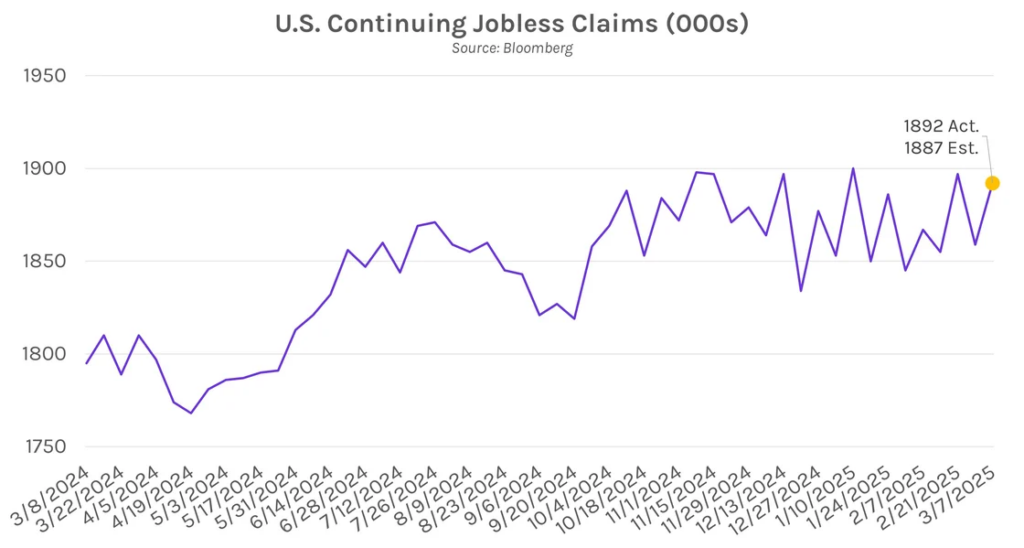

Rates nearly flat following FOMC meeting. Treasury yields traded within a 5 bp range today, with volatility largely absent after yesterday’s FOMC meeting spurred an 11 bp rate decline (from session highs) heading into the market close. The short end of the curve declined 1-2 bps today while 20-year and 30-year yields climbed less than half of a bp. Jobless claims data (which rose slightly from the previous week) and a decline in the Philadelphia Fed Business outlook contributed to the decline in yields early this morning. Meanwhile, equities declined slightly, with the S&P 500 and NASDAQ down 0.22% and 0.33%, respectively.

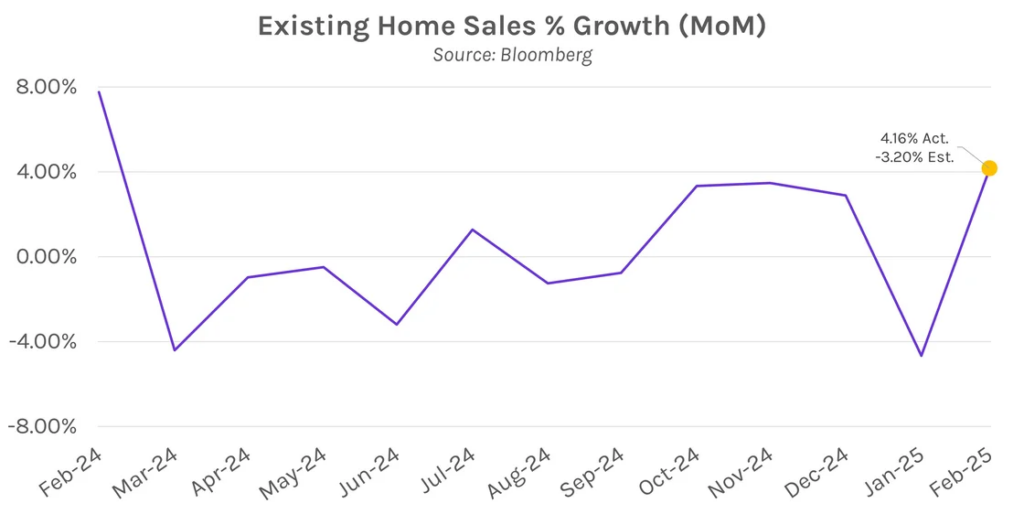

Existing home sales rebounded in February. Sales of existing home inventory in February rebounded from January’s slump, according to data released by the National Association of Realtors today (NAR). 4.26 million homes were sold in February, a 4.2% increase on an annualized basis vs. January, far exceeding expectations of a 3.2% decrease to 3.95 million. Elevated sales volumes were observed primarily in the West and South which had previously been battling wildfires and winter storms, respectively. The results were viewed as a welcome pocket of strength amidst growing turbulence in other asset classes. NAR chief economist Lawrence Yun commented, “Homebuyers are slowly entering the market…the momentum for home sales is flashing encouraging signs.”

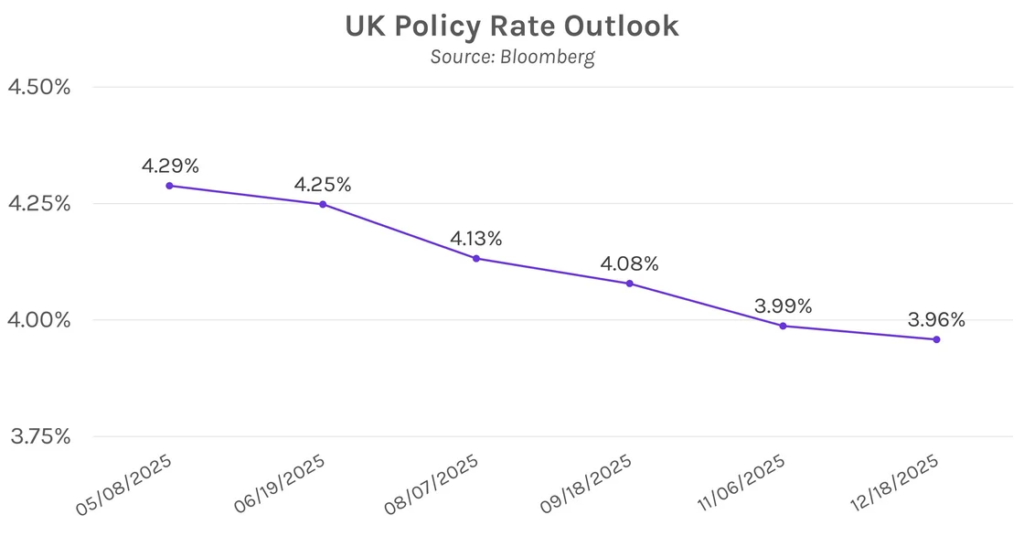

Bank of England holds policy rates. The BOE had a hawkish tilt at today’s policy meeting, with only one of nine voters favoring a rate cut. The voting marked a significant shift from February’s meeting, where all members favored a rate cut and two officials preferred a 50 bp move. The BOE reiterated its guidance for “gradual and careful” monetary easing, and BOE Governor Bailey said that “we still think that interest rates are on a gradually declining path.” However, meeting minutes showed there is no set path forward, and Bailey also noted that “there’s a lot of economic uncertainty at the moment.” Odds for a 25 bp rate cut at the next meeting (in May) declined slightly, now at 69%, and markets expect 50 bps total of accommodation in 2025.