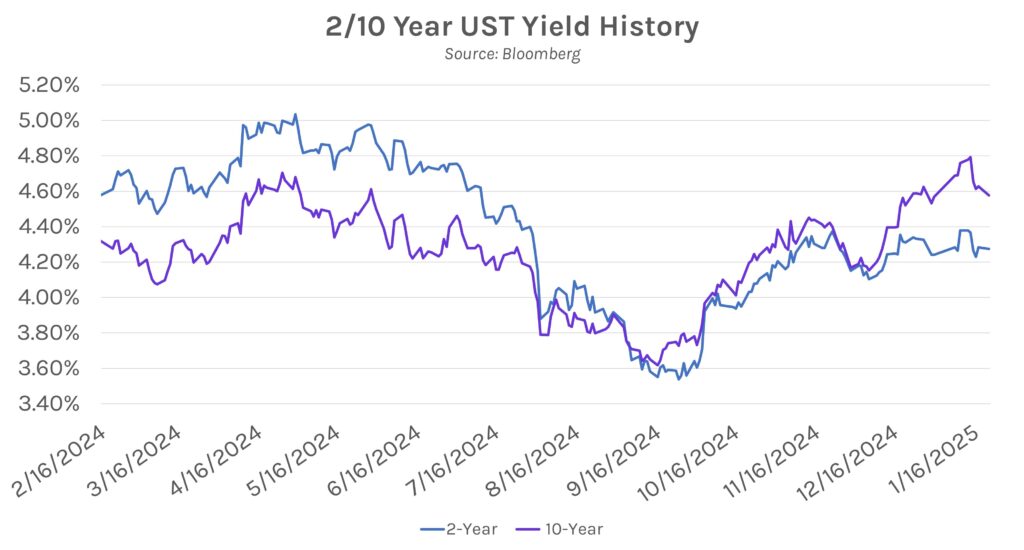

Yields tumble following President Trump’s inauguration. Treasury yields plummeted 5-8 bps overnight and closed 1-5 bps lower across a flattening curve following President Trump’s inauguration. Trump has been less aggressive with China tariffs than expected in his first two days in office, quieting some concerns about imminent global trade disruptions. The sentiment was reflected by tightening spreads between 2-year and 10-year yields, which fell to +30 bps, well below last week’s multi-year high of +42 bps. Meanwhile, equities rallied alongside Treasurys, with the S&P 500, DJIA, and NASDAQ up 0.64%-1.24% today.

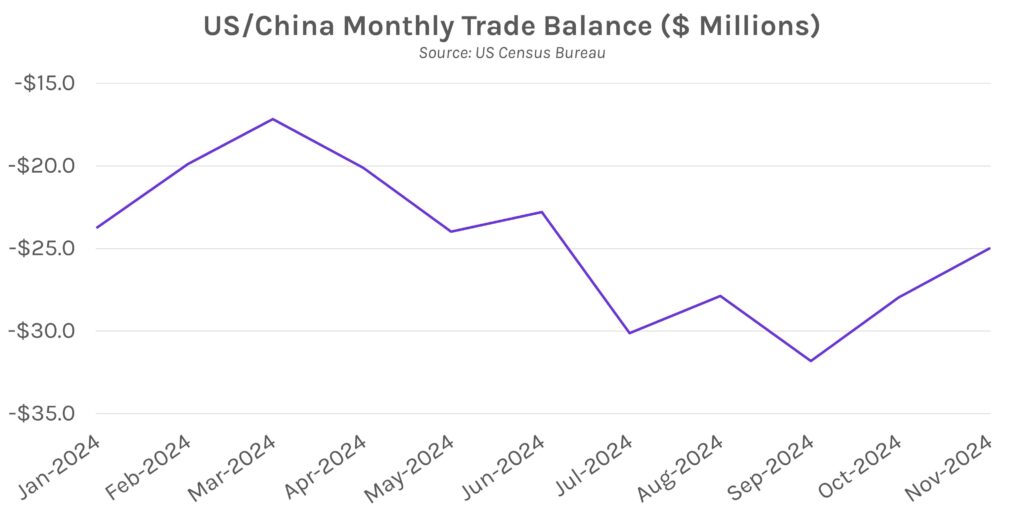

Tariff-talk dominates Trump’s early days. As of yesterday, it appeared that President Trump would carefully pace tariffs across the board, but within a few hours, he publicly pledged 25% tariffs on Mexico and Canada by February 1st. Still, no firm measures have been announced for Chinese trade despite calls during his campaign for levies as high as 60%, and his restraint has been viewed as a desire to negotiate with America’s third largest trading partner. He struck a diplomatic tone, saying, “We’re going to have meeting and calls with President Xi…” In turn, Chinese Vice Premier Ding Xuexiang said today at the World Economic Forum in Davos that China will expand imports, and that China doesn’t “…seek trade surplus. We want to import more competitive, quality products and services to promote balanced trade.”

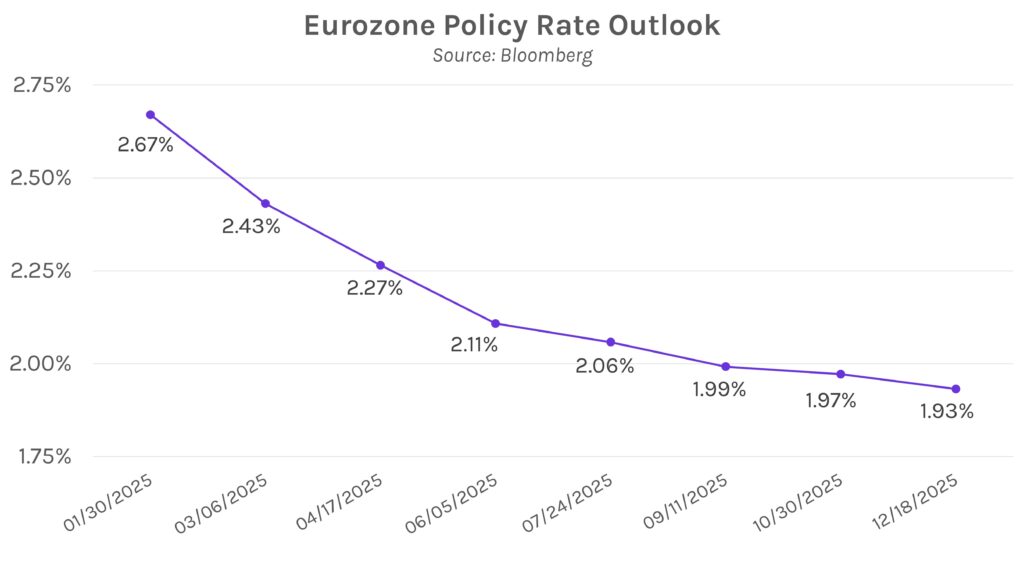

ECB Governing Council member Kazimir labels 3-4 consecutive rate cuts as “feasible.” The European Central Bank (ECB) is widely expected to cut rates by 25 bps next week after three consecutive rate cuts to end 2024. Ahead of the meeting, Governor of National Bank of Slovakia, Peter Kazimir, said the “deal is done” for accommodation next week, while adding that the move could mark the first of many in 2025. Futures currently have a 25 bp rate cut priced in as 95%+ likely at the next two ECB meetings, a stark contrast to the US, where a move is not expected until at least June. Furthermore, futures have nearly 100 bps of ECB rate cuts priced in for 2025 versus 40 bps in the US.