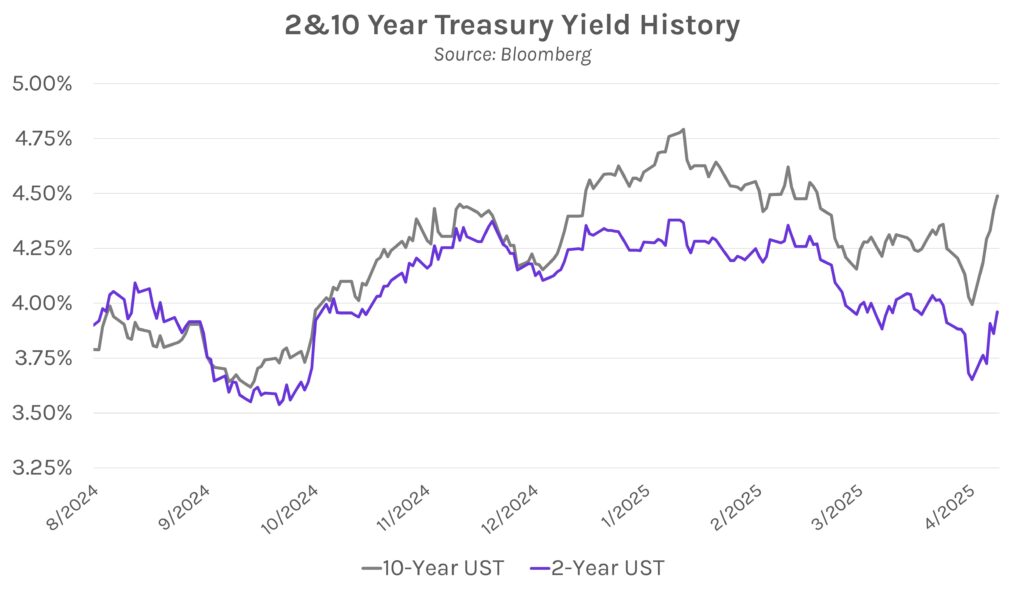

Treasury yields continue to soar. Last week’s dramatic flight to quality and surging demand for Treasurys has been almost fully reversed. Treasury yields rose 1-10 bps today, cementing a weekly increase of 30-50 bps. The 10-year yield rose more over the past five days than in any other week since the aftermath of 9/11, now at 4.49%. The Treasury sell-off reflects a lack of confidence in the US economy amid uncertain policy regarding tariffs. Investors have shifted investments toward foreign nations (such as Japan) and safe-haven gold; the yen has soared to 143.54 per dollar versus 146.93 per dollar at the end of last week, while gold spiked nearly 6.6% this week to $3,238 per troy ounce. Today’s softer-than-expected inflation data was overshadowed by this growing doubt.

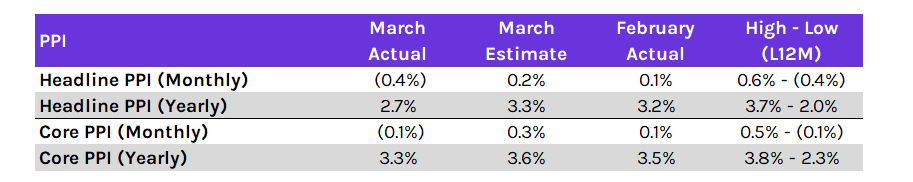

Producer price inflation lands below expectations. Per PPI data released today, producer inflation was more muted than expected in March, and deflation was observed within certain measurements. On a monthly basis, headline PPI contracted by 0.4% vs. surveyed estimates of a 0.2% advance, marking the first decline in headline prices since October 2023. Prices also fell by 0.1% on a monthly core basis (excluding food and energy) vs. expectations of a 0.3% increase. On a yearly basis, headline inflation was 2.7%, the lowest since last October, and core inflation was 3.3%, the lowest since last September. The report followed yesterday’s CPI data which also showed slower price growth, and together the releases illustrated that inflation may have been on a downward trend during the first quarter of 2025. However, the road forward is less clear given inflationary concerns stemming from tariffs.

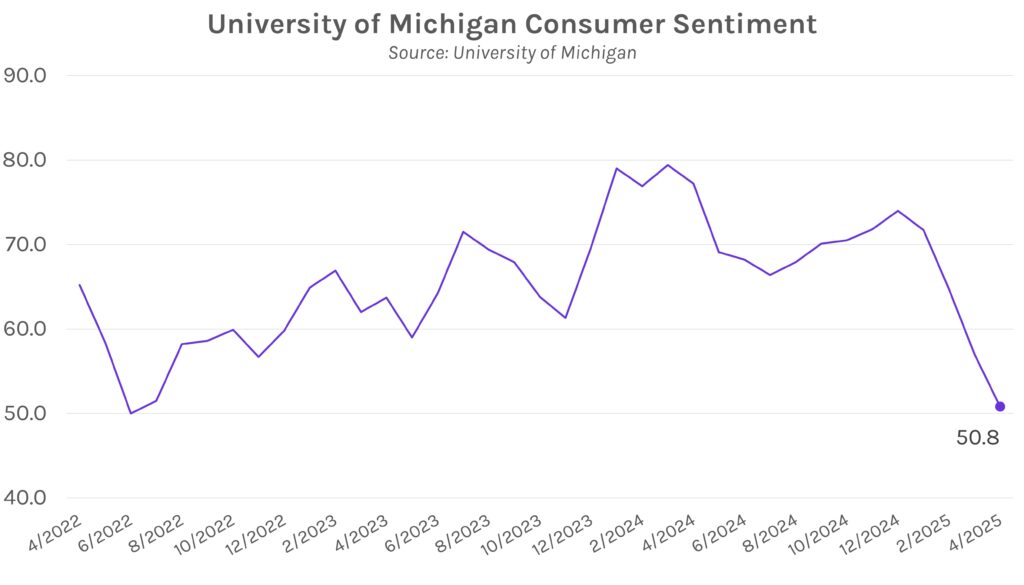

Consumer sentiment shows no signs of rebounding. Today’s University of Michigan April consumer sentiment data was well below 53.8 forecasts at 50.8. The data marked the third consecutive 6+ point monthly decline this year, with the index now ~21 points below January’s YTD high of 71.7. This was also the lowest level since June 2022, stemming from sentiment declines across all demographics. Survey director Joanne Hsu stated, “Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month.”