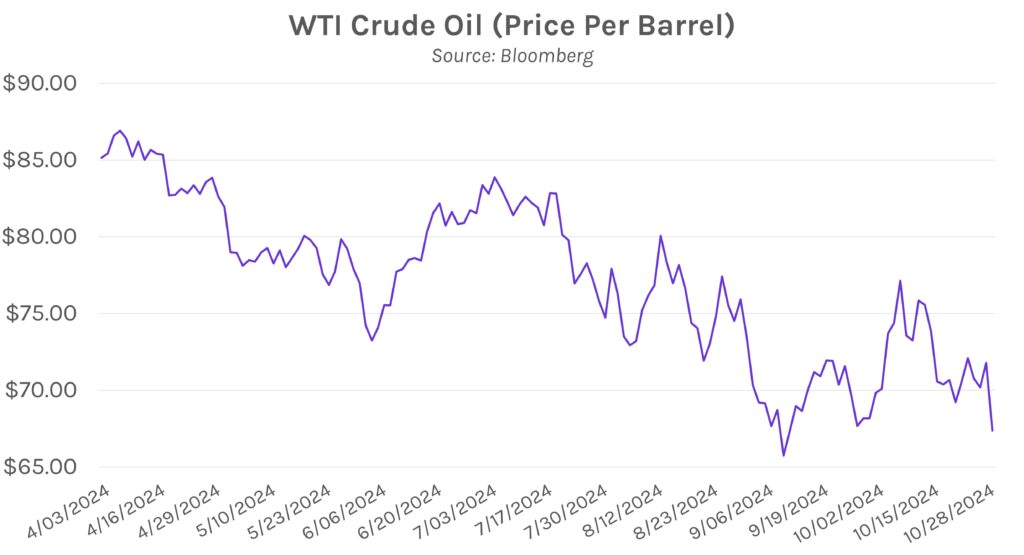

Rates rise as markets await crucial U.S. data. Swap rates declined from overnight levels this morning before grinding higher throughout the remainder of the session, closing 3-5 bps higher. Rates traded within a ~6bp range in a relatively quiet session, with markets eyeing Thursday’s inflation print, Friday labor market data, and next week’s presidential election. Meanwhile, crude oil prices plummeted over 5% today after Israel fired airstrikes against Iranian military bases on Saturday, opting not to fire strikes against Iran’s energy infrastructure.

Today’s U.S. Treasury auctions show weak demand. Yields climbed today, in part due to monthly auctions of 2-and 5-year UST notes that saw weaker-than-expected demand. The results raised questions about demand at upcoming auctions this week, as investors grapple with the trajectory of rate cuts and election risks when considering the value of purchasing securities now or waiting for potentially larger auctions next year. With high rates elevating interest payments on U.S. debt and expectations for the U.S. budget deficit to increase under either presidential candidate, UST demand will be crucial to help the government meet its obligations. In the near-term, the U.S. Treasury’s 4Q24 financing estimates of $546 billion, released today, were downwardly revised by $19 billion, and JPM strategists said today that the government should be “well financed” through the end of FY2025.

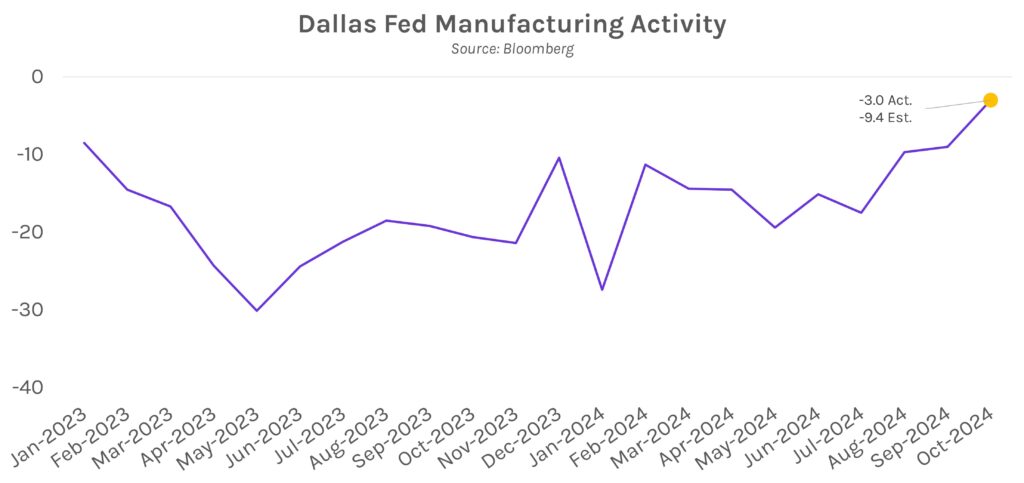

Dallas manufacturing hits highest level in over two years. The Dallas Fed manufacturing activity index was -3 in October, still in contraction-territory but well above the forecast of -9.4. This marked the strongest monthly result since April 2022 (0.7), the last time manufacturing activity grew. Furthermore, the production index (14.6) hit its highest level in over two years while the shipments index rose to 1.5.