“Higher for longer” characterized the price action in rates markets, and it was a view embraced by financial institutions as they executed their hedging programs in Q2.

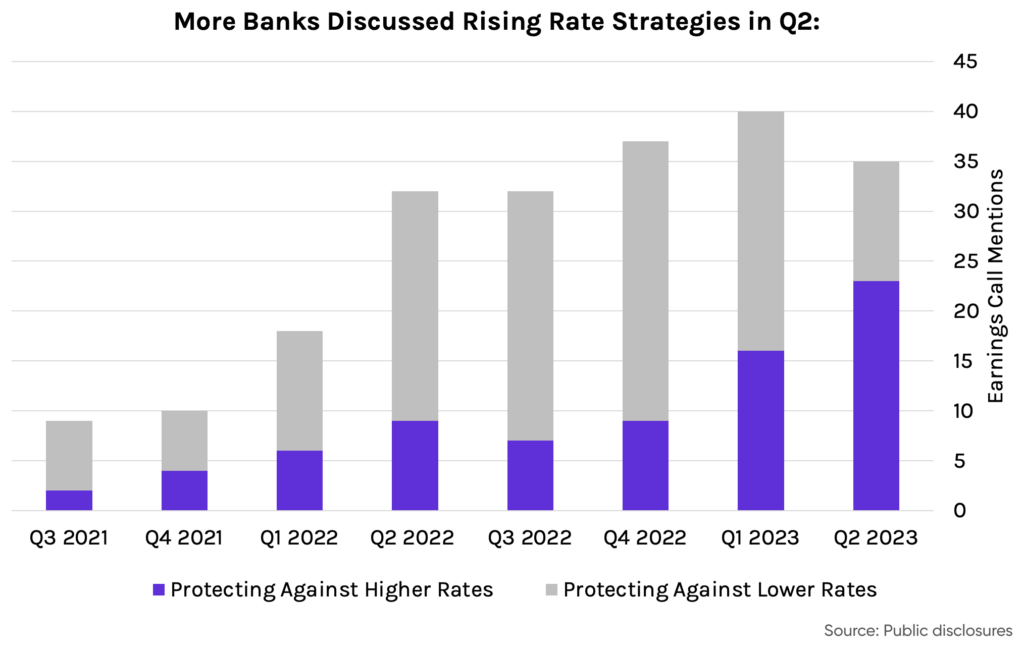

More banks spoke about hedging against rising rates than falling rates on their earnings calls for the first time in years, extending the trend we first observed last quarter.

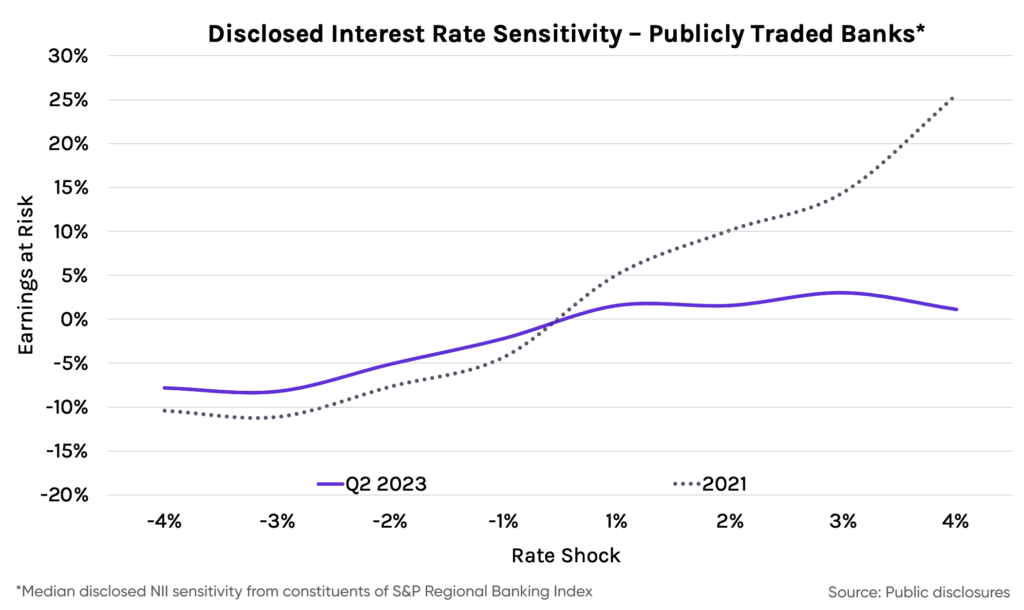

This shift towards pay-fixed swaps and other upside hedging strategies isn’t a surprise; the median bank benefits significantly less from higher rates than they did historically, and many institutions have become liability-sensitive. Banks that hedged highlighted the income accretive nature of pay-fixed swaps, income that was particularly valuable as margins come under pressure.

While the median bank has become much more exposed to rising rates, little has changed with respect to exposure to declining rates, and nearly 15% of banks in the S&P Regional Banking Index now disclose two-way exposure to both rising and falling rates.

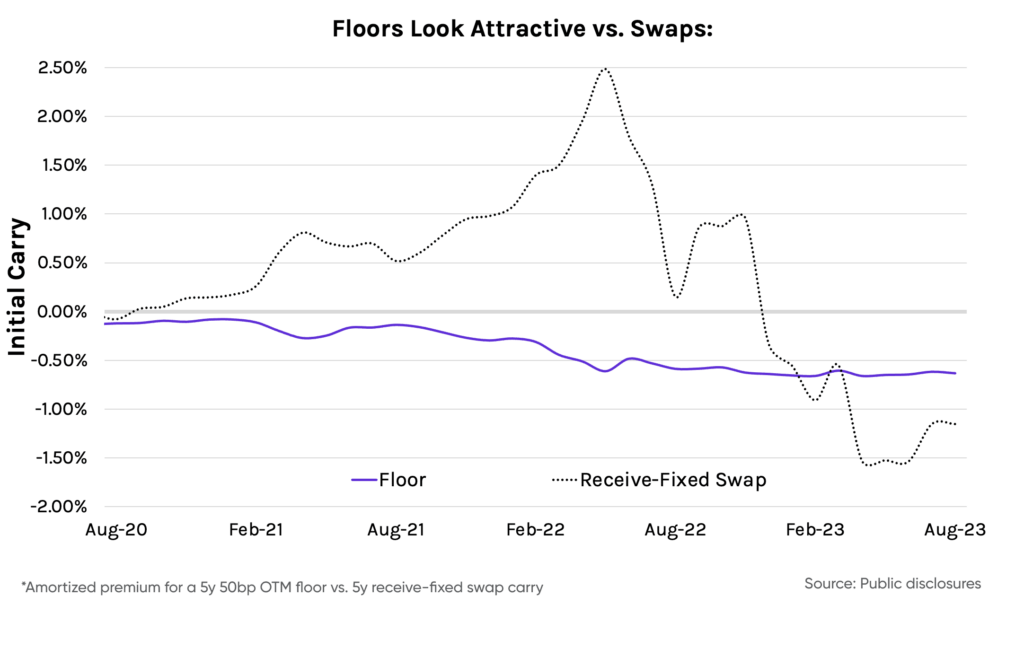

As we move through the third quarter, we expect to see an increase in downside hedging as we hit multiyear highs in the swap market. While receive-fixed swaps remain challenging to execute because of their initial negative carry, options strategies like interest rate floors look comparably attractive.

For a more in-depth look, we’ve compiled a complete list of hedging commentary from second quarter earnings calls: