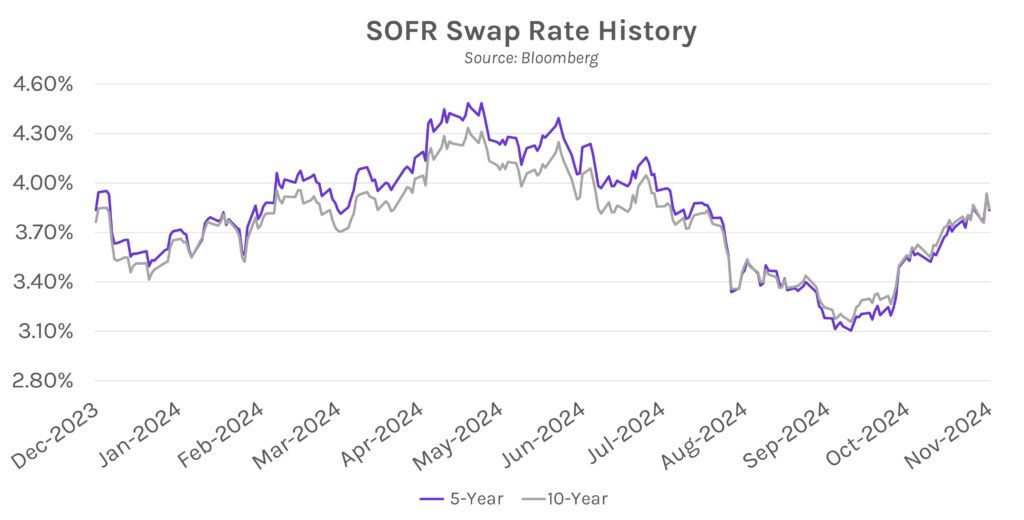

Rates fall dramatically on FOMC day. Rates reversed course today and closed 5-12 bps lower across a flattening curve after yesterday’s election-fueled 10-20 bp climb. The Fed delivered a fully priced-in 25 bp rate cut and market reaction to Powell’s presser was largely muted. Meanwhile, equities continued to rally, with the S&P 500 (+0.74%) and NASDAQ (+1.51%) surpassing yesterday’s all-time highs.

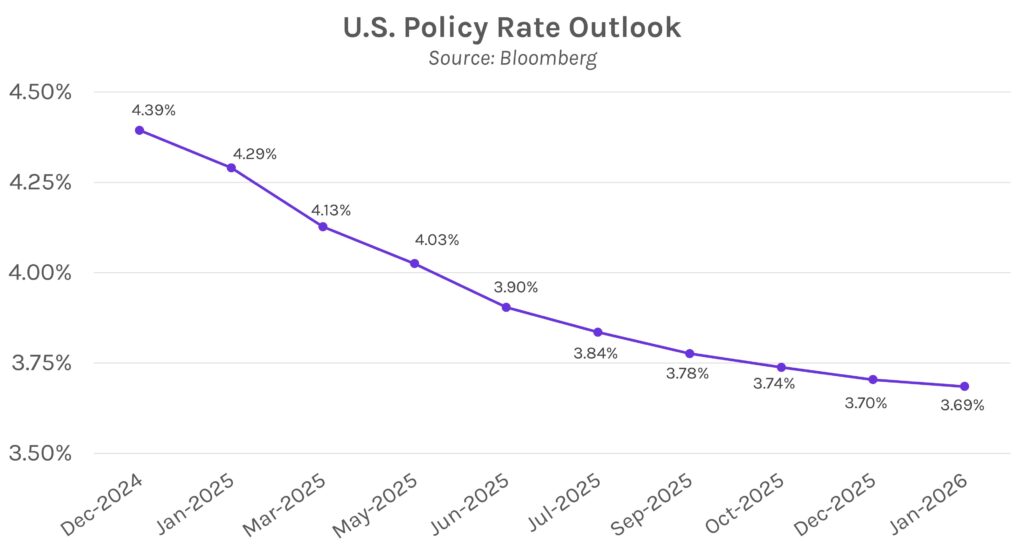

Fed cuts rates as expected, backtracks on key inflation language. The Fed unanimously voted to cut rates by 25 bps today, a move that was overwhelmingly priced into futures markets. Key changes to the FOMC statement included characterizing labor market conditions as having “generally eased” vs. “slowed” in September’s statement and removing a sentence highlighting progress on inflation and the balance of risks, which was considered a key insert last month.

Markets eagerly awaited election-related comments from Powell. He firmly said “no” when asked if he would resign if asked by President-elect Trump and said that removal or demotion of Fed board members during their term is illegal. On monetary policy, Powell said that the election results will have “no effects” on the central bank’s decisions in the near-term. He said it is too early to know the timing or impact of possible fiscal policy changes, and that, “we therefore don’t know what the effects on the economy would be, specifically whether and to what extent those policies would matter for the achievement of our goal variables: maximum employment and price stability.” A side-by-side comparison of the November and September FOMC meeting statements can be read here.

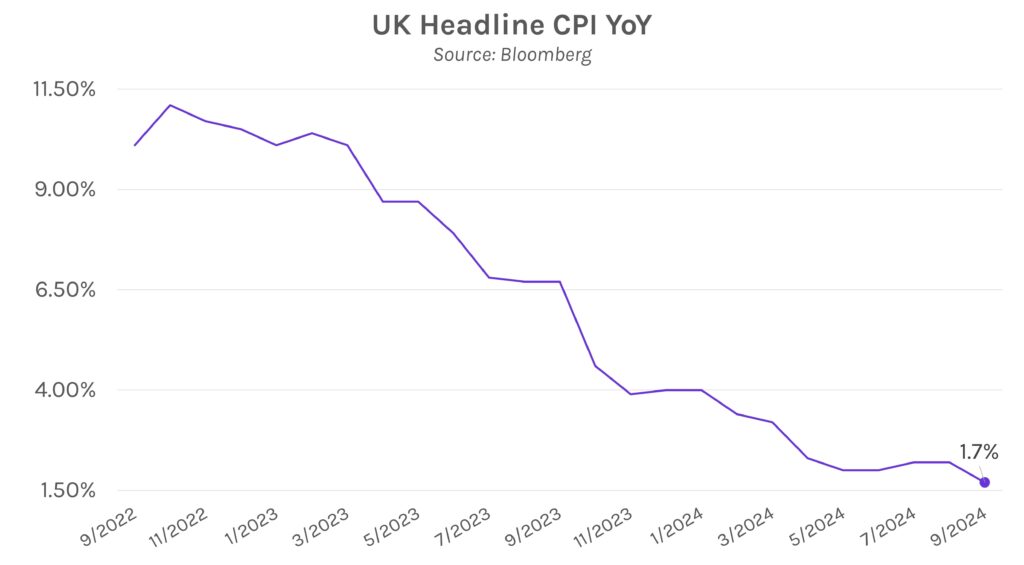

Bank of England (BOE) cuts rates again. The BOE delivered a second 25bp rate cut this year with a single dissenter on the 9-person voting committee. BOE Governor Andrew Bailey offered a dovish outlook for future policy decisions; he argued that “we need to make sure inflation stays close to target, so we can’t cut interest rates too quickly or by too much.” Bailey caveated by saying that the central bank would continue to “gradually” cut interest rates if the economy “evolves as we expect.” Futures markets now imply a 25% chance of a 25bp rate cut in December, a significant decline from ~38% as of yesterday.