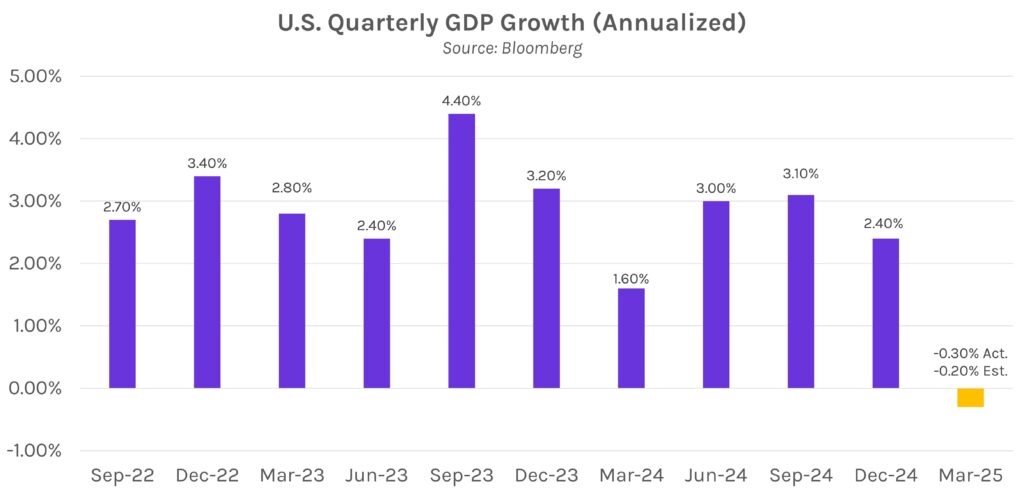

Treasurys rally following a key slate of economic data. Today’s economic data was highlighted by a U.S. GDP contraction in 1Q 2025 and generally higher-than-expected inflation. The combination spurred stagflation fears and a corresponding flight to quality, with Treasury yields falling 1-5 bps across most of the curve. The 2-year yield (-5 bps) closed at 3.60% while the 10-year yield (-1 bp) is now 4.16%. However, a report that the U.S. has proactively reached out to negotiate tariffs with China calmed some concerns regarding an impending economic slowdown. The news spurred a significant equity rally, with the S&P 500 closing up 0.15% after hitting intraday lows of -2.27%.

GDP likely contracted in 1Q 2025, driven by higher imports. The U.S. economy contracted slightly faster than expected in the first quarter of 2025, per initial GDP estimates released today. GDP fell by 0.3% vs. surveyed estimates of a 0.2% pullback due to elevated imports ahead of tariffs. Imports increased by ~41% in the quarter and were responsible for subtracting ~5% from GDP, the highest since 4Q24. Lower federal spending also contributed to the decline, highlighted by a sharp decrease in defense spending. On the other hand, personal consumption, which constitutes ~66% of GDP, grew 1.8% during the quarter. There are also hopes that the trade deficit could reverse in Q2, boosting GDP, though increased U.S. manufacturing and exports could require a longer timeframe.

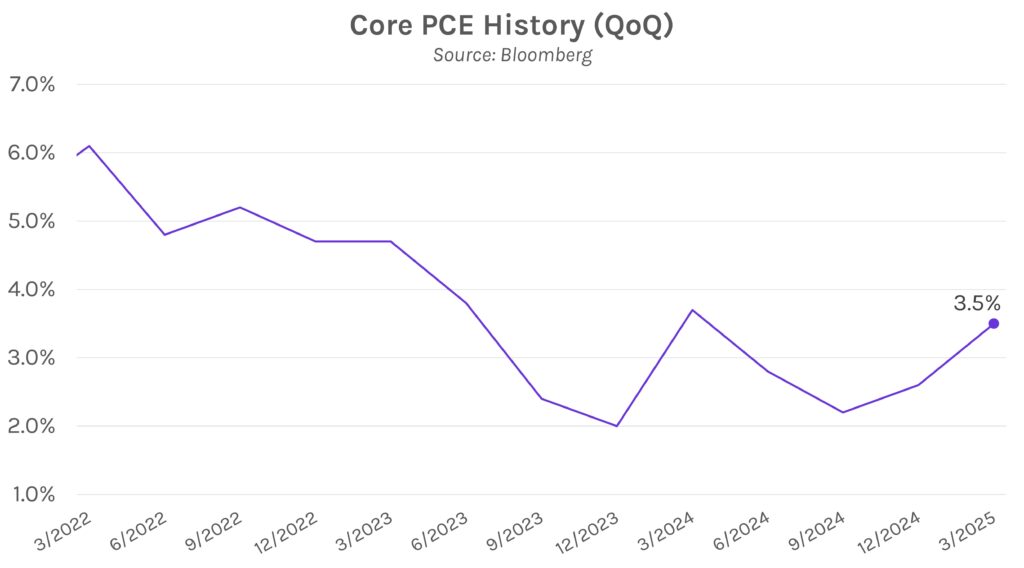

PCE revised higher in February while 1Q 2025 print greatly exceeded forecasts. Today’s PCE slate did little to quell concerns about the potential for tariff-driven price pressures. 1Q 2025 core PCE accelerated 0.9% from 4Q 2024 to 3.5%, the highest quarterly inflation rate since 1Q 2024. Meanwhile, all MoM and YoY PCE readings were revised higher in February. The data also does not fully incorporate the effects of tariffs, most of which were announced on April 2nd. Markets hope that tariff negotiations proceed smoothly, potentially reducing some of these future inflationary impacts.