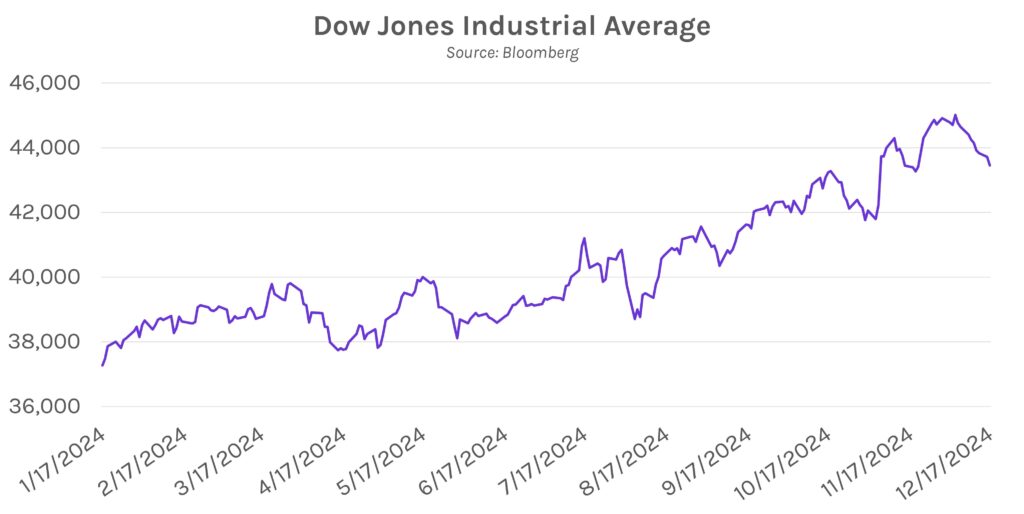

Rates close nearly flat again on the eve of the Fed’s policy decision. Rates closed within 1 bp of opening levels for the second consecutive session, with market attention geared toward tomorrow’s policy decision and succeeding Powell presser. Rates gradually fell throughout the session despite this morning’s retail sales data, which was slightly stronger than expected. The 2-year and 10-year Treasury yields are now at 4.25% and 4.40%, respectively. Meanwhile, equities generally declined today while the DJIA posted its longest consecutive sell-off streak (9 days) since 1978.

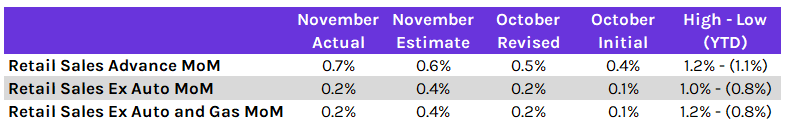

Retail sales show continued strength. Auto purchases and online shopping drove headline retail sales growth to 0.7% in November, 0.1% above estimates and higher than last month’s upwardly revised 0.5% print. This marks the 6th consecutive month that headline retail sales have exceeded expectations. Across core measurements, which exclude auto sales, growth was lower than expected and in-line with last month’s results. Overall, the release was viewed as a sign of continued consumer strength, another data-point in favor of a slower pace of easing from the Fed. In addition, the retail sales control group figure, which excludes certain categories and feeds directly into GDP, logged 0.4% growth vs. October’s 0.1% decline.

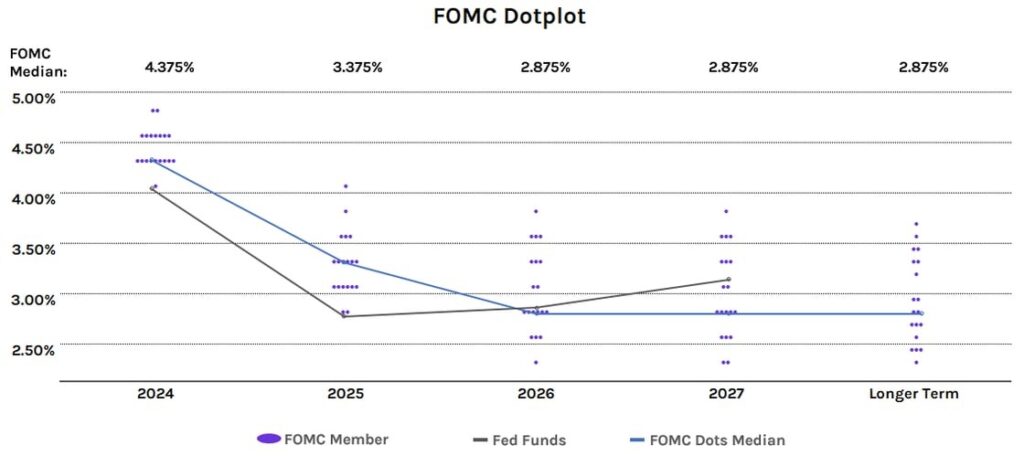

The little [rate cut] engine that could. The Fed’s rate cut train is expected to chug along tomorrow for an additional 25 bps, which would bring cumulative 2024 accommodation to 100 bps. While tomorrow’s move is effectively locked in, the outlook for 2025 remains unclear. According to futures markets, Fed Funds is currently expected to end 2025 near 3.85%, significantly higher than the most recent Fed Dot Plot, where the median projection for EOY 2025 was 3.375%. Robust inflation and sustained economic growth have driven the pullback in rate cut expectations, and Chair Powell recently stated that economic growth will allow the Fed to be “a little more cautious” with future policy decisions.