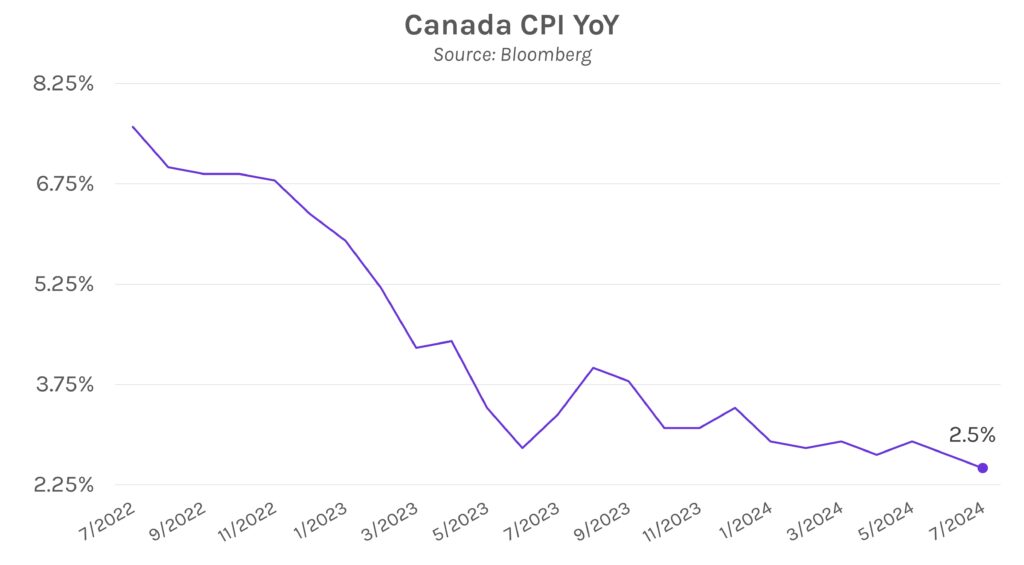

Rates grind lower ahead of FOMC minutes. Canada inflation data contributed to a 6-8bp rate decline in the US today. Bank of Canada September rate cut bets strengthened as the consumer price index (CPI) fell to 2.5% annualized in July from 2.7% in June. The move came ahead of tomorrow’s FOMC minutes and Friday’s Powell presser, both of which will be perused for guidance on policy rate outlook.

China holds one-year and five-year lending rates steady. The People’s Bank of China (PBOC) left their key benchmark rates unchanged today, as expected by economists. The one-year rate, a baseline for most new and outstanding loans in China, will remain at 3.35% while the five-year rate, a reference for mortgages, will hold at 3.85%. The move reflects a balanced approach in China after a surprising 10bp rate cut in July. While the PBOC is intent on spurring economic growth and boosting the struggling property sector, they wish to avoid “drastic” measures, as PBOC Governor Pan Gongsheng stated last week.

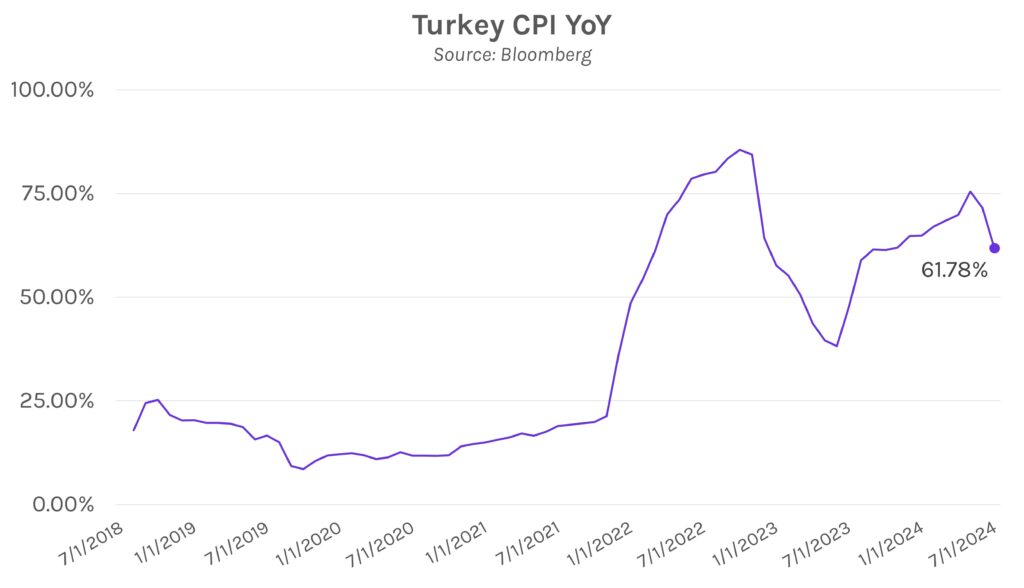

Turkey holds one-week repo rate at 50%. Turkey’s central bank held rates steady for a fifth consecutive month today while reiterating that inflation must show “significant and sustained declines” to allow for rate cuts. The Monetary Policy Committee added that “the alignment of inflation expectations and pricing behavior with projections has gained relative importance for the disinflation process.” Annualized inflation is currently 61.78%, and the central bank recently released forecasts for the end of 2024 and 2025 at 38% and 14%, respectively.