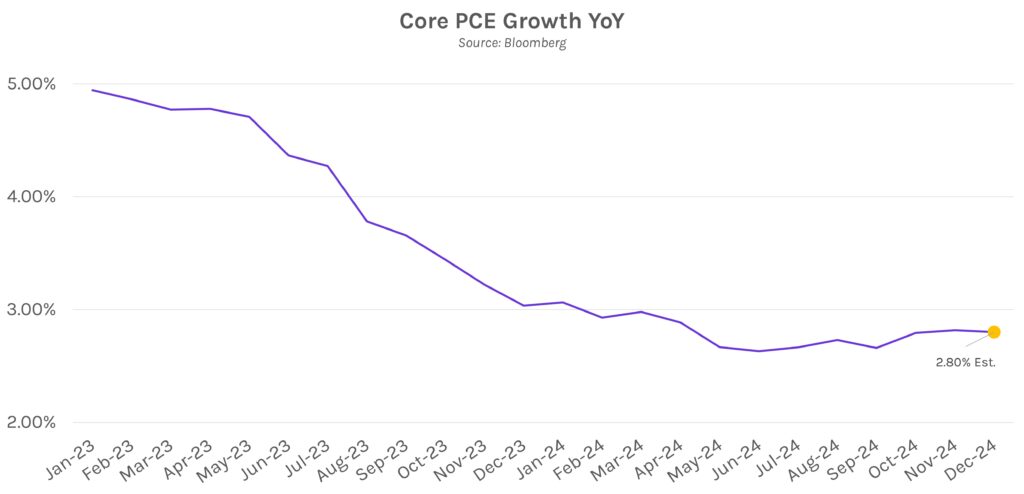

Yields trend lower ahead of PCE tomorrow. Treasury yields traded within a 5 bp range today and closed 1-2 bps lower across the curve. An overnight decline was offset by a gradual rise throughout the morning, most of which was spurred by strong personal consumption, an acceleration of QoQ core PCE, and lower than expected jobless claims figures. The data preceded tomorrow’s broader PCE slate, where headline (MoM and YoY) and core MoM figures are expected to rise from November to December. Core YoY PCE is expected to remain flat at 2.8% price growth.

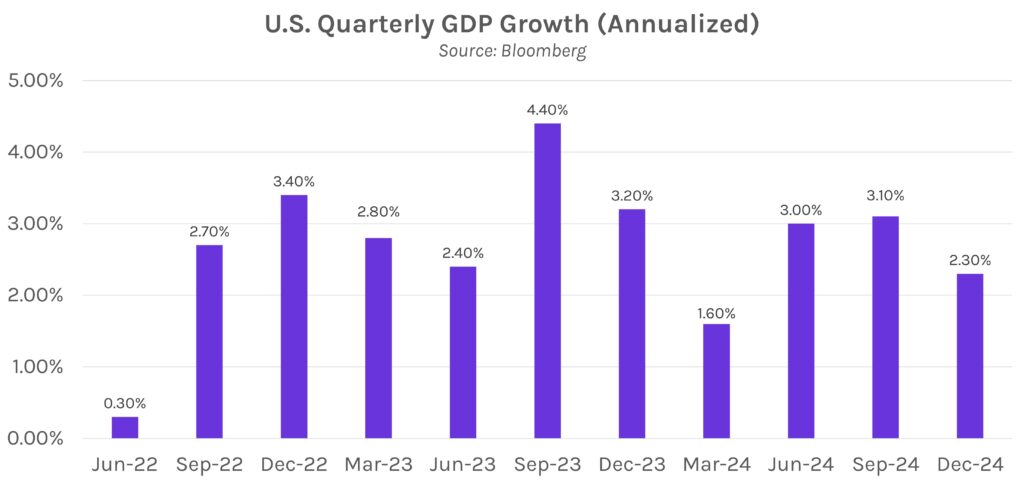

U.S. economic growth falls in 2024Q4 to cap an otherwise strong year. Final GDP growth readings for 2024Q4 showed the economy expanded by 2.3%, below expectations of 2.6% growth and falling from Q3’s 3.1% result. The growth was fueled in large part by strong consumer spending, with personal consumption climbing by 4.2% during the quarter, which offset a pullback in inventory investment. Despite slowing on a quarterly basis, the U.S. economy grew 2.8% on the year to log a third consecutive year of economic expansion, and the results were largely viewed as a positive sign that the U.S. economy remains on a strong footing. Encouragingly, U.S. economic growth also outstripped Europe’s and China’s before adjusting for inflation, reinforcing America’s continued economic outperformance globally.

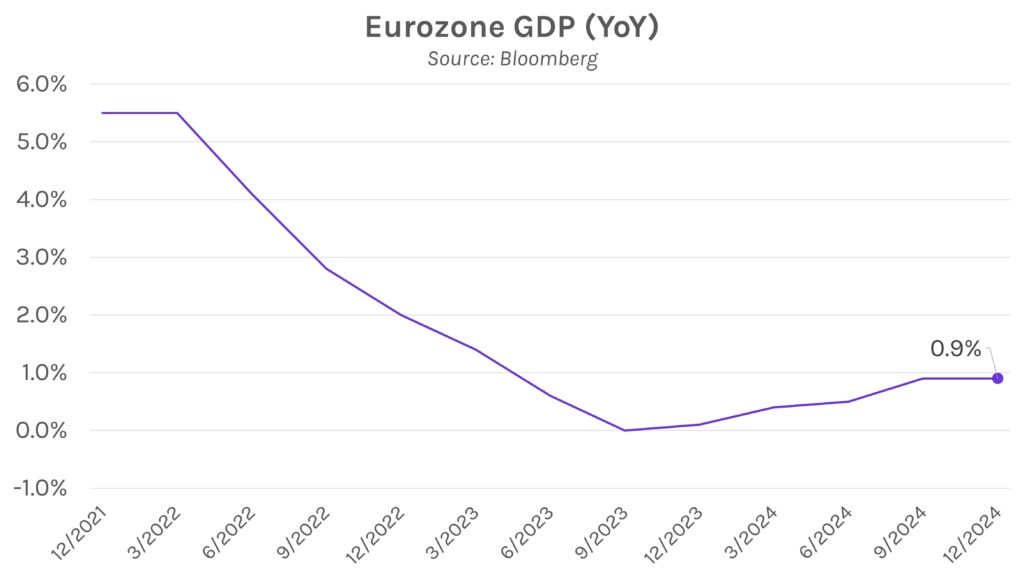

Stalled economic growth pushes the ECB to cut rates again. The European Central Bank trimmed their deposit facility rate by another 25 bps today to 2.75%, now totaling 125 bps of easing since June. Markets expect that trend to continue at March’s meeting, before another two rate cuts before year end, with lagging economic growth a significant contributor to the ECB’s aggressive timeline. Data released yesterday showed that Eurozone GDP remained at 0.9% YoY in Q4, below the expectation of 1.0% growth. President Trump’s tariffs could mean further pain for Eurozone economic growth, and President Lagarde argued that his policies would have a “global negative impact” that could make rate cuts even more viable.