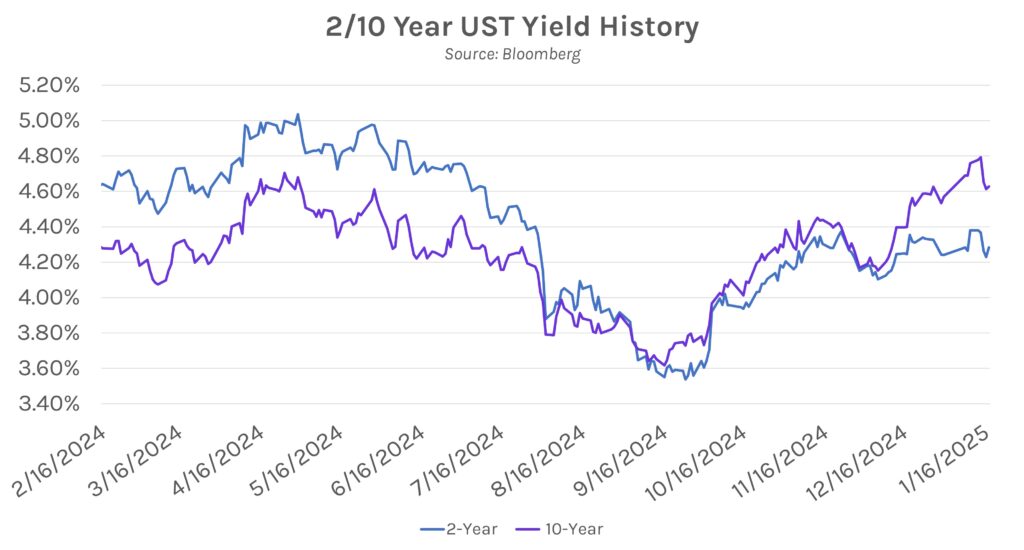

Yields rise to end a week of declines. U.S. Treasury yields were ~2-5 bps higher across the curve today on a relatively light economic calendar. Today’s movements capped a week of softer inflation data, which revived hopes that disinflation may not have completely stalled. The 10-year yield ended the week at ~4.63%, ~15 bps lower than Monday’s close, while the 2-year yield fell ~9 bps on the week, ending at ~4.28%. Equities rose on the week, with the S&P 500 ending 2.9% higher to log its strongest weekly performance since the November presidential election.

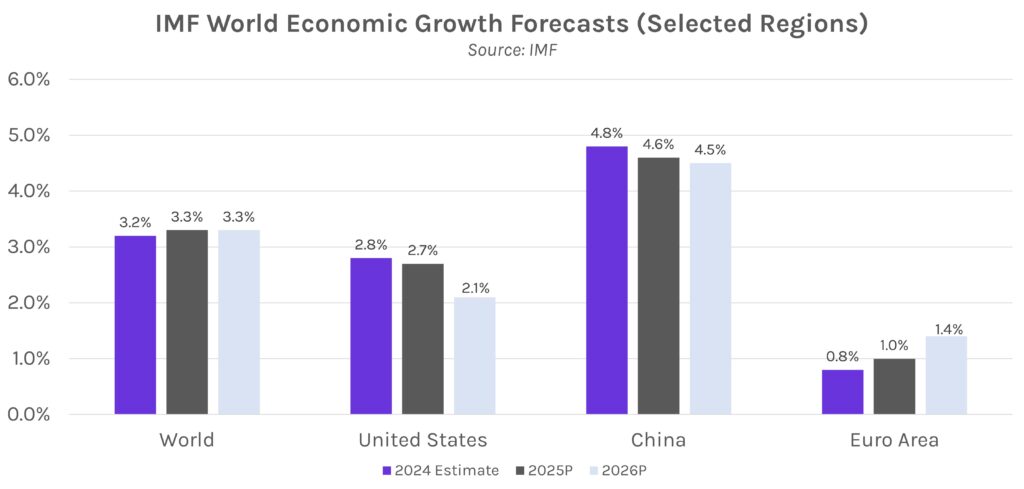

International Monetary Fund (IMF) boosts global growth outlook. The IMF upwardly revised it’s 2025 global economic growth forecast from 3.2% to 3.3% today, largely driven by expectations for U.S. economic performance. Among major economies, the U.S. GDP growth forecast received the largest upward revision of 0.5% to 2.7%, boosted by tailwinds such as less restrictive monetary policy, supportive financial conditions, robust labor markets and accelerating economic investment. The medium-term outlook was similarly positive, with risks tilted to the upside in the U.S compared to the rest of the world. Over the longer run, the IMF noted that the impacts of proposed tariffs and looser fiscal policy remain uncertain.

Chinese GDP growth exceeds forecasts, but risks loom. China’s economy grew 5.4% in 4Q24, above expectations and bringing full-year growth to the Chinese government’s 5% target. Elevated fiscal stimulus measures largely drove last year’s growth, with Morgan Stanley analysts estimating their impact at ~60% of the overall advance, with the rest coming from higher exports. Looking ahead, however, risks to China’s economic recovery are mounting. Fundamental measures of economic health such as consumption growth and property investment remained weak, and potential U.S. trade tariffs could limit exports. HSBC’s chief Asia economist Frederic Neumann said, “As exports come under pressure in 2025, dragged lower by U.S. import restrictions, there will be an even bigger need to apply domestic stimulus.”