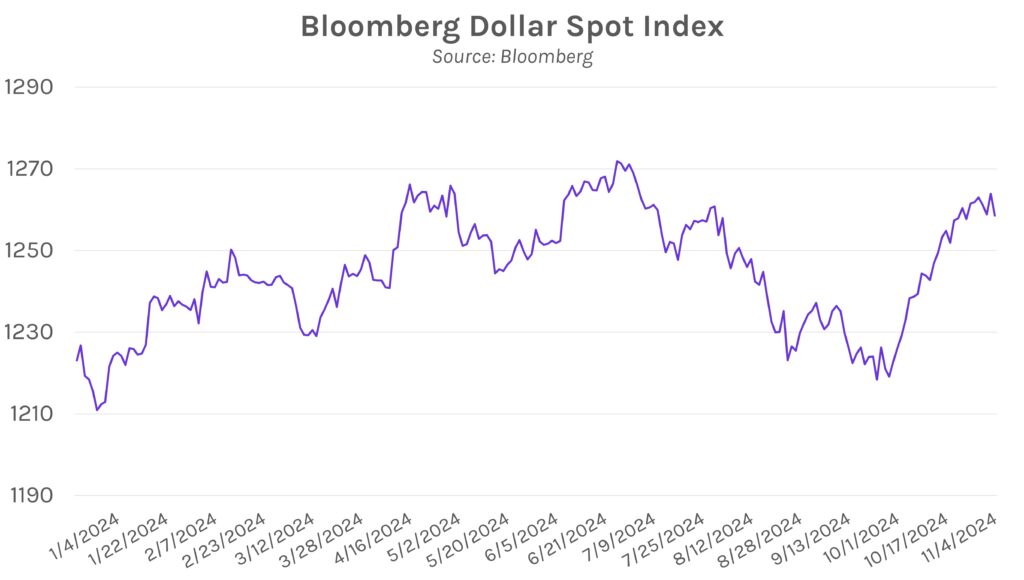

Rates fall on increased momentum for Kamala Harris election victory. After several weeks of markets favoring a Trump presidency, recent odds-making sites have put the race in a dead heat. Today’s swap rate decline reflects a shift away from the “Trump trade”, where proposed tariffs and tightening of labor markets had fundamentals pointing toward inflationary pressures and increased rates. Swap rates closed 2-11bps lower today across a bull flattening curve alongside a decline in the US dollar. The Bloomberg Dollar Spot Index fell -0.42% after dropping as low as -0.71% intraday.

Seven states are considered “swing states” this year. Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin featured close battles in the 2020 presidential election and will be key states this year. North Carolina was the only state that Trump won over Biden four years ago, with Georgia, Arizona, and Wisconsin decided by less than 1% margin of victory and Pennsylvania and North Carolina under 1.50% margin of victory. A poll released today from Emerson College showed that Trump has leads in Georgia, North Carolina, and Pennsylvania while Harris leads in Michigan. A separate Des Moines poll showed that Harris leapfrogged Trump in Iowa, now securing 47% of votes compared to 44% for Trump.

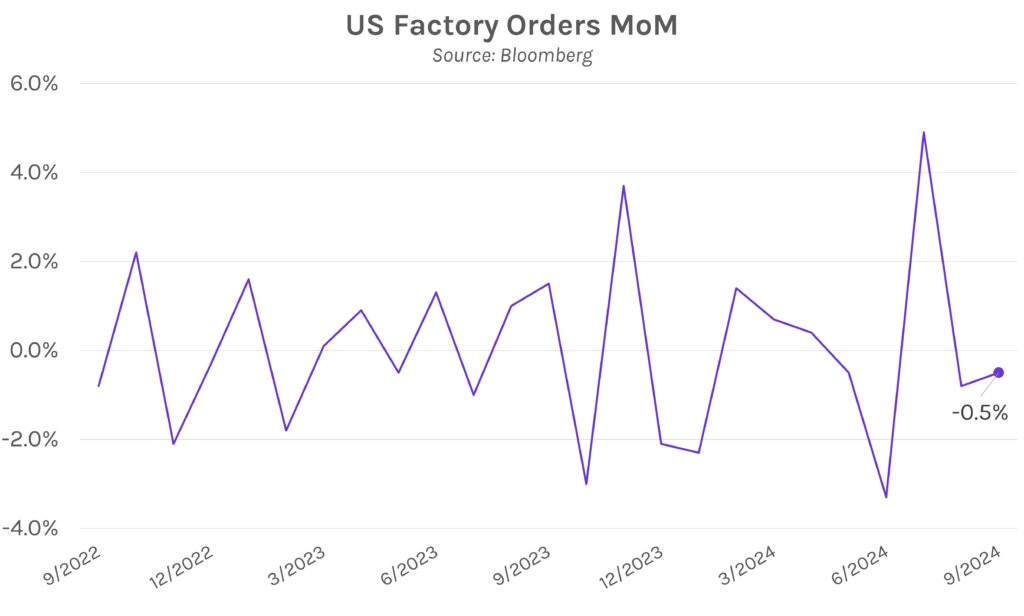

US factory orders declined in September. New manufactured goods orders dropped by -0.5% in September, which matched economic forecasts. August’s orders were revised lower to -0.8% from -0.2% originally, and four of the past five months have shown a contraction. Furthermore, final September figures showed a -0.7% decline in durable goods orders, largely led by falling demand for transportation equipment.