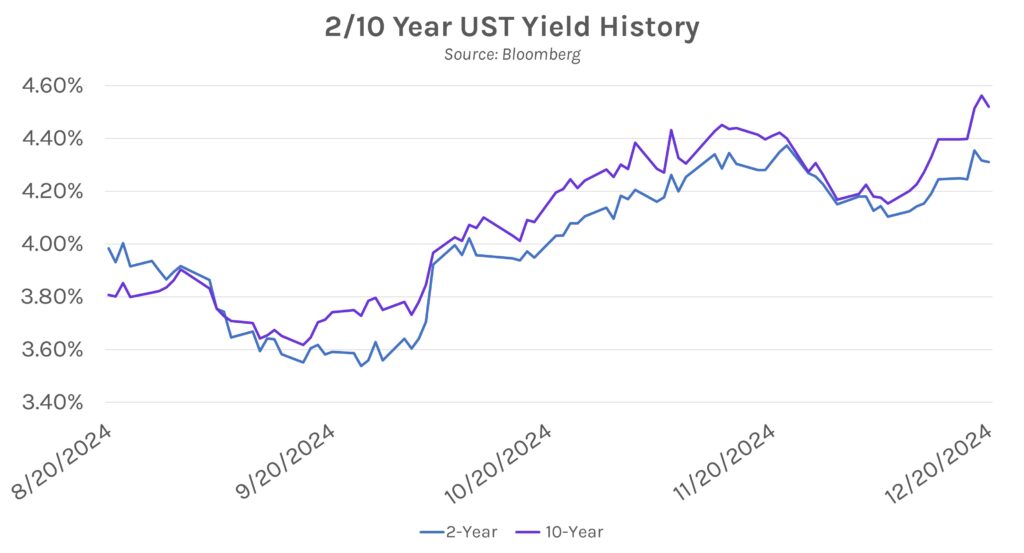

Rates fall after PCE data. US Treasury yields fell 1-5 bps across the curve today after PCE data showed inflation declined slightly in November. The 10-year yield ended at ~4.52%, 4 bps lower on the day, while the 2-year yield closed ~1bp lower at ~4.31%. Today’s decline only slightly offset an overall upward shift this week, with 10 – and 2- year yields ending ~13 bps and ~7 bps higher than Monday’s closing levels, respectively. Equities reversed course today, with major indices climbing ~1.00% – ~1.20% after a multi-day losing-streak.

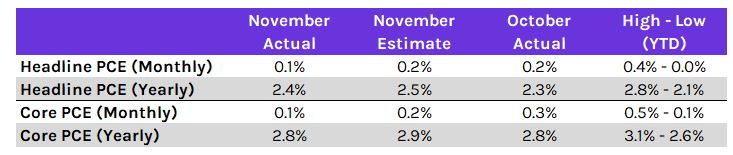

PCE inflation slows. Though inflation remained above the Fed’s 2% target, with core and headline PCE landing at 2.8% and 2.4% on a yearly basis, the Fed’s preferred inflation measure landed below expectations across all measurements in November. Encouragingly, on a monthly basis, core PCE declined to its second lowest level this year at ~0.10% vs. ~0.30% last month, and headline inflation fell from ~0.2% to ~0.1%, the lowest since August. The slight declines were a welcome sign of progress in the fight against inflation, following months of releases pointing to stagnant or climbing inflation, strong growth, and robust labor markets.

Fed’s lone dissenter speaks out. Cleveland Fed President Beth Hammack voted against a 25bp rate cut at this week’s FOMC meeting and offered some insight into her decision in a statement released today. In her statement, she said that monetary policy is “not far” from a neutral stance, and as such she wants to hold policy steady until she sees more evidence of progress toward 2% inflation. She cited elevated inflation data in recent months and economic strength as key reasons why she upwardly revised her own inflation forecasts, and noted that if inflation stalls above 2%, it will be even harder to return inflation to target levels. Interestingly, she concluded the release by saying, “I viewed my own decision as a close call…” underscoring the Fed’s foggy road ahead.