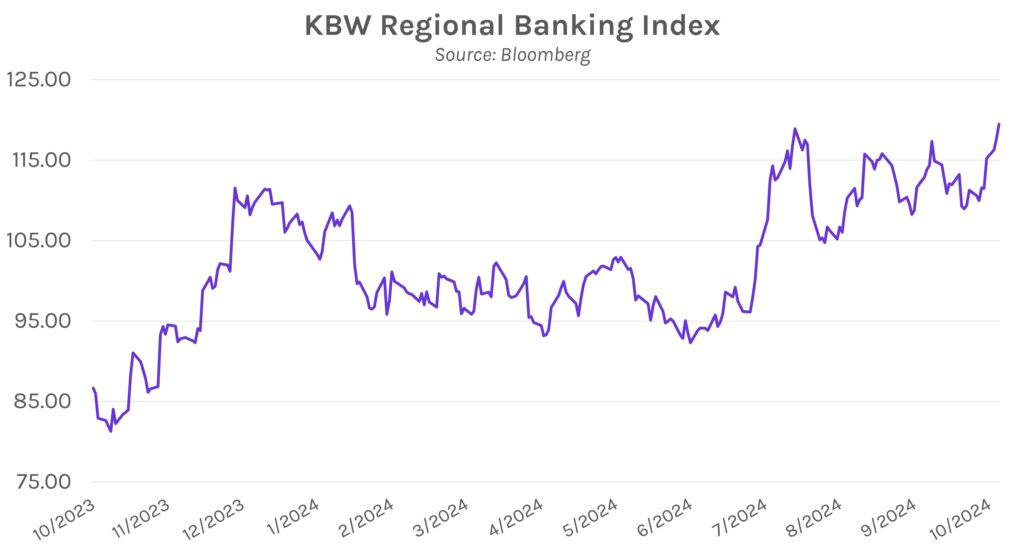

Rates close nearly unchanged ahead of retail sales. Rates traded within a ~5bp span today as markets look ahead to tomorrow morning’s retail sales data, which is expected to increase to 0.3% in September from 0.1%. Treasury yields closed 1-2 bps lower across the curve, now down 4-8 bps over the past five sessions. Meanwhile, billionaire investor Stan Druckenmiller made headlines today after he stated that markets are pricing in a Trump victory at the upcoming election; he argued, “you can see it in the bank stocks, you can see it in crypto.”

Bank stocks rally on positive earnings calls. After JPMorgan, Goldman Sachs, and Citigroup reported strong investment banking and trading revenue, Morgan Stanley (MS) followed suit. MS stock climbed 6.50% today after reporting a 32% rise in earnings and 16% revenue increase, with the former at $3.2B in Q3. Meanwhile, FHN and USB rose over 4% today after reporting their respective earnings, and the KBW regional banking index climbed over 1.50%. Meanwhile, the KRE banking ETF rose 1.37%.

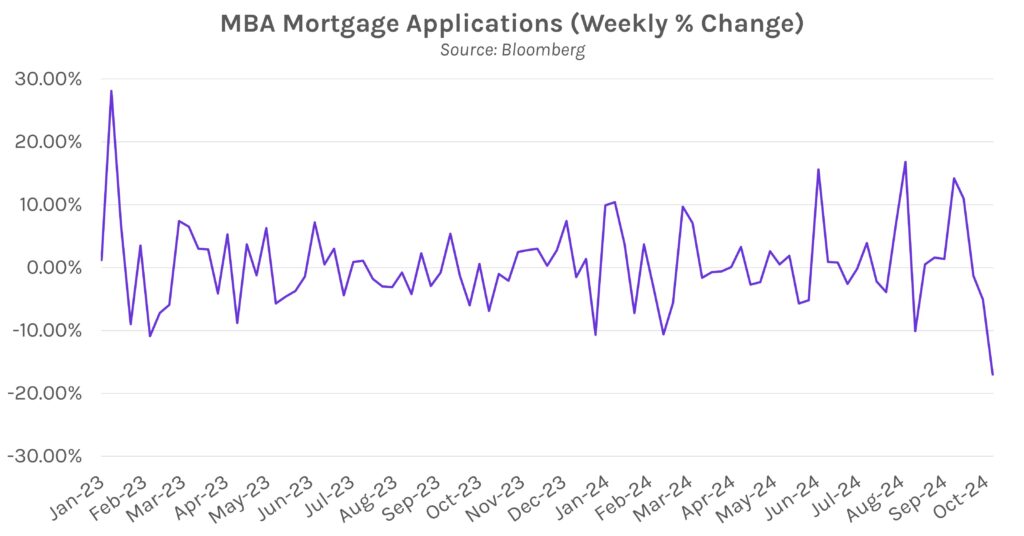

Mortgage applications fall for third straight week. Mortgage applications fell 17% during the week that ended October 11th per data released today by the Mortgage Bankers Association. The print marked a third consecutive weekly decline and was the steepest drop since April 2020. The declines over the past few weeks have largely been due to higher rates, with MBA deputy chief economist Joel Kan saying, “The recent uptick in rates has put a damper on applications…” The rate on 3-year fixed-rate conforming mortgages climbed to 6.713% as of yesterday, the highest since late August and ~40bps higher than mid-September.