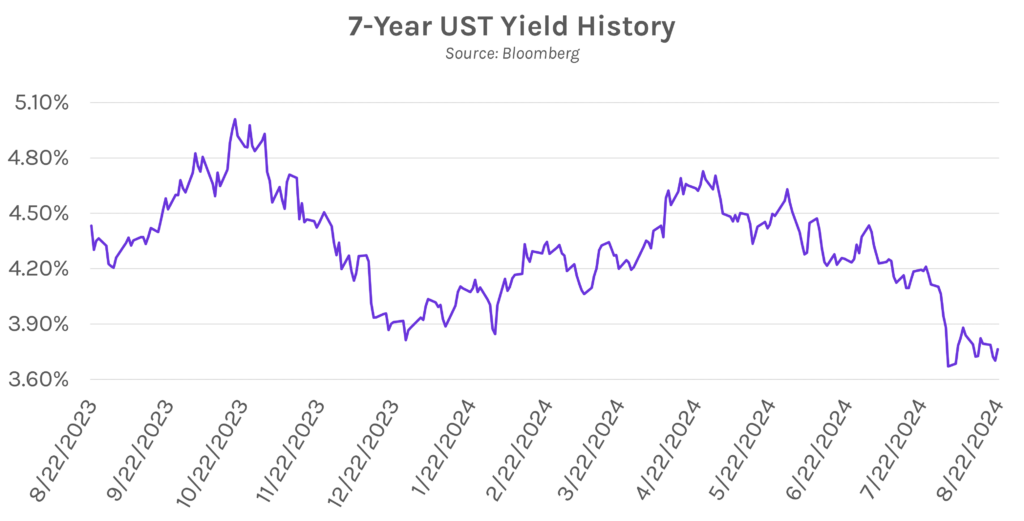

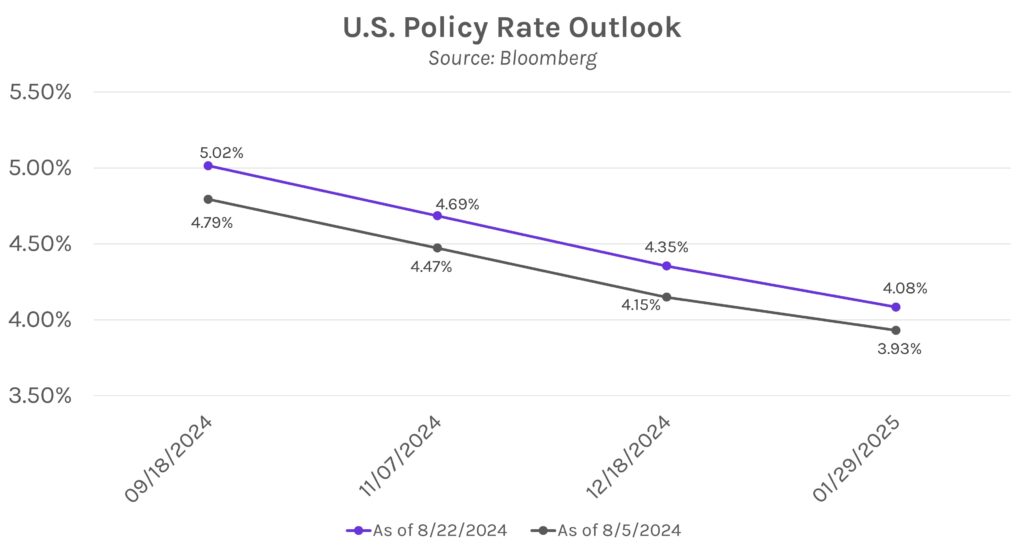

Markets prepare for Powell’s Jackson Hole speech. Markets shed risk today as they chewed on the possibility of Chair Powell advocating for a more gradual cutting pace at his Jackson Hole speech tomorrow and waded through comments from Fed speakers today who shared a similar sentiment. Commenting on market pricing, Mohamed El-Erian told Bloomberg, “It is problematic in my mind that the market is pricing in so many rate cuts right now…the market is overdoing it.” Treasurys fell with yields up ~5-7 bps across the long end of the curve at the close, and equities fell from near all-time highs, with the S&P 500 down ~0.90% and the NASDAQ down ~1.67%.

Fed officials use moderate language to describe easing. Boston Fed President Susan Collins said today that “…a gradual methodical approach to revisiting our policy stance over time, I think, will continue to be appropriate.” Employing similar language, Philadelphia Fed President Harker said, “In September we need to start a process of moving rates down…we need to start bringing them down methodically.” Kansas City Fed President Jeffery Schmid used decidedly more hawkish language, however, saying, “Before we act – at least before I act, or recommend acting – I think we need to see a little bit more.”

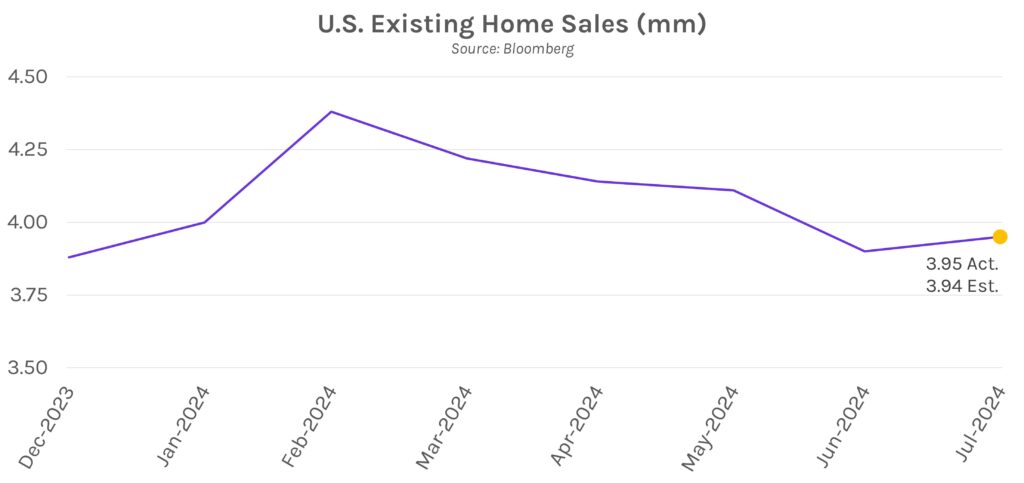

Housing data shows early signs of stabilization. Existing home sales data released today showed 3.95mm homes were sold in July vs. estimates of 3.94mm, higher than last month’s revised 3.90mm result. This was the first monthly increase since February. Commenting on the results, National Association of Realtors chief economist Lawrence Yun said, “…home sales are still sluggish, but consumers are definitely seeing more choices, and affordability is improving due to lower interest rates.”