Strong service sector data pushes the short end of the curve higher. Rates traded within a 6 bp range today to close out a relatively quiet week that was headlined by an unprecedented escalation of tensions in the Ukraine-Russia war and generally strong earnings results from the world’s most valuable company, NVIDIA.

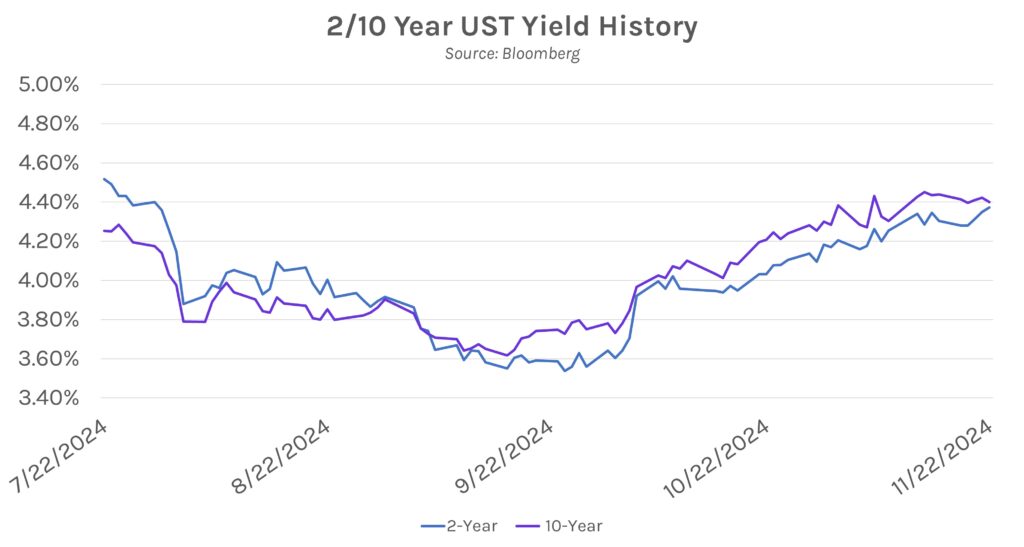

Much of the movement was driven by manufacturing and service sector data released this morning, which showed U.S. business activity in November expanding at the fastest pace since April 2022. The short end of the curve ended the day 1-3 bps higher while the long end declined 1-2 bps. The 2-year and 10-year Treasury yields are now at 4.37% and 4.40% after opening the week at 4.30% and 4.44%, respectively. Markets are now looking ahead to next week’s PCE data, the Fed’s preferred gauge of inflation.

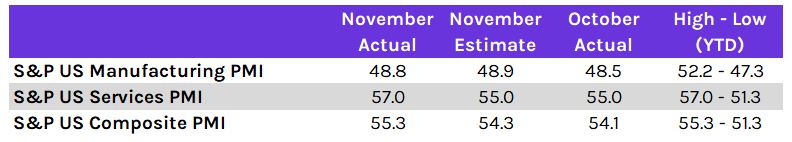

Overall business activity in the U.S. expanded in November by the most since April 2022, per S&P’s PMI index released today. U.S. business activity was carried by impressive service sector growth which offset a struggling manufacturing sector, a recent theme. Manufacturing activity has contracted in 17 of the last 24 months (meaning the monthly index reading was below 50), whereas the service sector has continuously landed in expansion territory since February 2023. While pressures within the current economic cycle, such as supply chain inefficiencies and higher rates, are partly to blame for the manufacturing slowdown, the possibility of greater protectionism and policies such as tariffs introduced by the new presidential administration have boosted confidence in the near-term outlook. Others also point to secular trends, such as offshoring and globalization, to argue that a lagging manufacturing sector isn’t necessarily concerning.

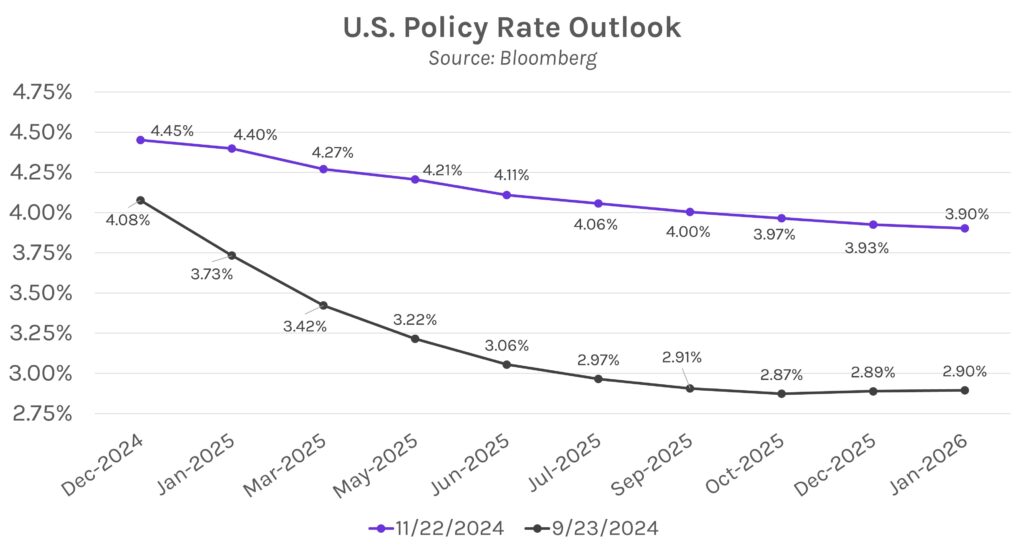

PCE is expected to have been elevated in October. Next week’s Thanksgiving-shortened slate will be highlighted by personal consumption expenditures (PCE) data. Core PCE is expected to accelerate to 2.8% year-over-year from 2.7% and remain flat at 0.3% month-over-month. That would continue the trend of the past several months, where core annual PCE has remained at or above 2.6% since May. Idle progress in the battle against inflation has contributed to futures markets pricing in ~100bps fewer rate cuts by the end of 2025 versus expectations in mid-September.