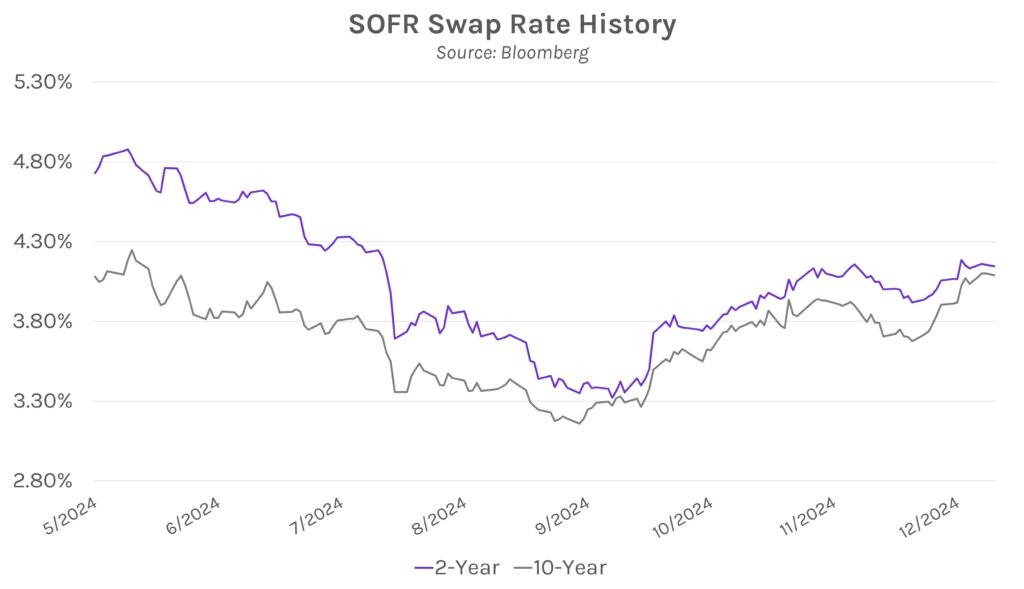

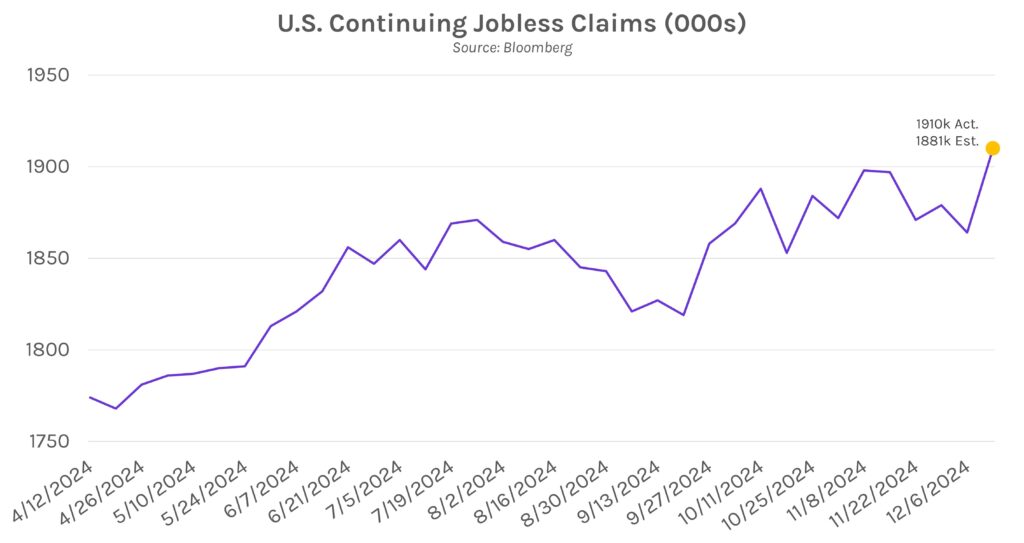

Rates close nearly unchanged despite multi-year high in unemployment claims. Rates rose overnight and were 3-5 bps above opening levels this morning until strong demand at a $44B auction of 7-year Treasury notes drove a ~3 bp decline at 1 PM EST. Rates dropped slightly throughout the remainder of the afternoon and closed 1-2 bps lower across most of the curve. The decline aligned with this morning’s continuing jobless claims data, which hit a 3+ year high and offered signs of a weaker labor market.

Continuing claims data signals labor market normalization. Continuing claims for U.S. unemployment benefits grabbed headlines today after it climbed to its highest level since late 2021 for the week ended December 14th. 1.91 million people applied for recurring unemployment benefits, above expectations of 1.881 million, and higher than last month’s downwardly revised 1.864 million. Continuing claims have (generally) risen steadily this year, with ~200,000 more people filing for unemployment benefits on a recurring basis vs. early January, indicating that the unemployed are having a harder time finding jobs.

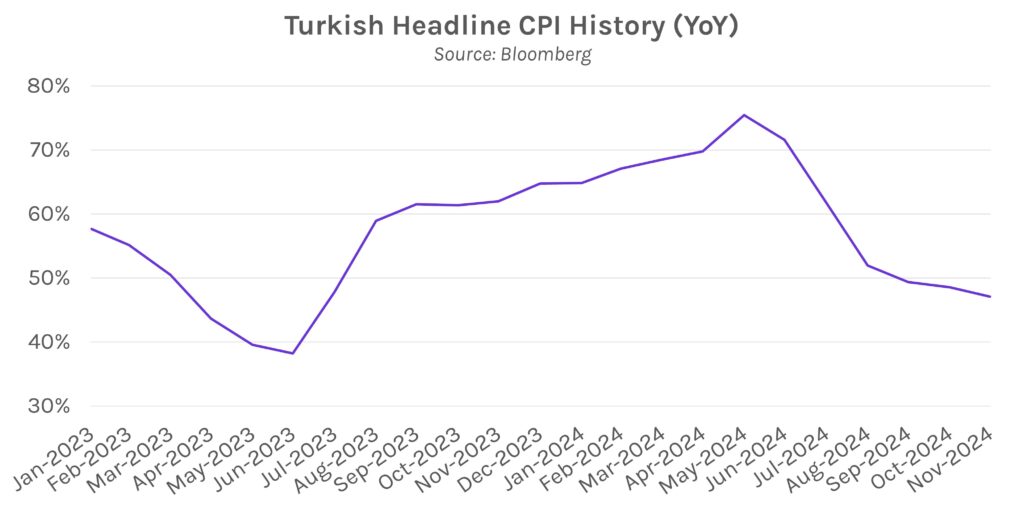

Turkish central bank cuts interest rates by 2.5%. Turkey’s central bank cut its one-week repo rate from 50% to 47.5% today, their first reduction in nearly two years. The move came after Turkey consumer inflation fell to 47% in November 2024 from a peak of 85.5% in October 2022, with the central bank noting a “flat” inflation trend in their official statement and expecting a decline in December. The central bank also said it will not necessarily continue to ease at the same pace moving forward and will instead “make its decisions prudently on a meeting-by-meeting basis with a focus on the inflation outlook.”