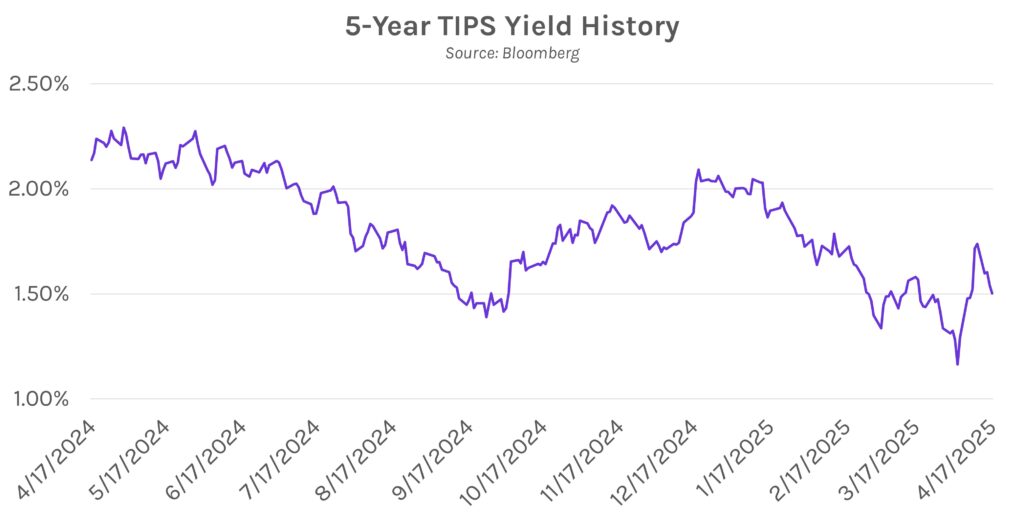

Yields reverse course to close out the holiday-shortened week. Treasury yields climbed 2-6 bps across a steepening curve today, partially offsetting the past 3 consecutive sessions of declines. The rise at the long end of the curve was driven by optimism from President Trump that the U.S. will be able to reach a trade deal with “Europe or anyone else.” Weak demand at a $25 billion, 5-year TIPS auction contributed as well. Ultimately, yields closed ~15 bps lower across the curve this week. Meanwhile, equities ended the day mixed, with the S&P 500 and NASDAQ ending roughly unchanged, while the DJIA fell 1.33%.

Trade talks progress with Japan while President Trump expects a deal with the EU. Today, President Trump said that “big progress” has been made with Japanese trade negotiators, and a second round of talks are expected to take place later in April. Encouragingly, Japanese lead negotiator Akazawa said the U.S. was looking for a deal before the 90-day tariff pause expires, and that both sides “aim to reach a swift agreement.” Separately, the President said today that “There’ll be a trade deal” with the EU during a meeting with the Italian Prime Minister, adding that he fully expects a deal to be made, but that he is in “no rush.” These updates are the latest in a string of optimistic language about negotiations with major U.S. trading partners, however formal agreements have yet to be inked as the 90-day delay period continues to elapse.

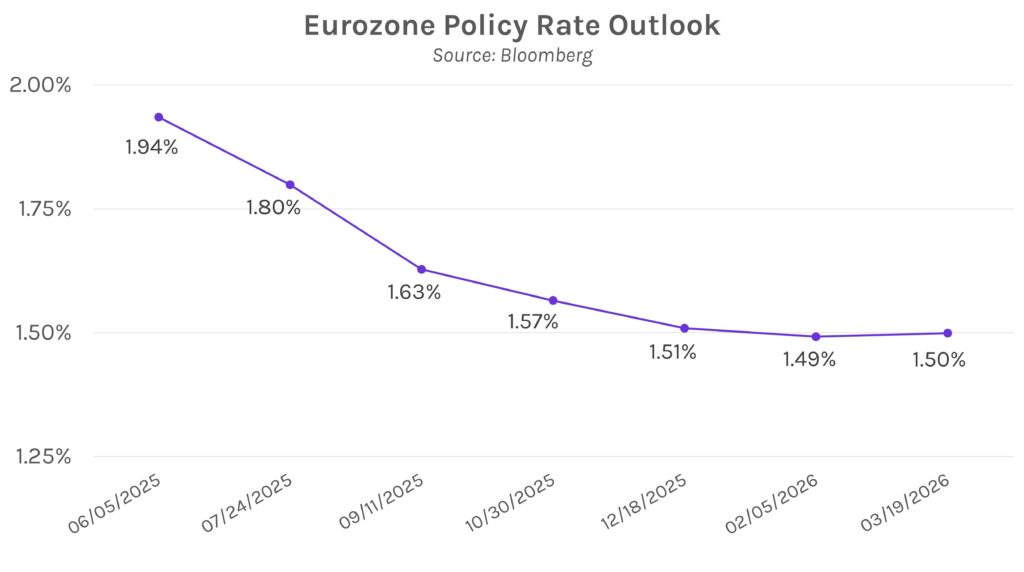

ECB cuts rates by 25 bps. The European Central Bank trimmed its deposit rate to 2.25% today amid growing concerns about economic growth due to tariffs. The move marks 175 bps of accommodation from the highs of the rate hike cycle, significantly more aggressive than the Fed’s 100 bps of rate cuts. ECB President Lagarde stated that “downside risks to economic growth have increased… the major escalation in global trade tensions and associated uncertainties will likely lower euro-area growth by dampening exports, and it may drag down investment and consumption.” Meanwhile, Chair Powell remains focused on controlling inflation, as he stated yesterday that the Fed’s “obligation is to keep longer-term inflation expectations well anchored.”