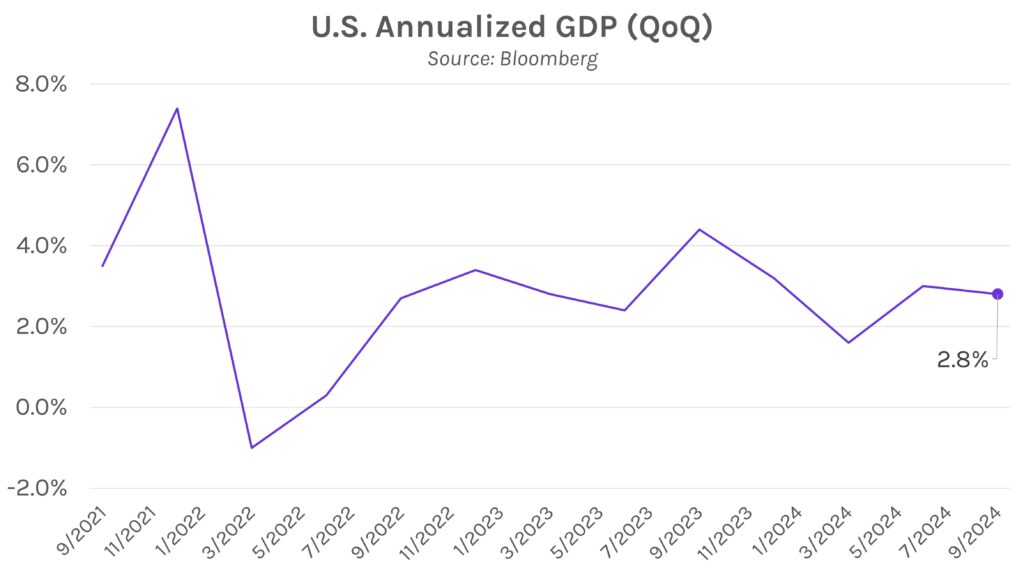

Rates fall despite elevated inflation data. Rates declined 6 bps overnight and were largely unaffected by this morning’s economic data. The second Q3 GDP report confirmed the first estimate of 2.8% quarterly economic growth (annualized), a slight deceleration from 3.0% growth in Q2. Shortly after the GDP release, PCE data fueled a 3 bp rise at the short end of the curve. Rates were little changed throughout the remainder of the session and closed 4-6bps lower.

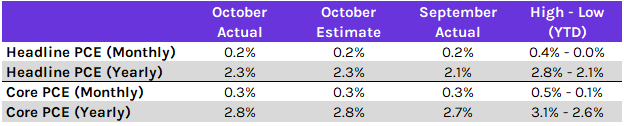

PCE inflation supports a patient Fed. As expected, the personal consumption expenditures (PCE) price index ticked upward in October across yearly measures and remained unchanged on a monthly basis. Core YoY PCE (+2.8%) has declined by ~0.25% since January, though it has grinded higher from June’s intra-year low of 2.6%. MoM core PCE (+0.3%) hasn’t declined since July and was at its third highest level this year. Today’s results confirm that inflation remains stubbornly above the Fed’s 2% target and supports many FOMC members’ beliefs that the committee should be patient with the pace of future rate cuts.

Thanksgiving meals are cheaper this year than last. Despite robust and prolonged US inflationary pressures, the cost of a 16-pound turkey is (surprisingly) down 6% from last year, now $27 on average. According to the American Farm Bureau Federation, the cost of a 10-person holiday meal is $58, down 5% from last year and 9% from 2022. When adjusting for inflation (and excluding 2020), this is the least expensive Thanksgiving meal in the 39 years that the AFBF has been conducting the price survey. The Derivative Path team wishes you a happy and healthy Thanksgiving!