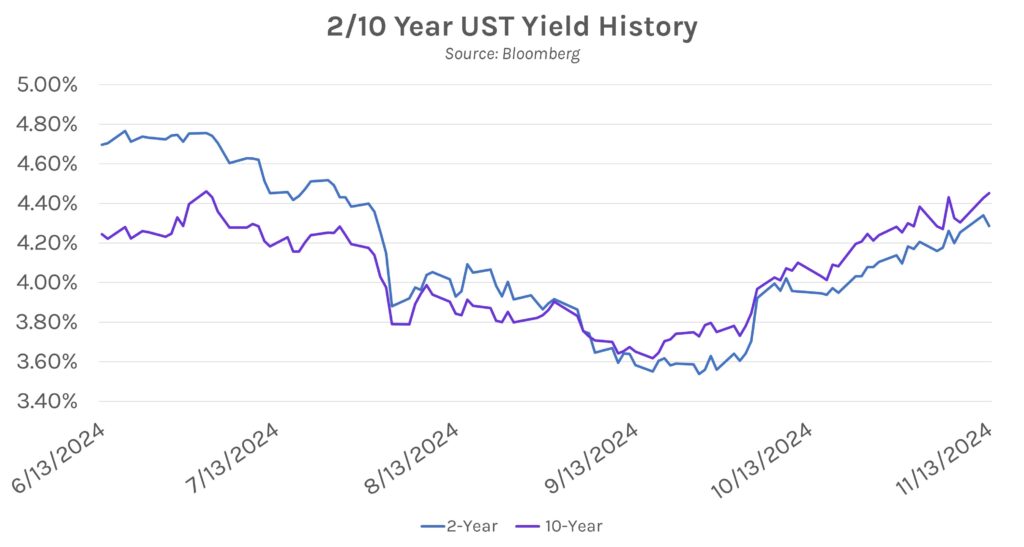

Swap curve steepens following inflation print. Swap rates and Treasury yields plummeted ~10 bps at the front end of the curve in the immediate aftermath of this morning’s CPI data, which matched estimates across all readings. However, longer-term concerns about elevated inflation led to a reversal in rates throughout the afternoon. The front end of the curve closed 3-6 bps lower while the long end rose 2-7 bps. The 2s10s Treasury yield spread is now +16 bps after flattening to +2 bps intraday yesterday.

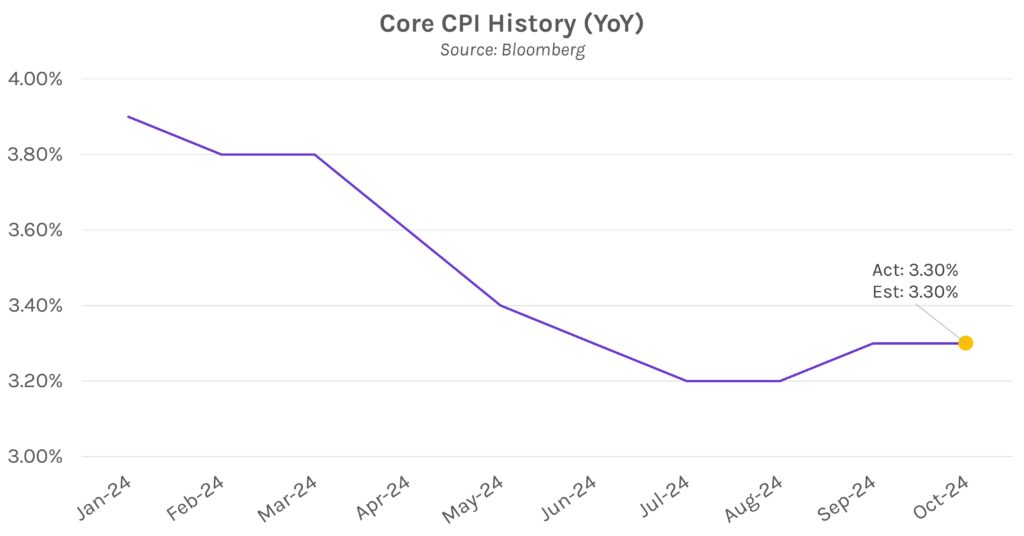

Today’s CPI data backs expectations for a prolonged inflation battle. October CPI matched expectations across all readings and remained well above the Fed’s 2% target. Month-over-month headline and core inflation were 0.2% and 0.3%, respectively. Year-over-year inflation climbed from 2.4% to 2.6% on a headline basis but remained steady at 3.3% on a core basis. The results mark a 4th straight month of static or increasing core inflation and reverse a 6-month streak of declining year-over-year headline inflation. Recent inflation data, strong economic results, and the election outcome have complicated the Fed’s path forward. Wells Fargo economists Sarah House and Michael Pugliese said in a note, “The inflation data over the past few months have not shown much additional progress…as a result, we think the time is fast approach when the FOMC will signal that the pace of rate cuts will slow further, perhaps to an every-other-meeting pace starting in 2025.”

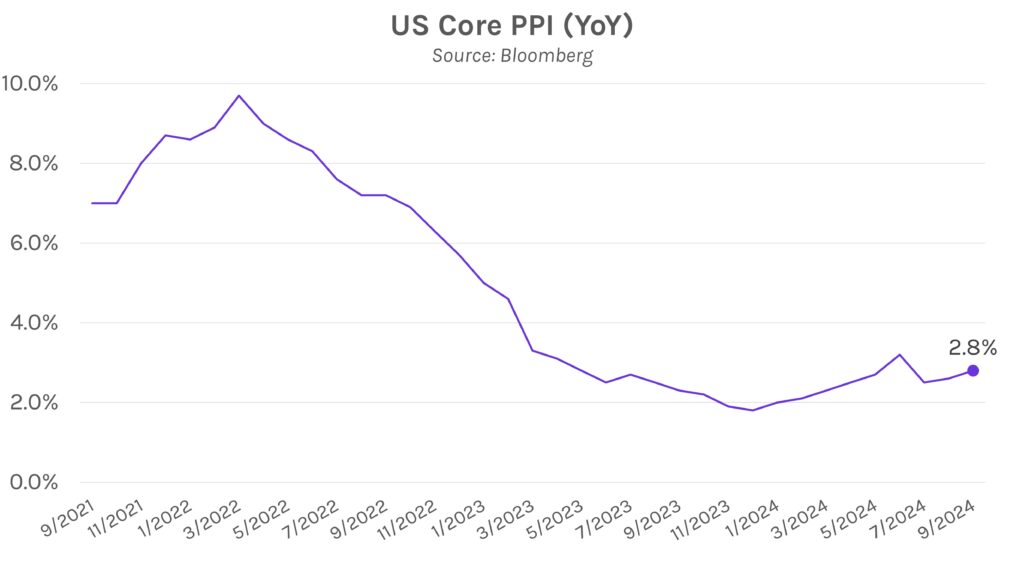

PPI is also expected to be elevated in October. PPI is forecast to accelerate across most readings from September to October. Year-over-year PPI is expected to reach 3.0% (from 2.8%) and 2.3% (from 1.8%) on a core and headline basis, respectively. Excluding June 2024, a 3.0% year-over-year core result would mark the highest level since April 2023. Meanwhile, month-over-month PPI is expected to be 0.2% on both a headline and core basis.