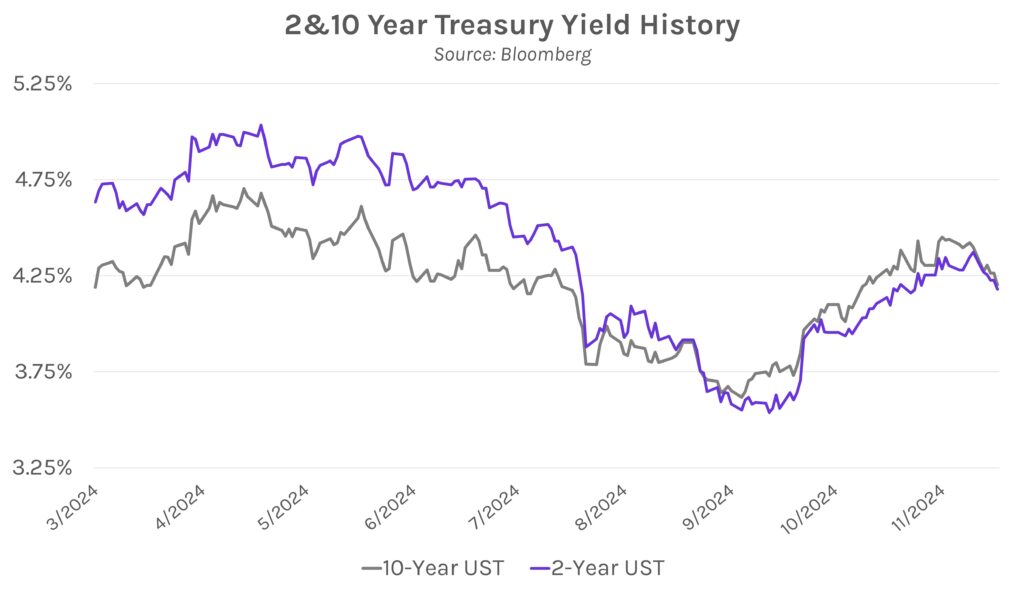

Rates fall while equities extend all-time highs. Treasury yields fell ~5 bps across the curve in today’s shortened session. The move cemented a 20 bp decline over the week, largely fueled by speculation that Scott Bessent, Trump’s nomination for Treasury Secretary, will have a more moderate approach toward tariffs and government spending. 2-year and 10-year yields closed out November at 4.18% and 4.20%, respectively. Meanwhile, the S&P 500, DJIA, and NASDAQ hit new all-time highs after a 0.60% – 0.90% rally.

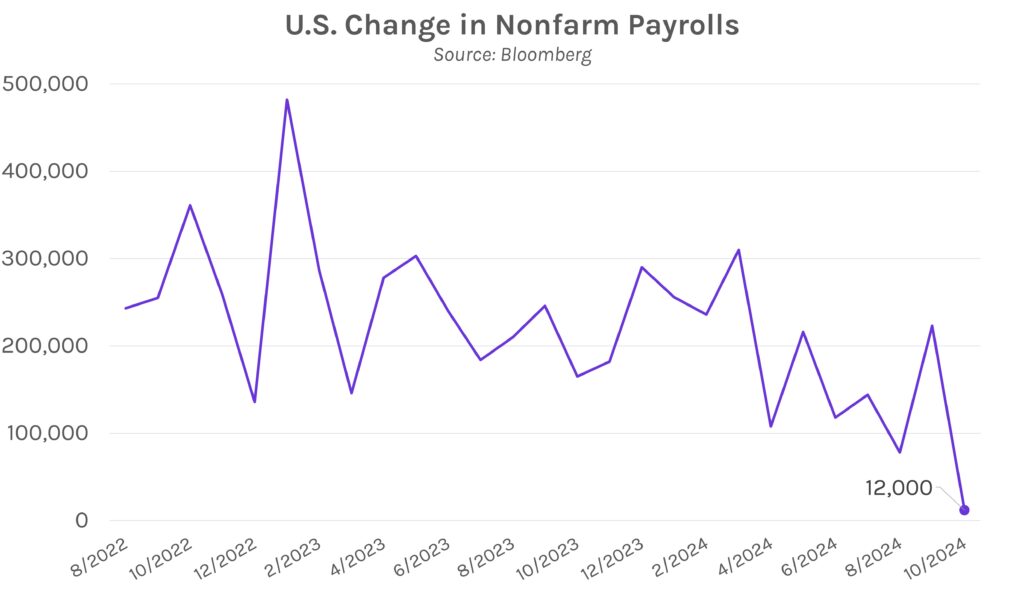

November labor data looms in the week ahead. Median economic forecasts are calling for nonfarm payrolls to rise from 12k jobs added in October to 200k in November. A rebound to 200k would be 23k below September’s 223k jobs added, another sign that the labor market remains robust despite the Fed’s aggressive rate hike cycle. The unemployment rate is expected to climb by 0.1% to 4.2%, which would be the seventh straight month being at or above 4.0%. FOMC minutes released this week showed that Fed officials have seen no sign of “rapid deterioration” in the labor market, and these results would support that optimism.