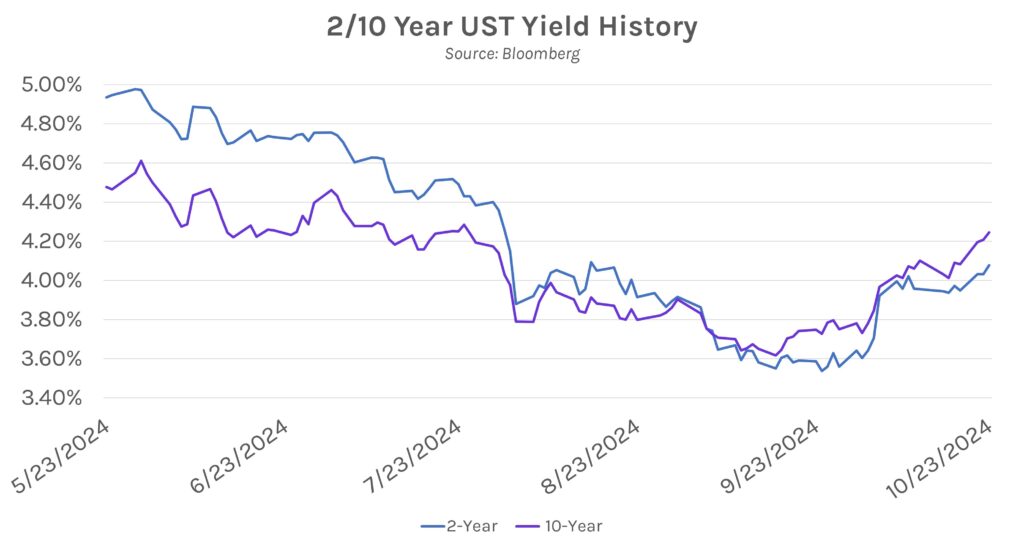

Rates climb while Tesla kicks off “Magnificent Seven” earnings. Swap rates and Treasury yields grinded higher today and closed 2-5bps above opening levels. Yields have risen 30-55bps over the past month, pushing the long end of the curve to its highest levels in 3 months. Meanwhile, Tesla stock soared over 10% in after-hours trading as the company reported stronger-than-expected EPS and gross margins. Tesla also forecasts increased deliveries throughout the remainder of the year and reiterated their goal to launch more affordable models in 2025.

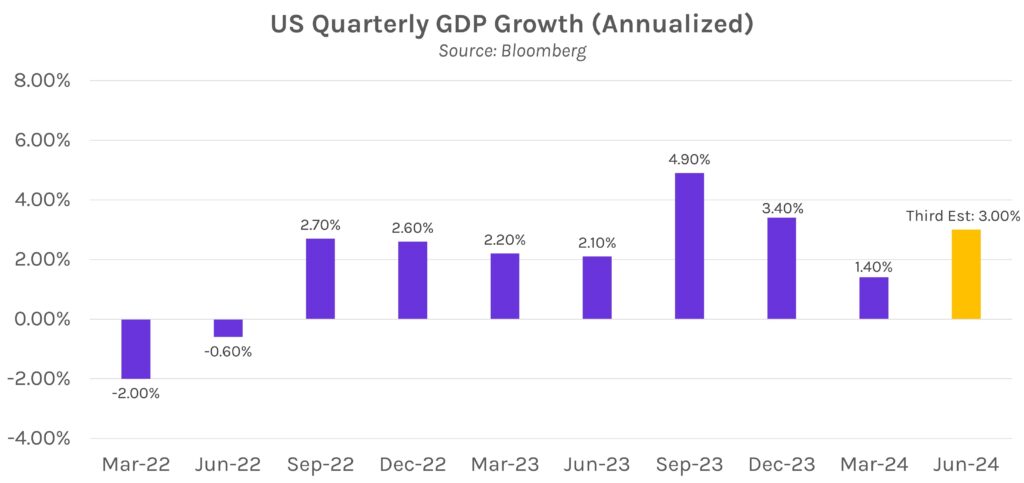

Beige Book tempers U.S. growth optimism. The latest edition of the Fed’s Beige Book, released today, showed flat economic growth across most of the U.S. since early September. While the banking sector showed some growth overall, with mixed loan demand across districts, most other sectors were stagnant. Over half of districts reported “slight or modest” employment growth, and most also observed continued price inflation. Election uncertainty was a common theme across districts, cited as a driver of growth slowdowns across various industries, more reluctant consumer spending, and subdued investing activity.

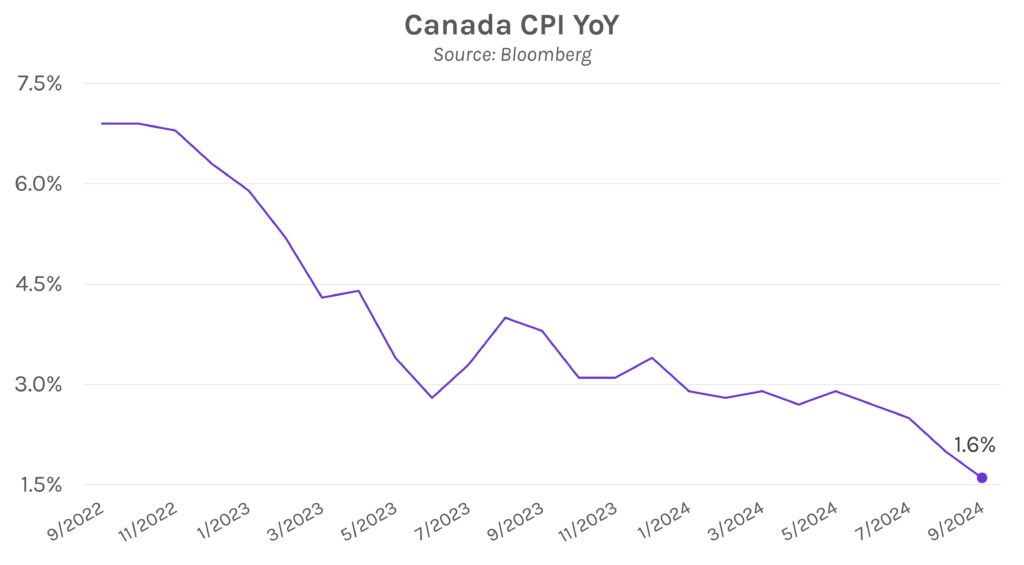

Bank of Canada slashes policy rate by 50bps. The Bank of Canada cut their benchmark policy rate to 3.75% today, cementing 125bps of monetary easing so far this year. Central bank Governor Tiff Macklem attributed the move to “low inflation,” adding that upward and downward risks to inflation are “reasonably balanced.” Canada CPI was 1.6% in September (year-over-year), a significant decline from 2.0% in August and below the 1.8% forecast. Given declining inflation, the central bank is now geared toward achieving a soft landing, and Macklem hinted that there will be additional rate cuts in December if the economy behaves as expected.